Aethir Growth Report Q3 2025: Key Financial and Operational Highlights

Primer on Aethir

Aethir is a decentralized cloud infrastructure network designed to improve access to high-performance computing, especially GPU power, while enhancing scalability and cost efficiency. Instead of relying on centralized data centers, Aethir operates through a globally distributed ecosystem of more than 430,000 GPUs (self-reported) across 93 countries. This includes both consumer- and enterprise-grade hardware, such as NVIDIA H200s, which enables a flexible and diverse compute network. By aggregating underused resources and allocating them dynamically based on demand, Aethir supports use cases ranging from cloud gaming and AI model training to enterprise-level computing workloads.

Aethir’s infrastructure operates on a three-tier architecture: Network, Edge, and Application, engineered to reduce latency and optimize the distribution of computational workloads. Edge nodes serve as local gateways, coordinating nearby clusters to enable swift failover and dynamic resource allocation, thereby maintaining consistent performance for end users. The platform also integrates a staking and slashing mechanism powered by its native ATH token, ensuring network reliability, incentivizing honest behavior, and aligning the interests of participants throughout the ecosystem.

With over 200 gaming studio partners, a reported capacity to serve up to 221 million monthly users, and a focus on decentralization, Aethir differentiates itself by offering an alternative to costly, centralized cloud platforms like AWS and Google Cloud.

Key Takeaways

- Decentralized GPU infrastructure growth: Aethir operates a global network of over 430,000 GPUs across 93 countries, offering both consumer- and enterprise-grade hardware for compute-intensive tasks.

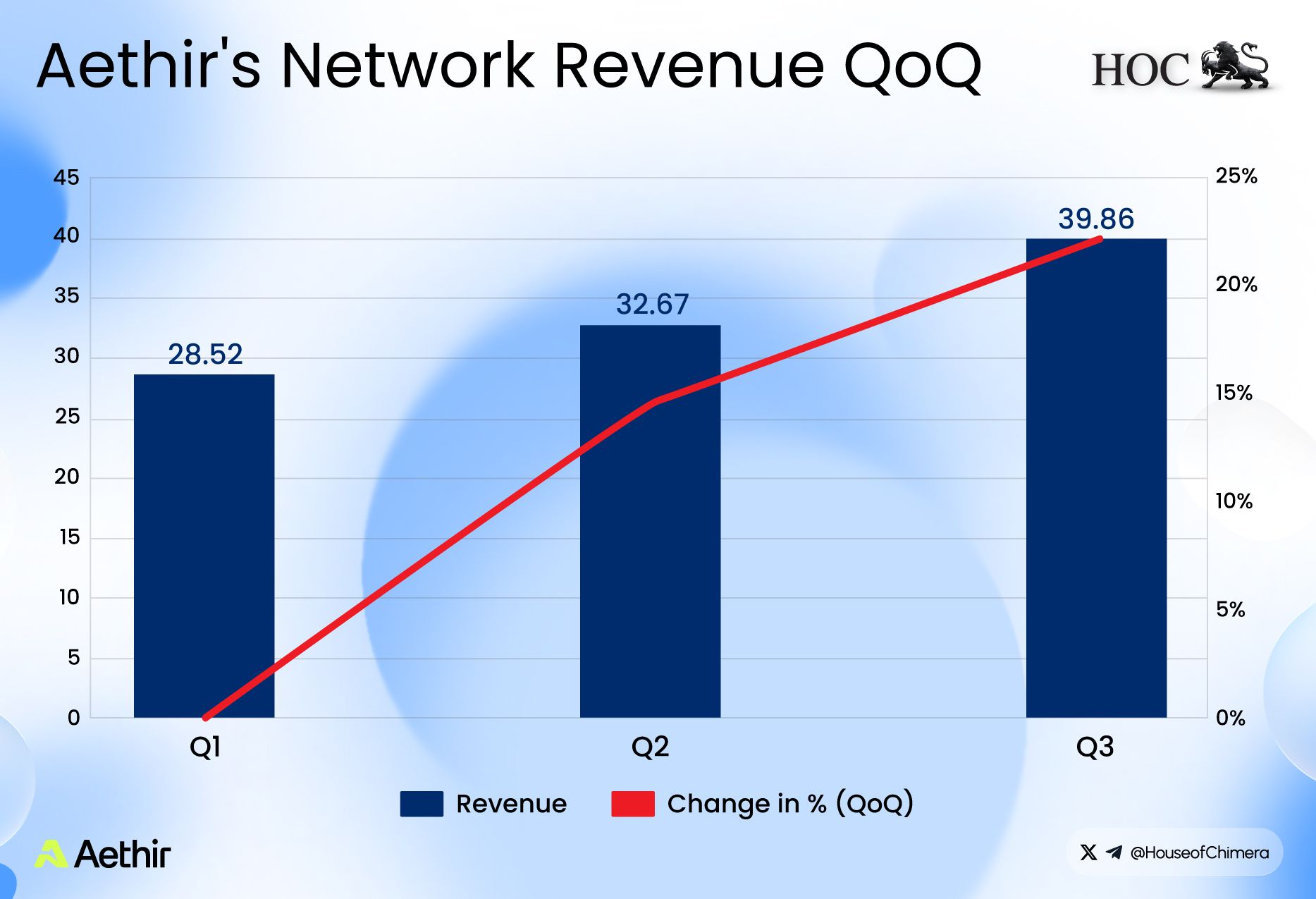

- Financial momentum: Q3 2025 saw self-reported revenue of ~US $39.8 million and 130 million monthly compute hours (≈ +20% QoQ), with ARR at US $114 million and outlook towards US $160 million.

- Workload segmentation: The network is evolving to separate retail-grade GPUs (i.e. cloud gaming) from enterprise-grade units (i.e. AI modeling and LLMs), allowing for targeted resource deployment and scalability.

- Strategic ecosystem shift: The company is transitioning from infrastructure-only to full-stack ecosystem provider through significant partnerships (e.g., with Predictive Oncology and the “AI Unbundled Alliance”) and new collaborators, including Arizona State University, Sogni, Respeecher, and Messiah Network.

- Tailwinds from macro & sector trends: The surge in demand for GPU compute (driven by AI and cloud gaming), along with semiconductor supply-chain and geopolitical risks facing centralized providers, favor decentralized models like Aethir’s.

- Long-term competitive positioning: Success rests on scaling infrastructure reliably, expanding enterprise-grade GPU capacity, maintaining cost & latency advantages, and executing on the developer/partnership ecosystem, potentially evolving into a foundational layer of the decentralised compute stack.

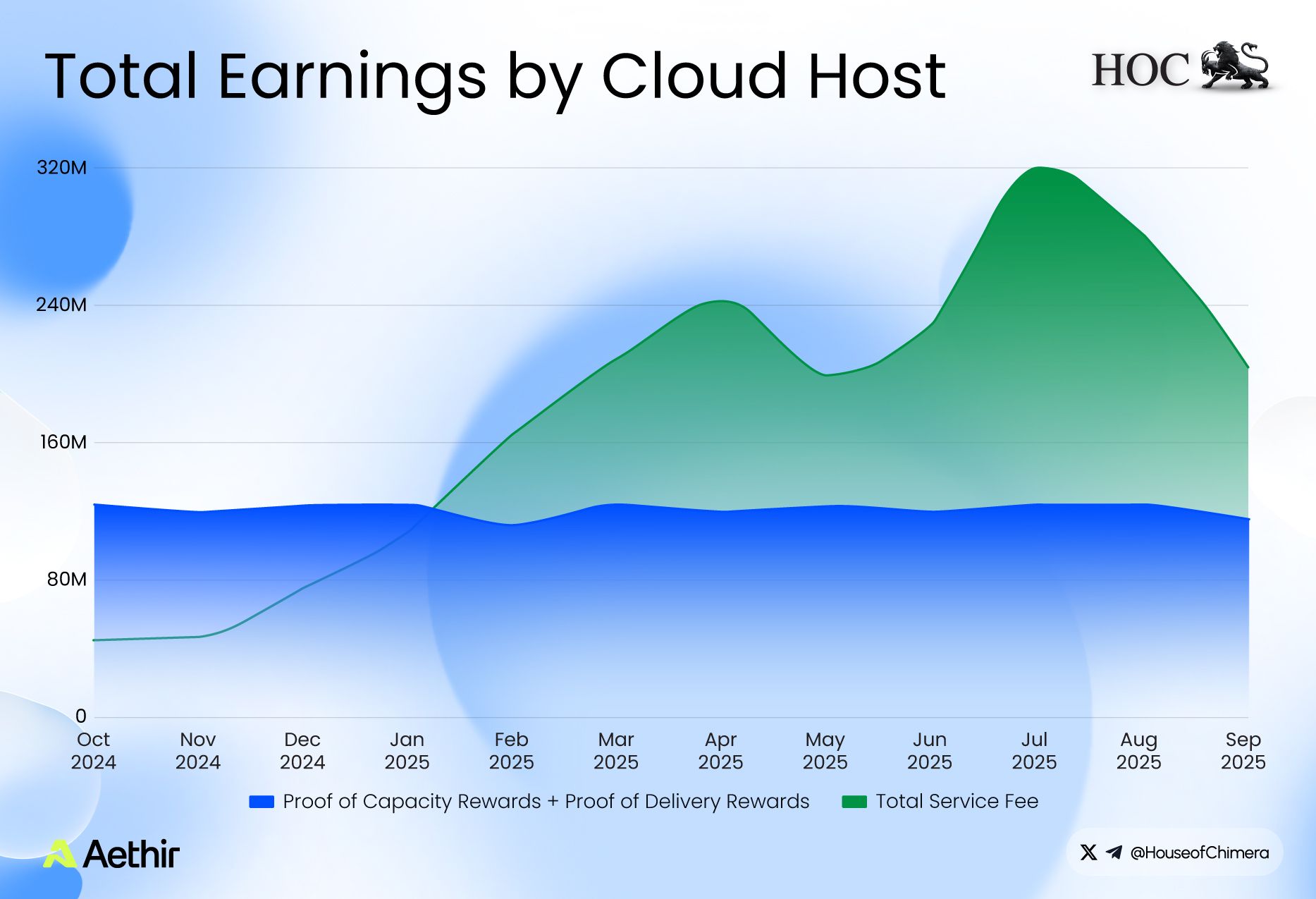

The Financials of Aethir

Q3 2025 marked another record-breaking quarter for Aethir, with self-reported revenue reaching $39.8 million, solidifying its position as the highest-earning DePIN project by absolute revenue. These figures remain off-chain and thus unverified, as House of Chimera cannot independently confirm their accuracy. The network’s Annual Recurring Revenue (ARR) currently stands at $114 million, with projections suggesting it could reach $160 million based on recent quarterly performance. Additionally, Aethir reported an average of 130 million compute hours per month, reflecting a ~20% quarter-over-quarter increase in utilization.

Unlike most DePIN networks, which have experienced declining revenues according to on-chain data, Aethir continues to outperform peers such as Akash, GeodNet, io.net, and Edge, underscoring its strong growth trajectory. This resilience stems from the surging global demand for GPU-powered computing, driven by the accelerating adoption of AI across the Web 2.0 and Web 3.0 industries. The trend mirrors rising search interest and robust financial results from traditional chip manufacturers like Nvidia and TSMC. Furthermore, geopolitical tensions and supply chain disruptions, particularly between the U.S. and China, continue to underscore the strategic importance of decentralized infrastructure. With no single point of control or reliance on physical data hubs, platforms like Aethir stand out as more resilient alternatives amid increasing regulatory and trade uncertainties.

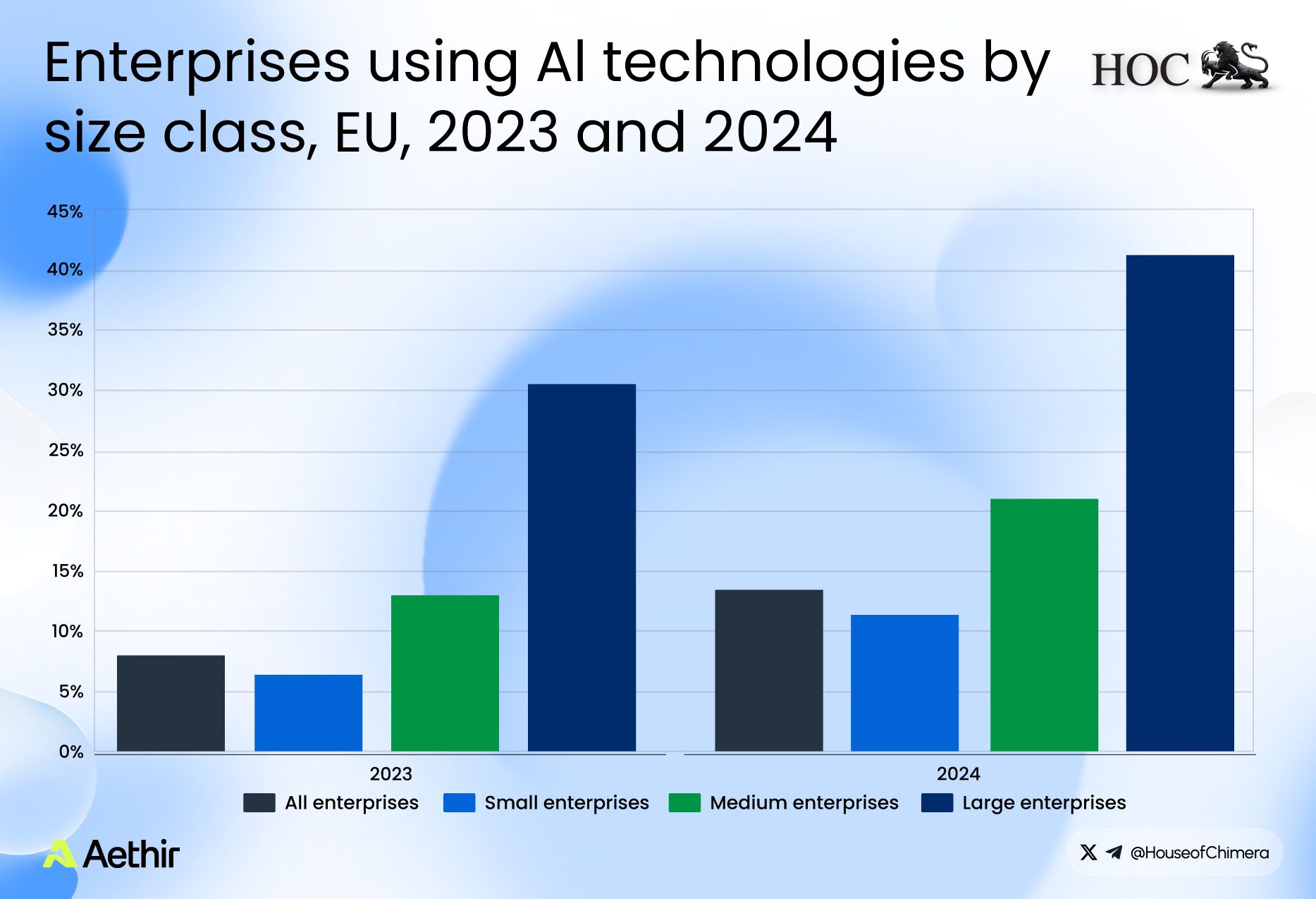

As AI models continue to grow in size and computational complexity, the shortage of available compute remains one of the most pressing bottlenecks in the digital economy. Global demand for GPU capacity is expected to grow by more than 60% year-over-year, supported by an expanding enterprise adoption base, particularly in Europe, where AI implementation rates among large organizations have nearly doubled. Aethir’s distributed GPU infrastructure and multi-tier architecture uniquely position it to address this demand, offering granular resource allocation that differentiates between high-performance AI workloads and latency-sensitive gaming environments.

In addition to AI, Aethir maintains a strong position in the cloud gaming sector, partnering with over 230 gaming studios and operating more than 650 clusters that support approximately 14 million active players worldwide. Although the growth trajectory in gaming remains steadier than in AI, it provides a consistent, subscription-based revenue stream as cloud-native gaming gains traction over hardware-dependent alternatives. This diversification strengthens Aethir’s business fundamentals, ensuring balanced exposure across multiple compute-intensive verticals.

State of the Aethir Network

The Aethir Network has continued to scale its computational capacity, now comprising over 437,000 GPUs with an aggregate performance of approximately 32.9 million TFlops, up from 23.6 million TFlops in Q1 2025. The network's theoretical maximum concurrent player capacity has risen from 209 million to 221 million, while the average compute power per GPU has increased from 59 to 75 TFlops. This substantial improvement indicates the integration of more advanced, enterprise-grade GPUs into Aethir’s infrastructure, consistent with its strategic pivot toward serving AI and machine learning workloads alongside gaming.

Whereas gaming workloads primarily rely on consumer-grade GPUs such as the RTX 4080–5090 series, AI applications require high-performance units like NVIDIA’s H100 and H200, which deliver significantly higher computational throughput. Aethir’s approach appears to segment GPU allocation, dedicating retail-grade hardware to cloud gaming clusters and reserving enterprise-grade resources for AI clients. This model enhances operational efficiency, workload optimization, and service differentiation, allowing Aethir to effectively balance the performance demands of both AI and gaming verticals within its decentralized network.

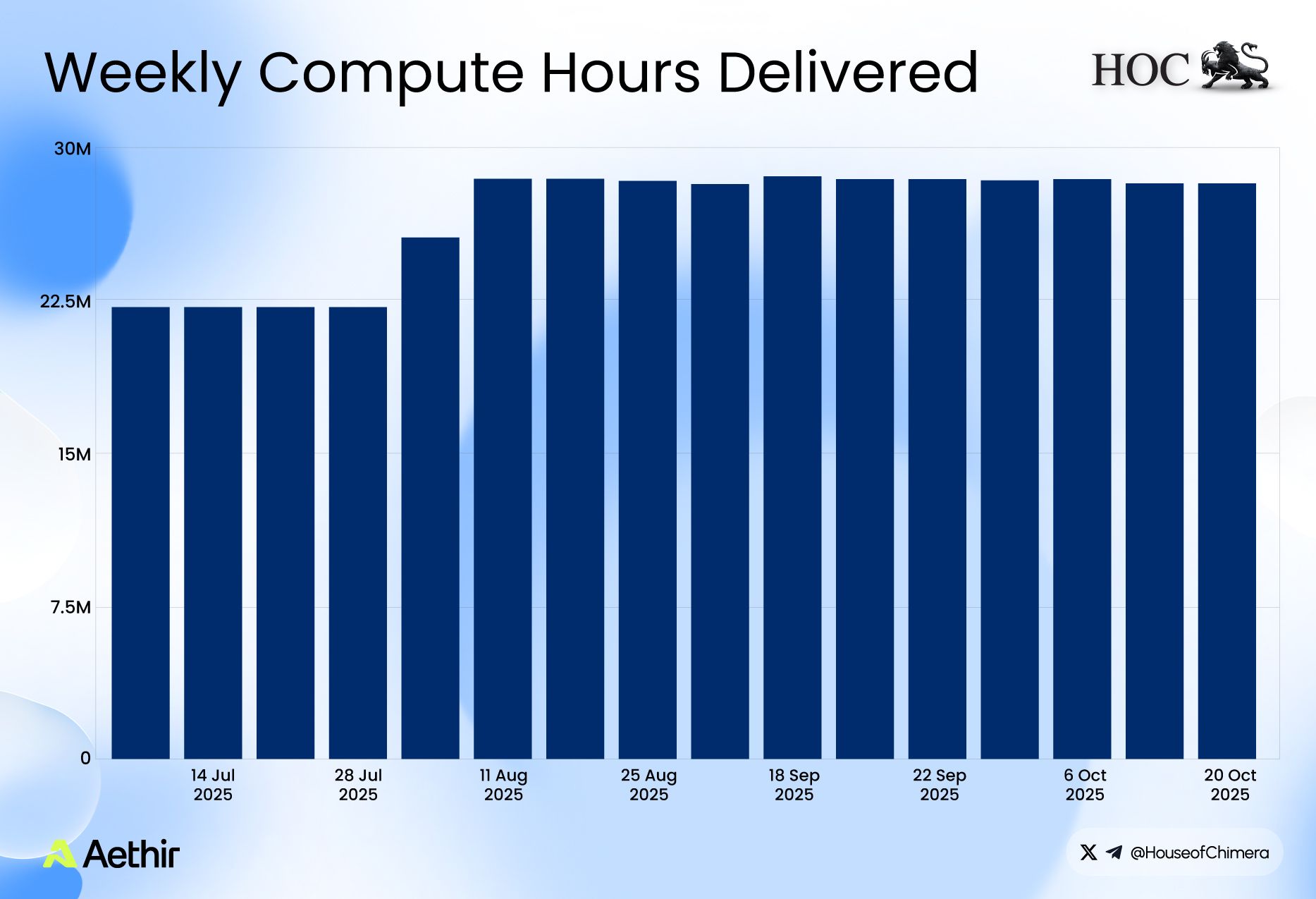

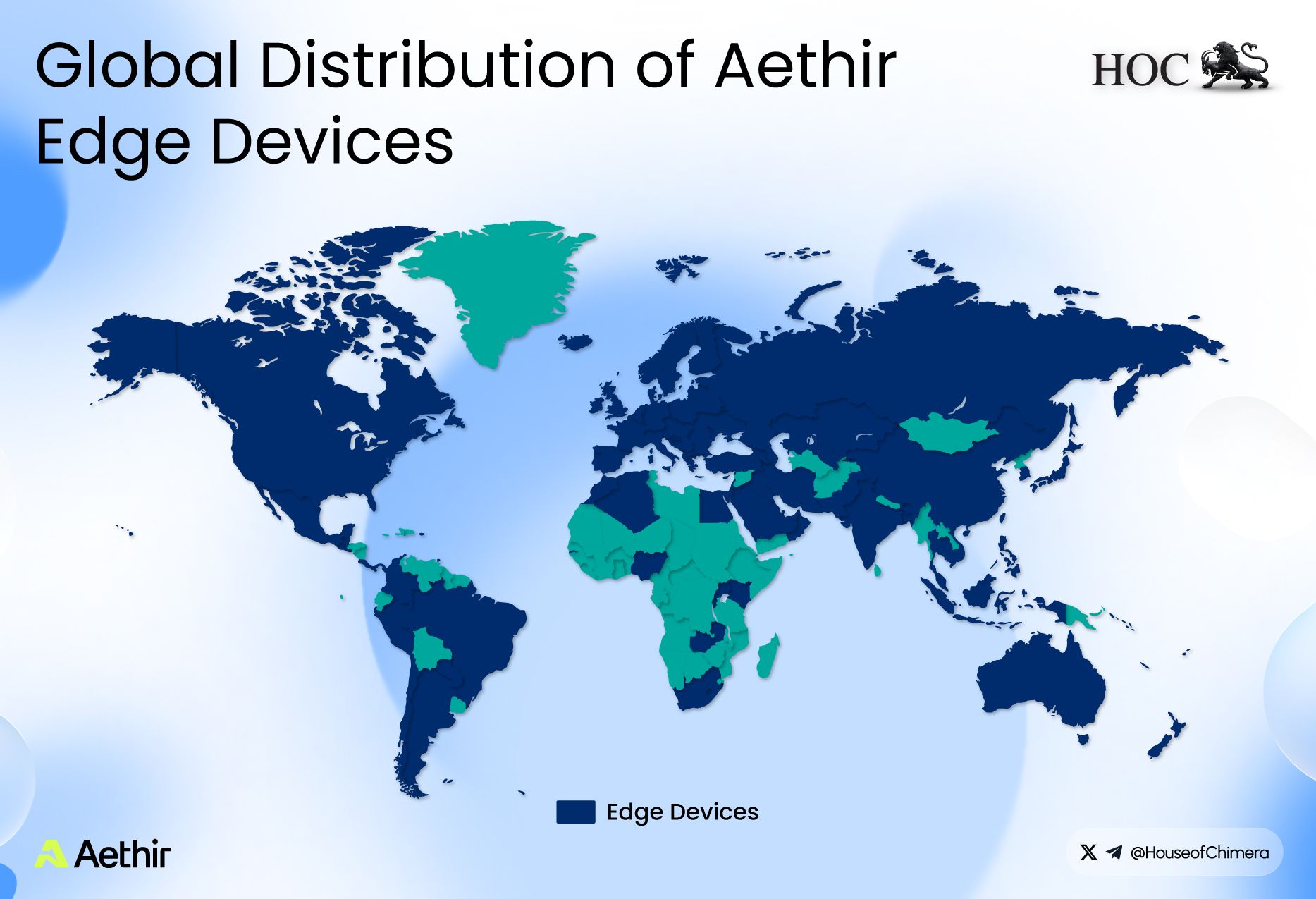

In Q3, the network delivered an estimated 28 million GPU hours per week, while its infrastructure now spans 93 countries (although regional GPU counts remain undisclosed). A globally distributed system of over 67,000 active Edge devices, deployed across 93 countries, plays a critical role as local gateways and orchestrators of GPU clusters, facilitating rapid resource reallocation, failover protection, and low latency for real-time workloads. These edge nodes enhance responsiveness by placing compute resources closer to end users, a design essential for applications such as cloud gaming and live AI inference. To learn more about how the Edge Device prevents latency: https://www.houseofchimera.com/blog/is-aethir-the-next-giant-in-cloud-gaming

Operational Highlights

Aethir has recently executed several high-impact strategic initiatives that clearly reflect its shift from a pure infrastructure provider to a full-stack ecosystem builder. The company announced a partnership with Predictive Oncology, involving a private investment of approximately US $344 million to establish what is described as a “Digital Asset Treasury” focused on the native token $ATH, essentially creating the first “Strategic Compute Reserve”. Under this framework, Predictive Oncology will deploy and monetize Aethir’s GPU infrastructure for enterprise AI workloads, then reinvest the realized revenue into additional ATH token purchases, thereby aligning token utility with the scale of the infrastructure.

Complementing this, Aethir has launched the AI Unbundled Alliance, an industry-wide collaborative platform with over 20 partners that offers GPU compute, data processing, blockchain oracles, and developer tooling in a single stack. One of the flagship additions to this ecosystem is Chainlink Labs, whose oracle infrastructure and the Chainlink Runtime Environment (CRE) join forces with Aethir’s decentralized GPU cloud, enabling builders to author verifiable workflows spanning on-chain, off-chain APIs, and legacy systems. Through this alliance, members gain access to hackathon bounties, grants, co-marketing support, and early access to tools like CRE, delivering a seamless environment for Web3 AI innovation.

Arizona State University (ASU), Sogni, Respeecher, and Messiah Network have recently joined forces with Aethir, marking a significant expansion of its partnership ecosystem and signalling rising demand for its decentralized GPU infrastructure. In the ASU collaboration, Aethir is supporting a global AI & blockchain education initiative through the university’s Endless Games & Learning Lab, offering up to US $3 million in compute subsidies to empower student-researchers with enterprise-grade GPU access.

Meanwhile, Sogni teamed up with Aethir to power scalable creative AI workflows via its decentralized cloud, including a dedicated airdrop campaign for Aethir’s stakers and Edge holders, an effort aimed at blending GPU infrastructure with the creator economy. Aethir Respeecher, a voice-AI pioneer, became a compute-client of Aethir to scale high-fidelity speech synthesis projects globally, citing Aethir’s low-latency, globally distributed GPU cloud as a core enabler. Aethir Messiah Network likewise tapped Aethir’s infrastructure to enhance its Web3+AI platform capabilities.

Future Outlook

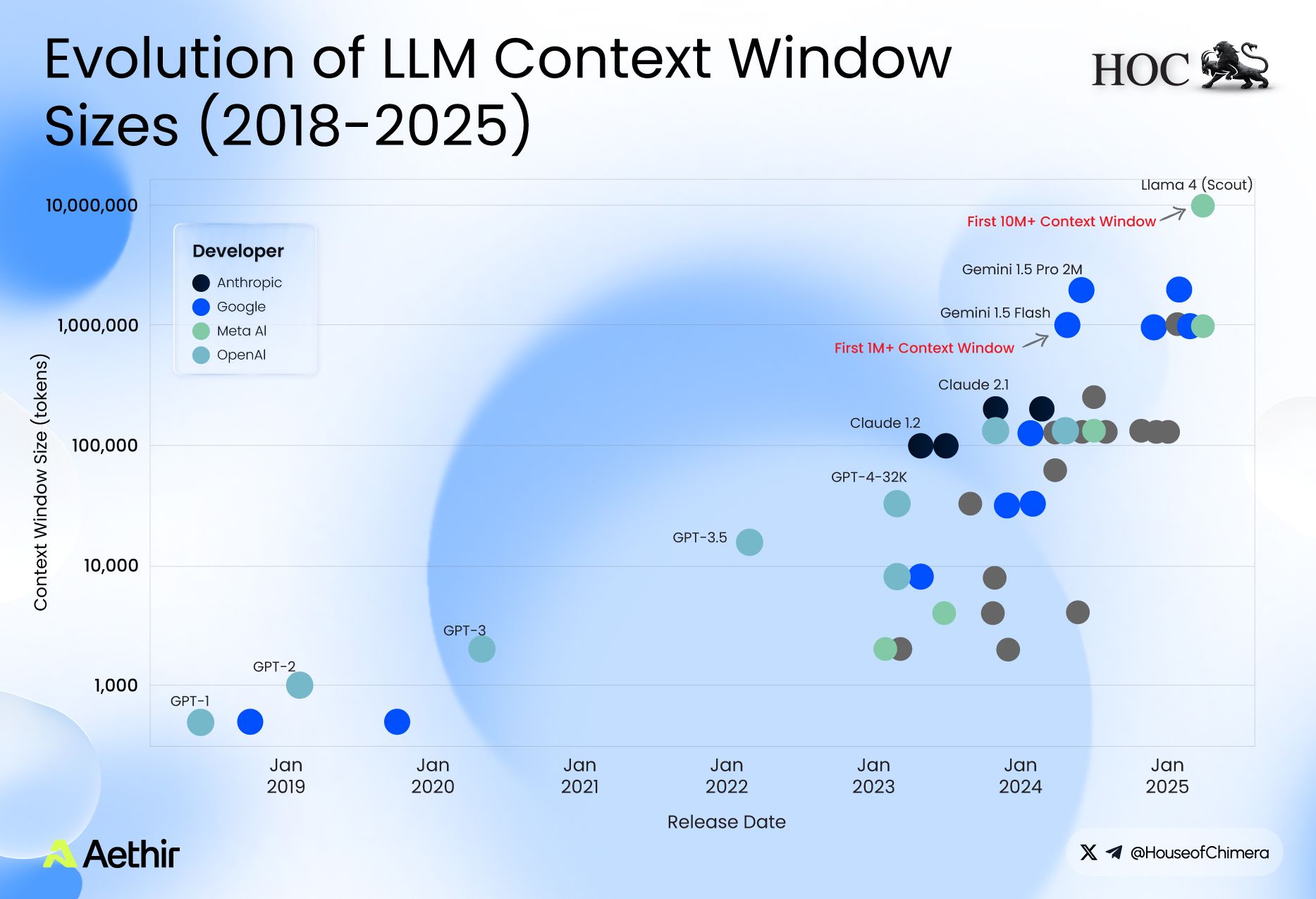

Aethir is strategically positioned to capitalize on multiple macro- and sector-specific trends shaping the trajectory of decentralized infrastructure networks. With the global market for AI infrastructure forecast to grow from roughly US$35 billion in 2023 to over US$223 billion by 2030 at a CAGR of ~30%+, and data-centre capacity expected to triple by 2030 with ~70% of demand coming from AI workloads, the timing is favourable for decentralized GPU supply models. Because high-performance GPUs are in increasingly short supply, especially as AI workloads like large-language-model training, real-time agent-based systems, and generative AI scale, Aethir’s model of aggregating underutilised compute resources gives it a structural advantage in a supply-constrained environment.

On the sector-specific front, the sophistication of AI workloads means that enterprise-grade GPUs, as opposed to consumer-grade cards, are becoming increasingly essential. Aethir’s ability to segment its infrastructure between gaming and AI use cases enables operational flexibility and targeted scaling, which is key as it expands its enterprise-grade GPU inventory. Additionally, the explosion of edge computing, with AI and real-time applications demanding lower latency and local processing, adds another tailwind to decentralized networks that place compute closer to end-users. Geopolitical uncertainty and semiconductor supply-chain fragility, such as trade tensions between major economies that threaten centralized providers, may further reinforce demand for borderless, decentralized alternatives like Aethir, which are inherently more resilient to centralized bottlenecks.

Looking ahead, Aethir’s long-term competitiveness hinges on its ability to scale its infrastructure while maintaining reliability, expand its high-performance GPU capacity, and capitalize on structural shifts across the AI and cloud-gaming verticals. If successful, it could evolve into a foundational layer for the broader decentralised compute stack and, in specific verticals, rival some centralised incumbents over the coming cycles.