Aethir Q1 2025 Report: Record Growth in AI & Gaming

Primer on Aethir

Aethir is a decentralized cloud infrastructure provider that aims to make high-performance computing, particularly GPU resources, more accessible, scalable, and cost-efficient. Unlike traditional cloud providers that rely on centralized data centers, Aethir leverages a distributed network of over 425,000 GPUs (self-reported), including consumer-grade and enterprise-level hardware such as NVIDIA H100s. This model allows underutilized computing resources to be pooled and allocated dynamically based on demand, serving use cases in cloud gaming and AI development.

Aethir’s architecture is built around a three-layer system (Network, Edge, and Application) designed to minimize latency and optimize workload distribution. Its Edge devices act as gateways that manage local clusters and ensure rapid failover and resource reallocation, improving the quality of service for end-users. Additionally, Aethir employs a staking and slashing mechanism using its native ATH token to enforce service reliability and align incentives across the ecosystem.

With over 200 gaming studio partners, a reported capacity to serve 12 million monthly users, and a focus on decentralization, Aethir differentiates itself by offering an alternative to costly and centralized cloud platforms like AWS or Google Cloud.

The Financials of Aethir

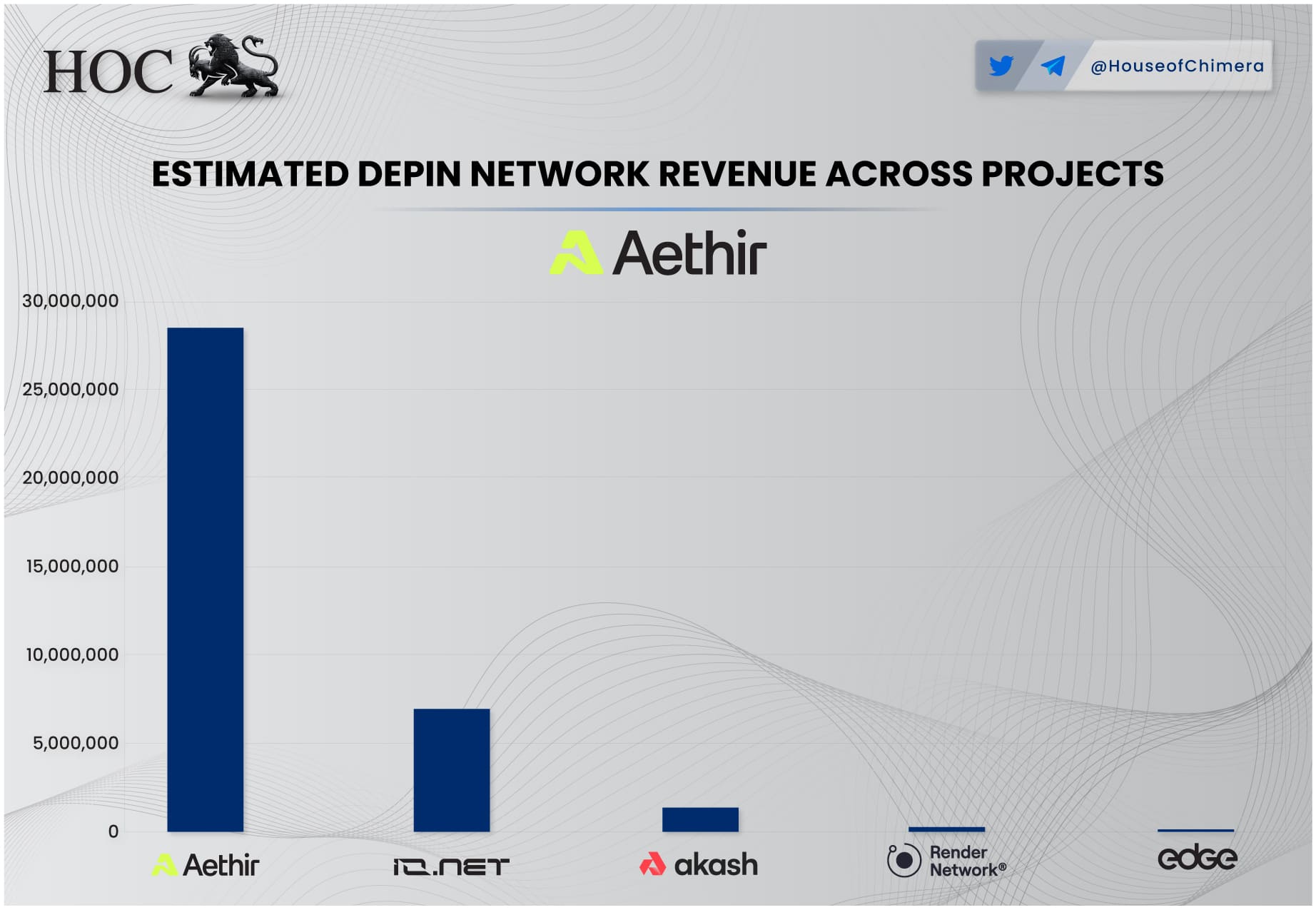

- Quarterly Revenue: Self-reported Q1 2025 revenue reached $20.5 million, the highest among DePIN projects.

- Annual Recurring Revenue (ARR): Climbed to $127 million, reflecting a ~90% QoQ increase.

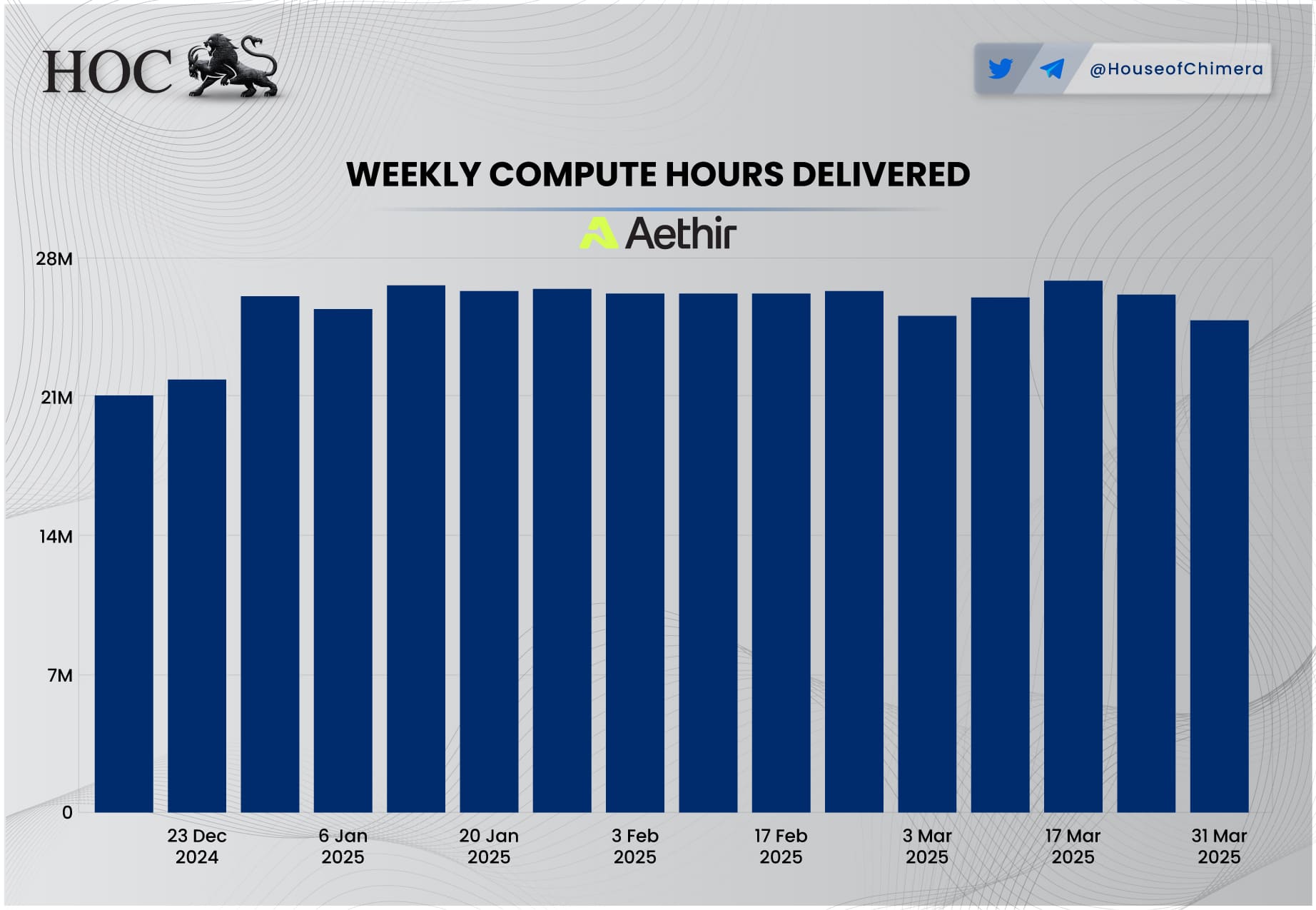

- Compute Utilization: Averaged ~100 million monthly compute hours, up ~25% QoQ.

- Sector-Wide Growth: Mirrors broader DePIN momentum as GPU demand intensifies.

- Revenue Drivers: Growth supported by AI adoption and sustained cloud gaming traction.

- Gaming Network: 200+ partners and 690 gaming clusters serving ~12 million players.

- Macro Tailwinds: Trade tensions and compute scarcity may reinforce decentralized alternatives.

Q1 2025 marked a record quarter for Aethir, with self-reported revenue reaching $20.5 million, positioning it as the top-performing DePIN project in absolute revenue. The ecosystem's Annual Recurring Revenue (ARR) rose to $127 million, reflecting a ~90% increase compared to the previous quarter. Aethir also reported an average of 100 million compute hours per month in Q1, representing a ~25% quarter-over-quarter increase in utilization.

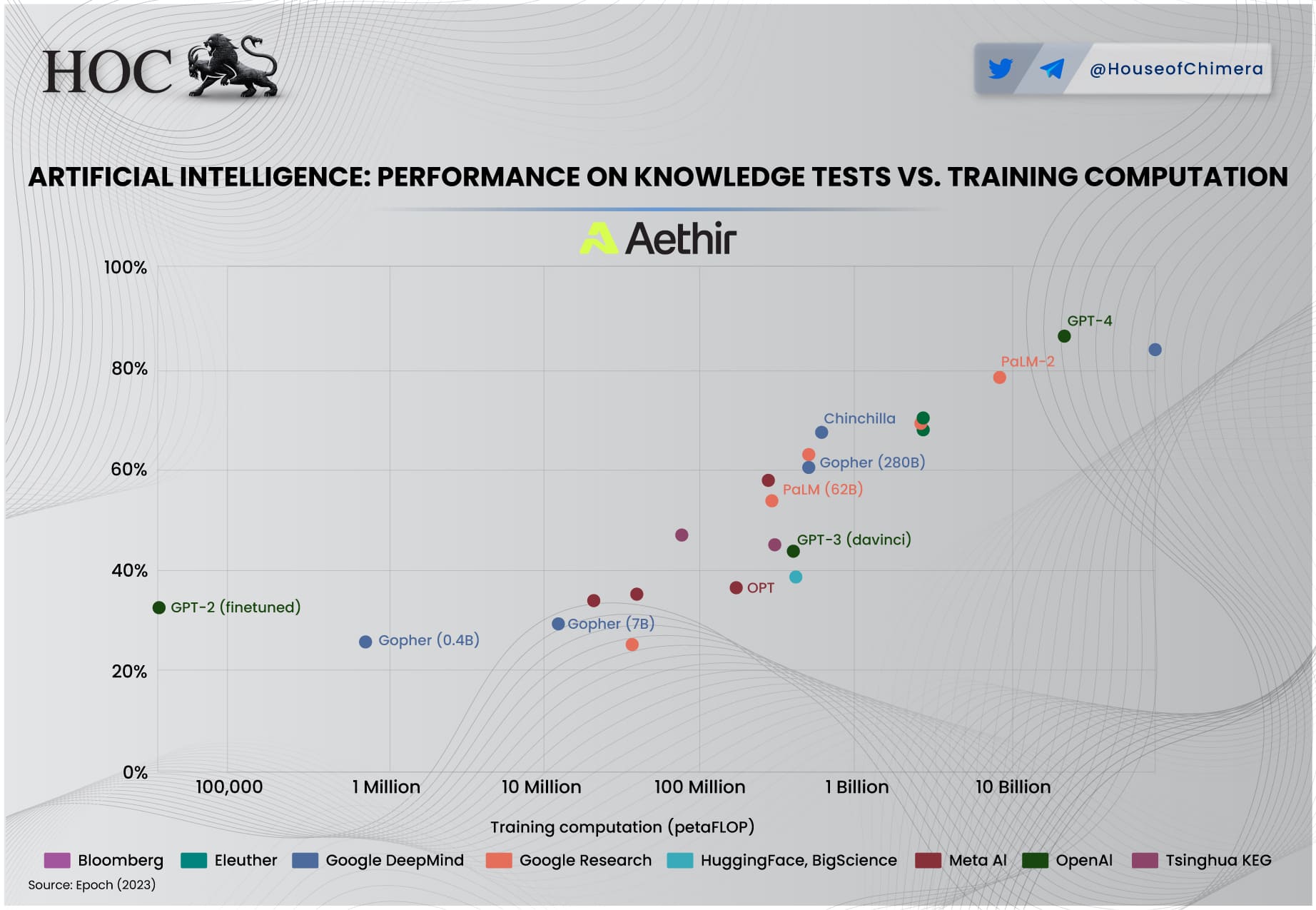

This growth aligns with a sector-wide uptrend observed across other DePIN networks such as Akash, GeodNet, io.net, and Edge, indicating strong momentum in decentralized compute infrastructure. The key driver behind this expansion is the sharp rise in global demand for GPU-based computing, heavily influenced by the acceleration of AI adoption across both Web2 and Web3 markets. This macro trend is reflected in search interest and supported by strong earnings from traditional chip manufacturers such as Nvidia and TSMC.

Importantly, the broader geopolitical landscape may further reinforce the case for decentralized infrastructure. Trade tensions and semiconductor supply chain disruptions—particularly between the U.S. and China—pose risks for centralized providers but may highlight the resilience of borderless, decentralized alternatives like Aethir. These platforms, which lack centralized control or physical hubs, are inherently more resistant to regulation and tariffs.

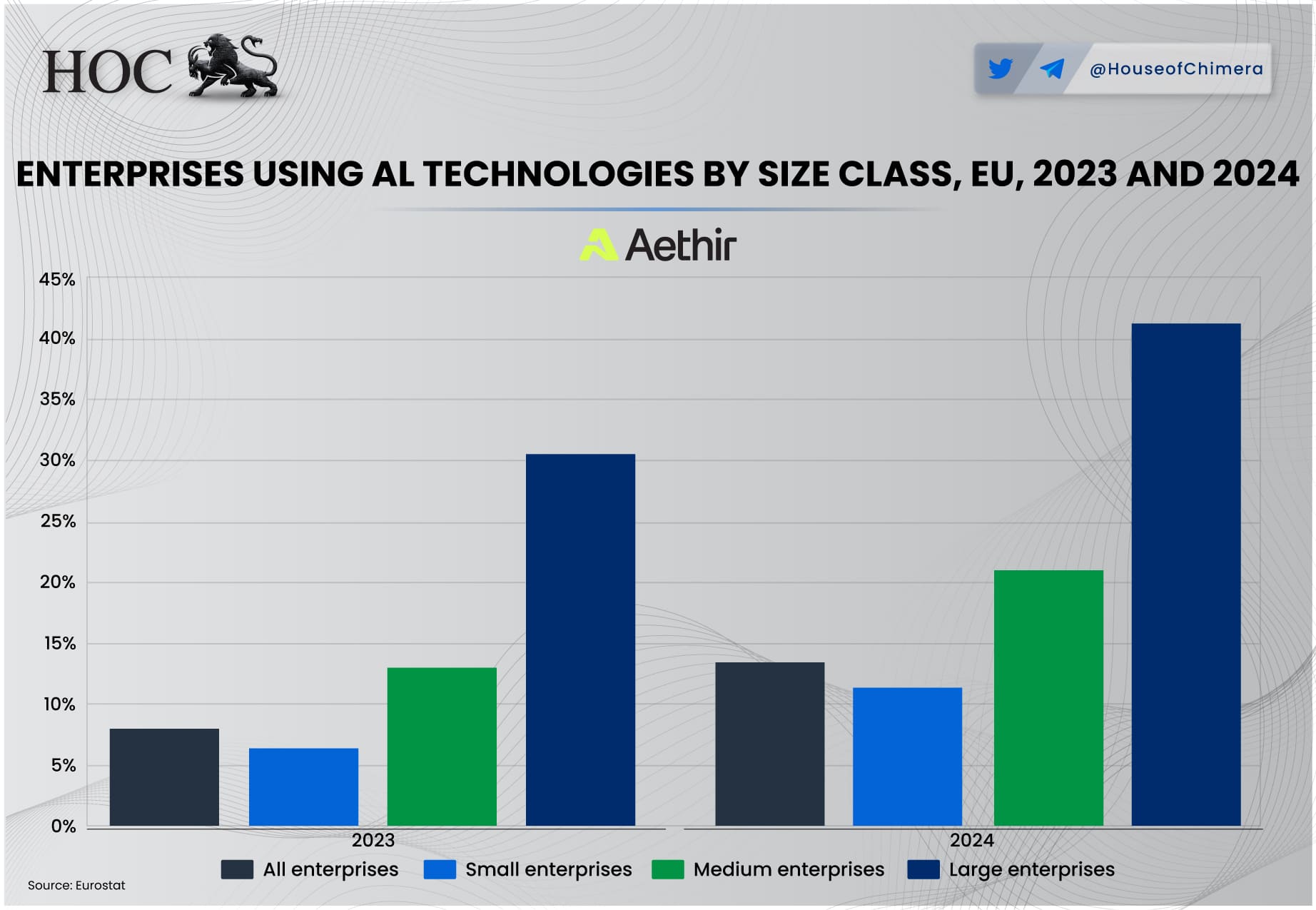

As AI models grow in complexity, the scarcity of computing power becomes a critical constraint. Compute demand is expected to rise further as enterprises continue to scale their AI capabilities, evidenced by a ~50% year-over-year increase in enterprise AI usage in Europe. Aethir’s architecture and resource pool position it to meet these demands, particularly its ability to segment GPU types for AI and gaming use cases.

Beyond AI, Aethir maintains a strong footprint in cloud gaming. The platform partners with over 200 gaming companies and operates 690 clusters serving approximately 12 million players. While the growth rate in gaming is expected to be more stable than in AI, it represents a meaningful and recurring revenue stream as cloud gaming becomes a more viable alternative to traditional hardware-based gaming.

State of the Aethir Network

- GPU Inventory: Network includes 425,000+ GPU containers with a total of ~23.6 million TFlops in compute capacity.

- GPU Profile: The average GPU performance (~59 TFlops) is comparable to retail-grade cards like the RTX 4080 Super.

- Compute Segmentation: Likely operational split—retail GPUs for gaming, high-end GPUs for AI workloads.

- Utilization Rate: In Q1, the network delivered ~26 million GPU hours weekly, indicating a ~38.5% utilization rate.

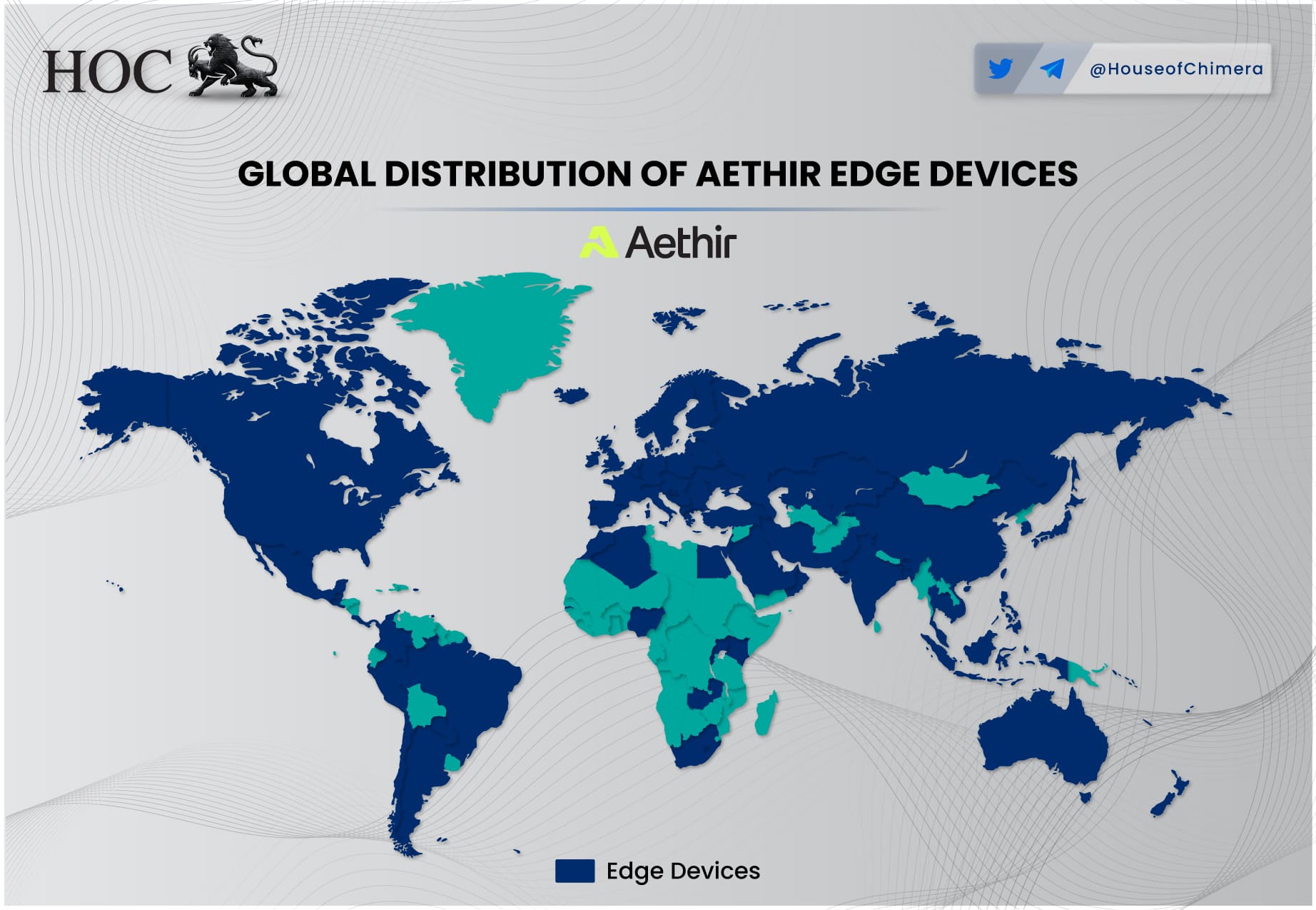

- Geographic Reach: GPUs are distributed across 95 countries, and Edge Devices are active in 97 countries.

- Edge Infrastructure: 66,000+ staked Edge Devices, with ~10% QoQ growth, supporting low-latency performance.

- Deployment Strategy: Edge Devices are placed close to users to optimize latency, especially for cloud gaming.

The Aethir Network currently comprises over 425,000 GPU containers with an aggregate compute power of 23,631,280 TFlops, theoretically capable of supporting over 209 million concurrent players. Based on the reported figures, the average compute power per GPU stands at approximately 59 TFlops, comparable to consumer-grade hardware such as the RTX 4080 Super. While not an issue for cloud gaming use cases, this hardware profile may not meet the requirements of more intensive AI workloads. As a result, it is expected that Aethir segments its operations, allocating retail-grade GPUs to gaming workloads and reserving enterprise-level GPUs, such as NVIDIA H100s, for AI tasks. This separation allows the network to serve both verticals efficiently without overburdening low-tier resources.

In Q1, the network delivered an estimated 26 million GPU hours weekly. The current GPU count equates to a utilization rate of approximately 38.5%, above the industry average and indicative of strong demand across its user base. While the exact distribution of hardware is unclear, Aethir has confirmed that its infrastructure spans 95 countries, though specific GPU counts per region are not disclosed.

A globally distributed network of Aethir Edge Devices supports this infrastructure, now present in 97 countries. Over 66,000 Aethir Edge Devices are staked and active on the network as of the latest reporting period, with roughly 10% quarter-over-quarter growth. These Edge Devices are critical in managing local clusters, facilitating rapid resource reallocation, and reducing latency, which is especially important for real-time applications like cloud gaming. Their proximity to end-users enables more stable service delivery and minimizes lag, reinforcing Aethir’s infrastructure design, which is focused on responsiveness and decentralization. To learn more about how the Edge Device prevents latency: https://www.houseofchimera.com/blog/is-aethir-the-next-giant-in-cloud-gaming

The Social Metrics of Aethir

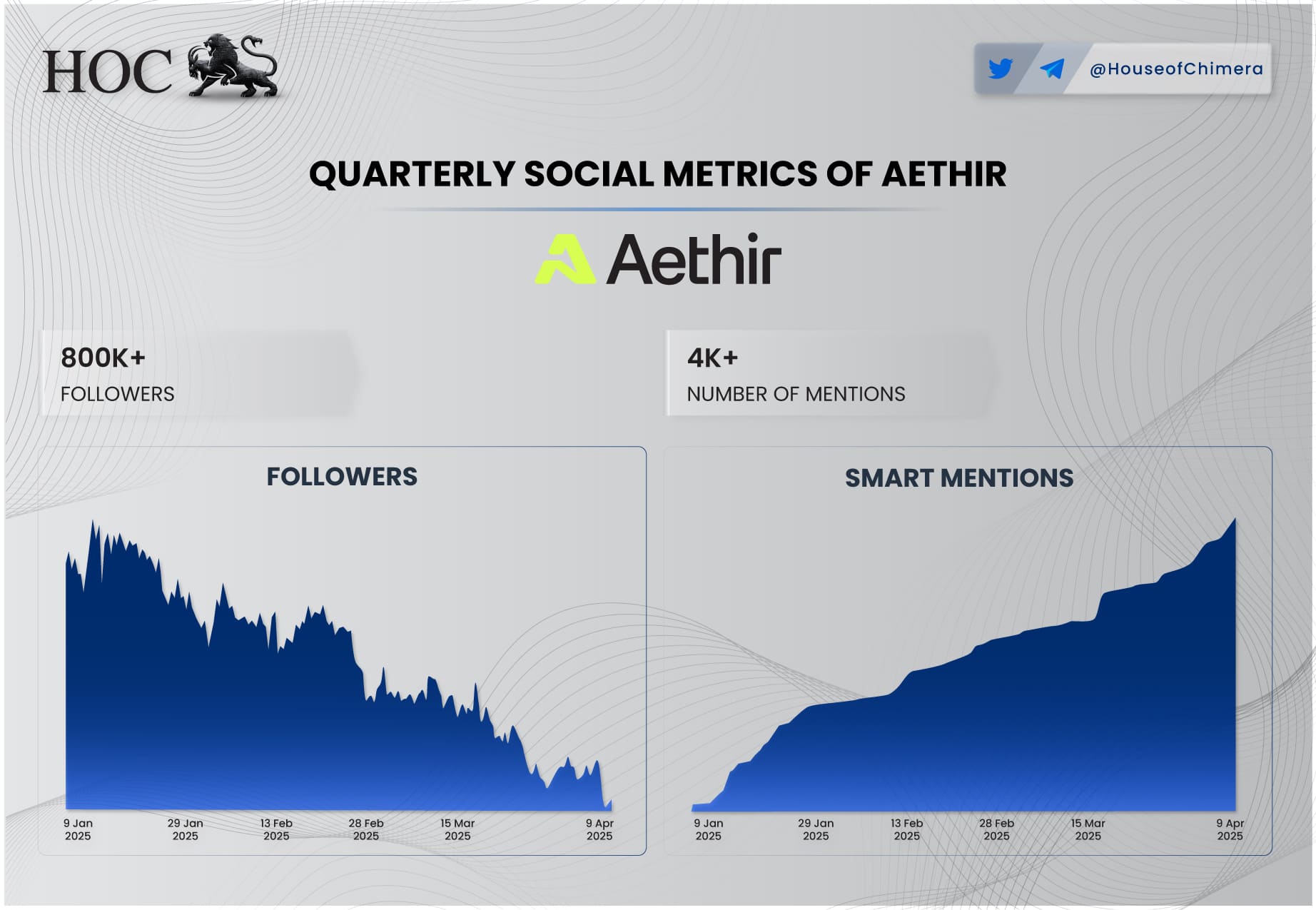

- Community Size: Slight QoQ decline in follower count on X; Smart Money followers down ~1%.

- Mentions: Smart Money mentions remained stable, indicating continued interest from key market participants.

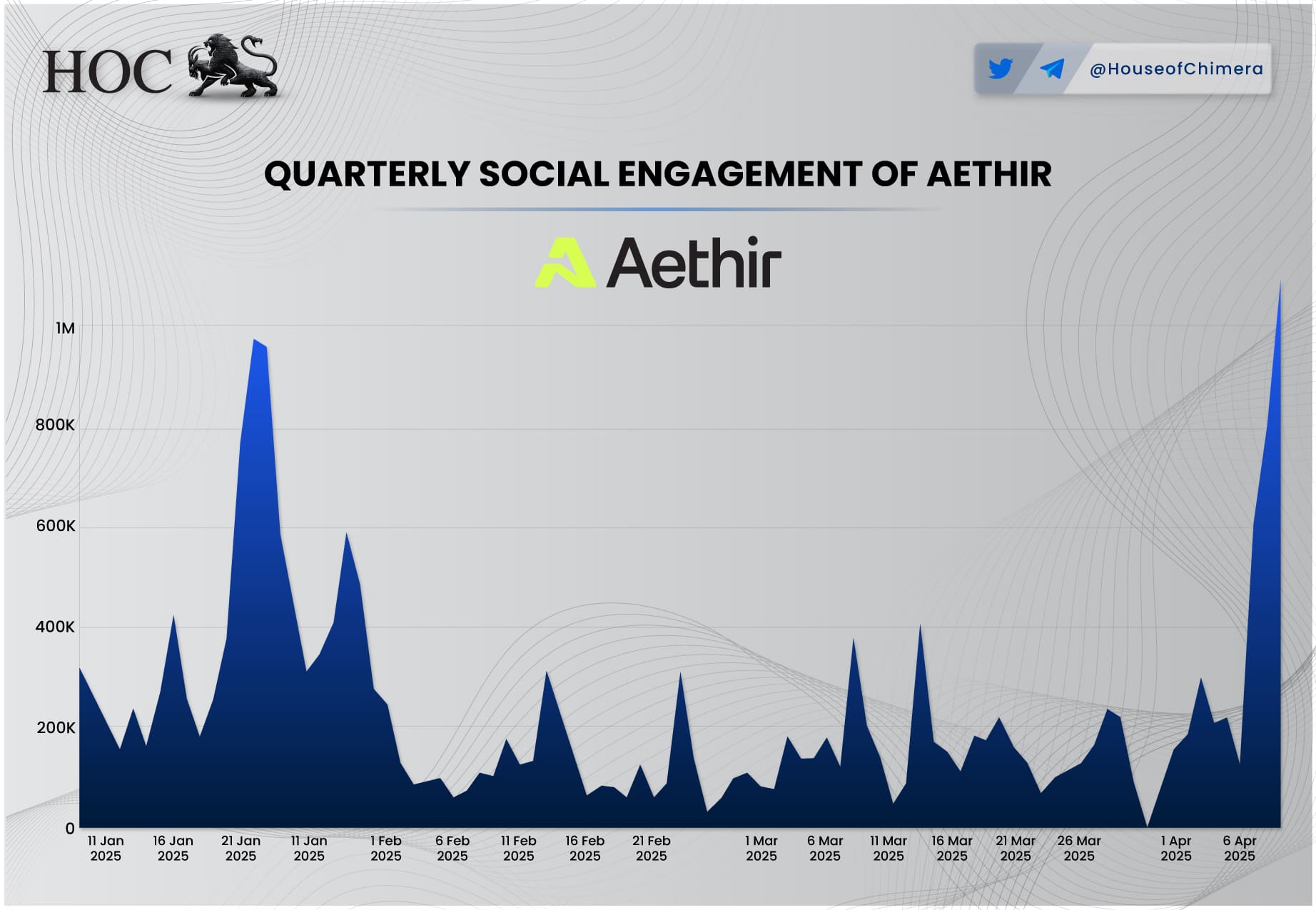

- Engagement Spike: Significant surge in engagement following Binance Alpha listing.

- Social Dominance: Recovered later in Q1, but underperformed earlier due to broader altcoin market weakness.

- Sentiment: ATH sentiment reached an all-time high toward quarter-end, driven by increased exposure and retail participation.

- Market Context: Metrics reflect broader market conditions, not waning interest in Aethir specifically.

Community engagement remains a key performance indicator within the crypto industry, particularly for projects operating in emerging verticals like DePIN. In Q1 2025, Aethir experienced minor declines across specific social metrics, including a 0.25% quarter-over-quarter drop in its X (formerly Twitter) follower count and a 1% decline in Smart Money followers. Despite this, Smart Money mentions remained stable, indicating that interest from informed market participants was largely unaffected by short-term volatility.

Aethir's social engagement saw a notable increase later in the quarter, primarily triggered by its listing on Binance Alpha. This event sparked a surge in user interaction and platform visibility, indicating a renewed community interest. While social dominance lagged earlier in Q1, due in part to broader altcoin market underperformance and Bitcoin’s outsized narrative share, it recovered toward the end of the quarter.

Notably, sentiment surrounding the ATH token reached an all-time high by the end of Q1. This likely reflects the influx of new users and retail investors introduced to the project through the Binance Alpha listing. The modest declines seen earlier in the quarter are more a function of prevailing market dynamics than project-specific challenges. Overall, Aethir remains well-positioned to build on its renewed momentum in Q2, especially if positive sentiment and engagement trends continue.

Operational Highlights

- Token Listing: Aethir’s token was listed on Coinbase, enhancing accessibility and legitimacy.

- Gaming Initiative: Launched a $1 million grant program with Xsolla to support early-stage game developers.

- Infrastructure Focus: Grant recipients gain access to Aethir’s decentralized GPU resources for cloud-native gaming.

- Community Expansion: Rolled out Aethir Forge, a global grassroots engagement program.

- Local Leadership: Appointed ForgeMasters to drive adoption via education, events, and user onboarding.

- Regional Support: Established Regional Forges as operational hubs for community and partner activation.

- Case Studies: Aethir’s instant‑play streaming tech in the SuperScale case study drove a 43% preference for instant play, +35% CTR and +45% conversion in Phase 1, and in Phase 2 delivered +143% stream selection, +75% D7 ROAS, +93% ARPU, +77% more sessions, +26% longer sessions, +60% D1 retention, and +80% D7 retention

Aethir has executed a series of strategic initiatives to reinforce its infrastructure, grow its community, and enhance its market presence. One of the most notable developments was listing its token on Coinbase. This move significantly improves accessibility for both retail and institutional participants while potentially boosting liquidity across trading platforms.

Aethir partnered with Xsolla to launch a $1 million grant program to support early-stage developers in the gaming vertical. The initiative provides financial backing and access to Aethir’s decentralized GPU network, offering scalable compute power to develop high-performance, cloud-native games. Beyond funding, the program is structured to promote innovation and solidify Aethir’s presence within the broader Web3 and gaming ecosystem.

To support the growth of its decentralized ecosystem, Aethir also introduced Aethir Forge—a community-led expansion framework focused on localized engagement. ForgeMasters, regional ambassadors responsible for hosting events, onboarding users, and fostering education around the Aethir platform, are central to this initiative. These efforts are coordinated through Regional Forges, which act as logistical and operational anchors across key markets. Collectively, these programs reflect Aethir’s approach to scaling its infrastructure and user base through coordinated, on-the-ground efforts.

Future Outlook

Aethir is strategically positioned to benefit from several macro and sector-specific trends that are expected to shape the trajectory of decentralized infrastructure networks. The growing global demand for high-performance computing, particularly in AI and cloud gaming, continues to outpace the available supply of GPU resources. This supply-demand imbalance creates a favorable backdrop for Aethir’s decentralized GPU model, which aggregates underutilized computing power to meet dynamic market needs.

The increasing sophistication of AI workloads—such as large language model training, AI inference, and real-time agent-based systems—will likely intensify the demand for enterprise-grade GPUs. While Aethir’s current network comprises consumer-grade and high-performance units, its ability to segment resources between AI and gaming use cases suggests operational flexibility and room for targeted scaling. Expanding its database-grade GPU capacity will be crucial to securing more substantial AI-centric contracts and partnerships.

Geopolitical uncertainty and the potential for prolonged global trade disruptions, particularly in the semiconductor supply chain, could serve as an unintended catalyst for the development of decentralized alternatives. As traditional providers face regulatory and logistical bottlenecks, platforms like Aethir, which operate without centralized

Looking ahead, Aethir’s ability to scale its infrastructure while maintaining service reliability, expand its enterprise-grade GPU inventory, and capitalize on structural shifts in AI and gaming will be key to its long-term competitiveness. If victorious, Aethir could emerge as a core infrastructure layer in the broader decentralized compute stack, potentially rivaling centralized incumbents in specific verticals over the coming cycles.

Closing Summary

Aethir has established itself as a notable player in the decentralized cloud infrastructure space, with a focus on GPU-intensive applications in AI and cloud gaming. Its distributed architecture, combined with an extensive network of consumer and enterprise-grade GPUs, enables dynamic resource allocation and cost-efficient compute delivery.

In Q1 2025, Aethir reported the highest revenue among DePIN projects, driven by strong growth in compute hours and network utilization. Strategic initiatives, such as the Xsolla gaming grant and the Aethir Forge community program, support further adoption and ecosystem expansion.

Key challenges remain around data transparency and scaling enterprise-grade infrastructure, particularly for AI workloads. However, Aethir's operational segmentation between gaming and AI, along with favorable market trends in compute demand, positions it to serve as a core infrastructure provider in the decentralized computing stack.