Will DeFi Summer 2.0 Return in 2025? How UX and Innovation Could Spark the Next DeFi Boom

DeFi Summer 2.0: Can Better UX Trigger the Next Wave of Crypto Growth?

Nostalgia is arguably one of the most powerful emotions, a longing for a time when everything seemed more straightforward, better, and meaningful. That moment is the summer of 2020, not the Summer of ‘69, anon, but what’s now famously known as DeFi Summer. The good old times when one could get a 50% APR, and no one batted an eye. Unfortunately, the summer did not last forever, and now we are all in limbo with point systems.

But will DeFi Summer 2.0 make a comeback in 2025? Let’s find out.

Quick Takeaways

- DeFi Summer 2020 marked explosive growth in decentralized finance, with yields hitting 50%+ and TVL jumping from $800M to $10B.

- The hype cooled fast, shifting from sky-high gains to slower, sustainable growth.

- DeFi today is bigger but fragmented, spread across Ethereum, Solana, Arbitrum, and more.

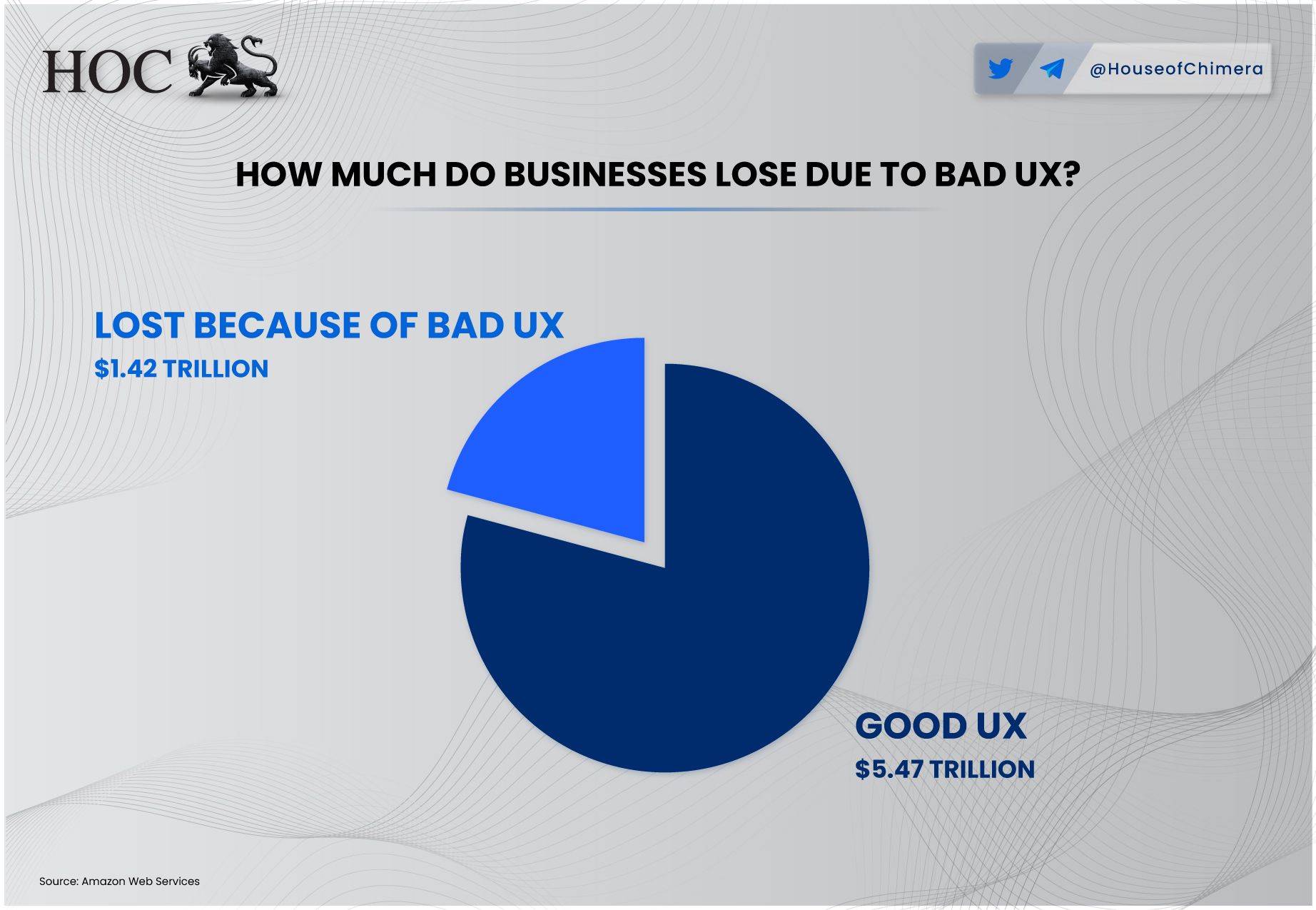

- UX is the bottleneck. Wallet chaos, seed phrases, and clunky apps block mainstream adoption.

- Apps like Pump.fun & DeFiDotApp show that better UX could kickstart DeFi Summer 2.0.

What was DeFi Summer?

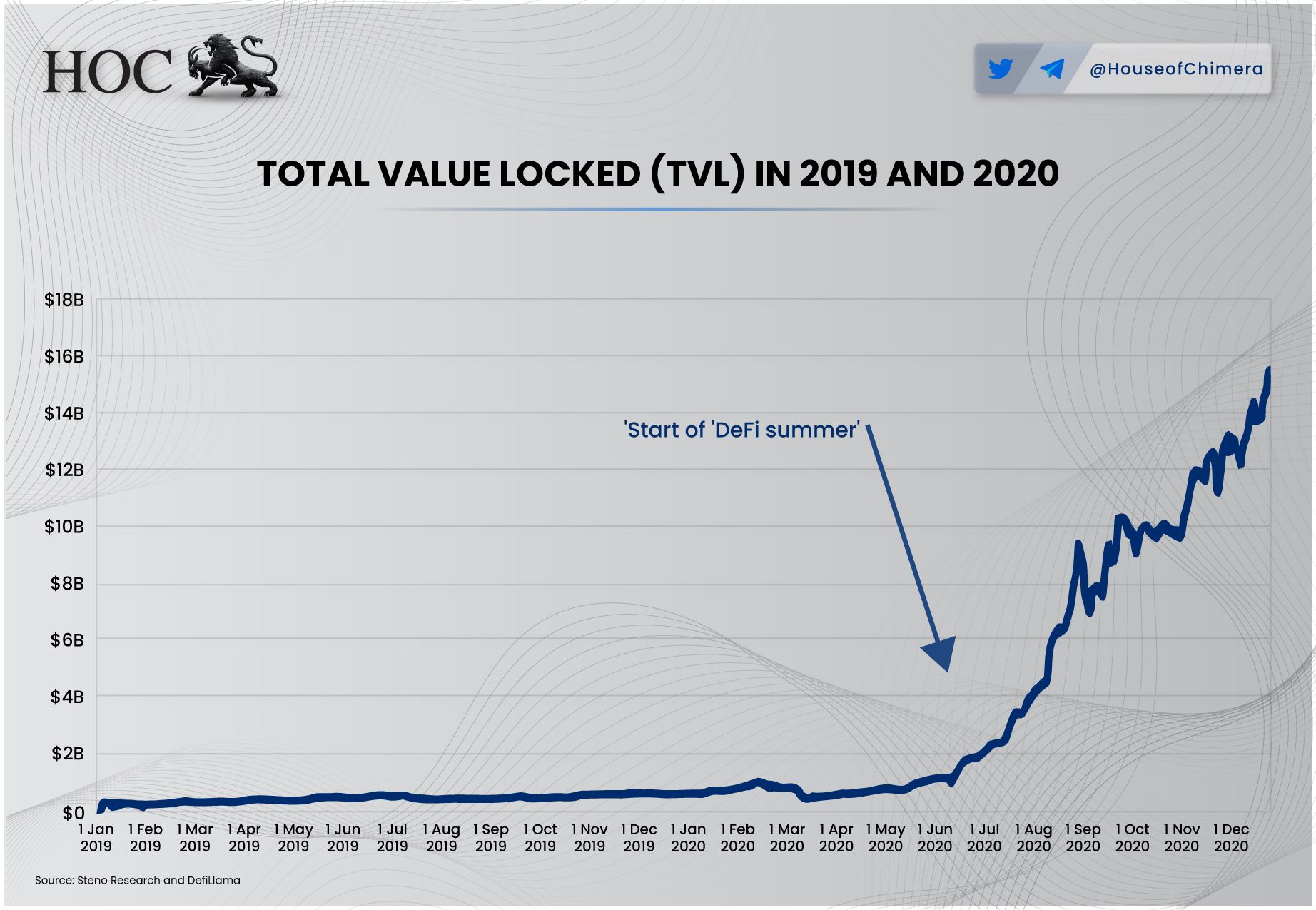

DeFi Summer was a turning point in Decentralised Finance (DeFi), with multiple new and interesting projects emerging. During this time, the DeFi ecosystem surged in popularity as users gravitated toward platforms offering financial services without relying on traditional intermediaries. The sector saw meteoric growth, driven by a wave of new protocols (e.g Uniswap, Yearn, Compound, Sushiswap) that created a surge in available opportunities. Fierce competition for users led to exceptionally high APRs, sparking a domino effect across lending, borrowing, trading, and derivatives markets. Consequently, the industry's total value locked (TVL) went up significantly during this period, highlighting the increase in overall activity.

As with any golden era, DeFi Summer wasn’t without controversy. Chef Nomi infamously sold his entire stake of SUSHI tokens, and YAM Finance suffered a critical bug in its rebase mechanism despite accumulating $500M in TVL within a single day.

Yet, even with these setbacks, the growth was staggering. Uniswap’s monthly trading volume skyrocketed from $169M in April 2020 to over $15B by September, nearly a 100x increase. Total Value Locked (TVL) across DeFi jumped from $800M to over $10B, a nearly 13x surge. Surprisingly, even wrapped Bitcoin on Ethereum grew from 20,000 to almost 60,000 BTC in the same timeframe.

But DeFi Summer didn’t last forever. By the end of September 2020, the market cooled rapidly. Many top DeFi tokens saw steep declines, with some losing up to 75% of their peak value. As a result, the initial hype began to fade. The following opportunities were less explosive but more sustainable, shifting focus from aggressive gains to safer, long-term growth. TVL continued to rise at a more tempered pace.

What were the catalysts of DeFi Summer?

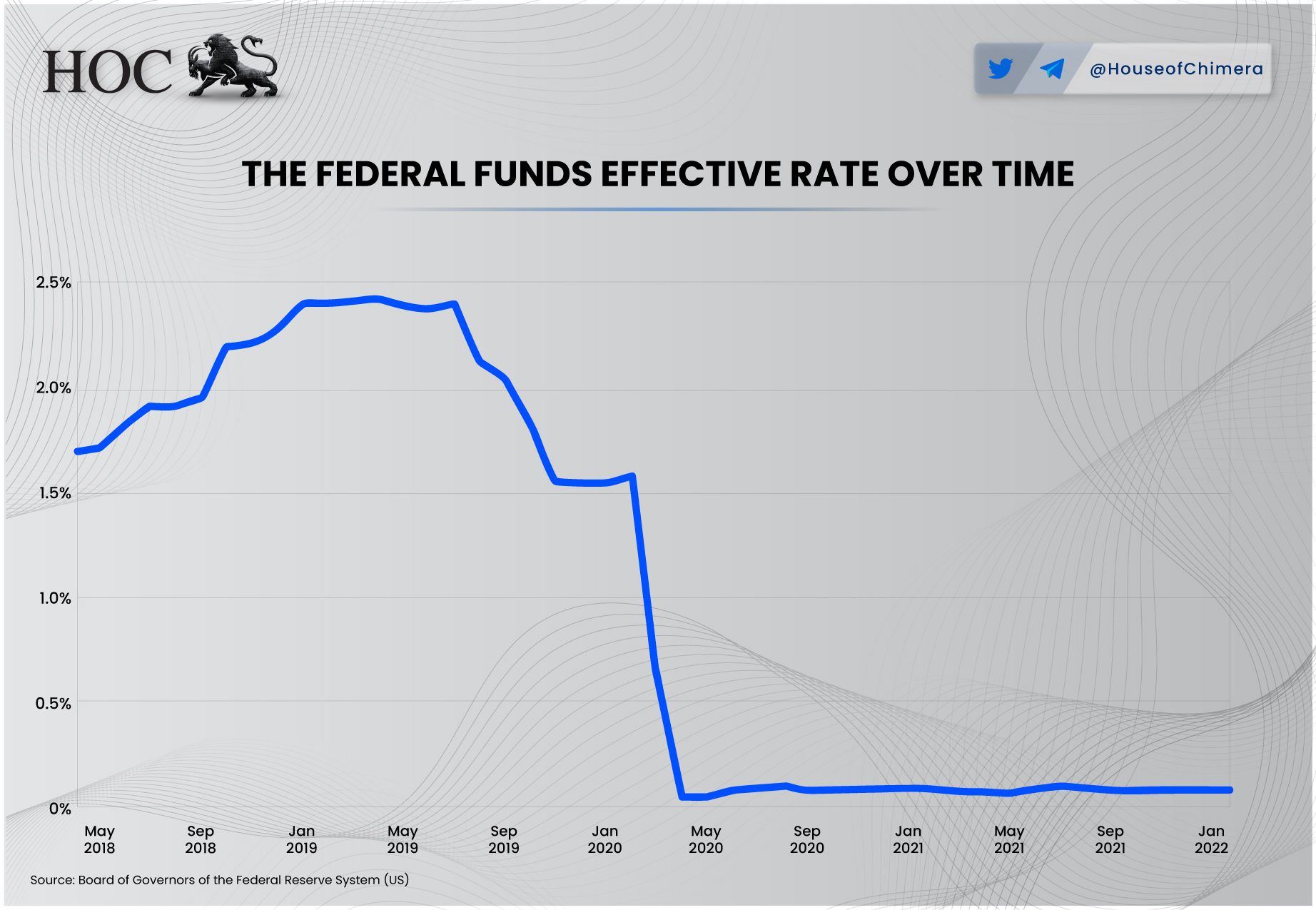

The catalysts behind DeFi Summer were twofold. On one hand, a surge of innovative DeFi protocols introduced new use cases and, more importantly, attractive opportunities. This gave investors a compelling reason to engage with the DeFi ecosystem, as yields were competitive compared to traditional alternatives. On the other hand, the Federal Reserve had begun an easing cycle by cutting interest rates, significantly increasing overall economic liquidity. With abundant capital and a low cost of debt, investors sought higher returns beyond traditional markets, ultimately turning to DeFi as a promising alternative.

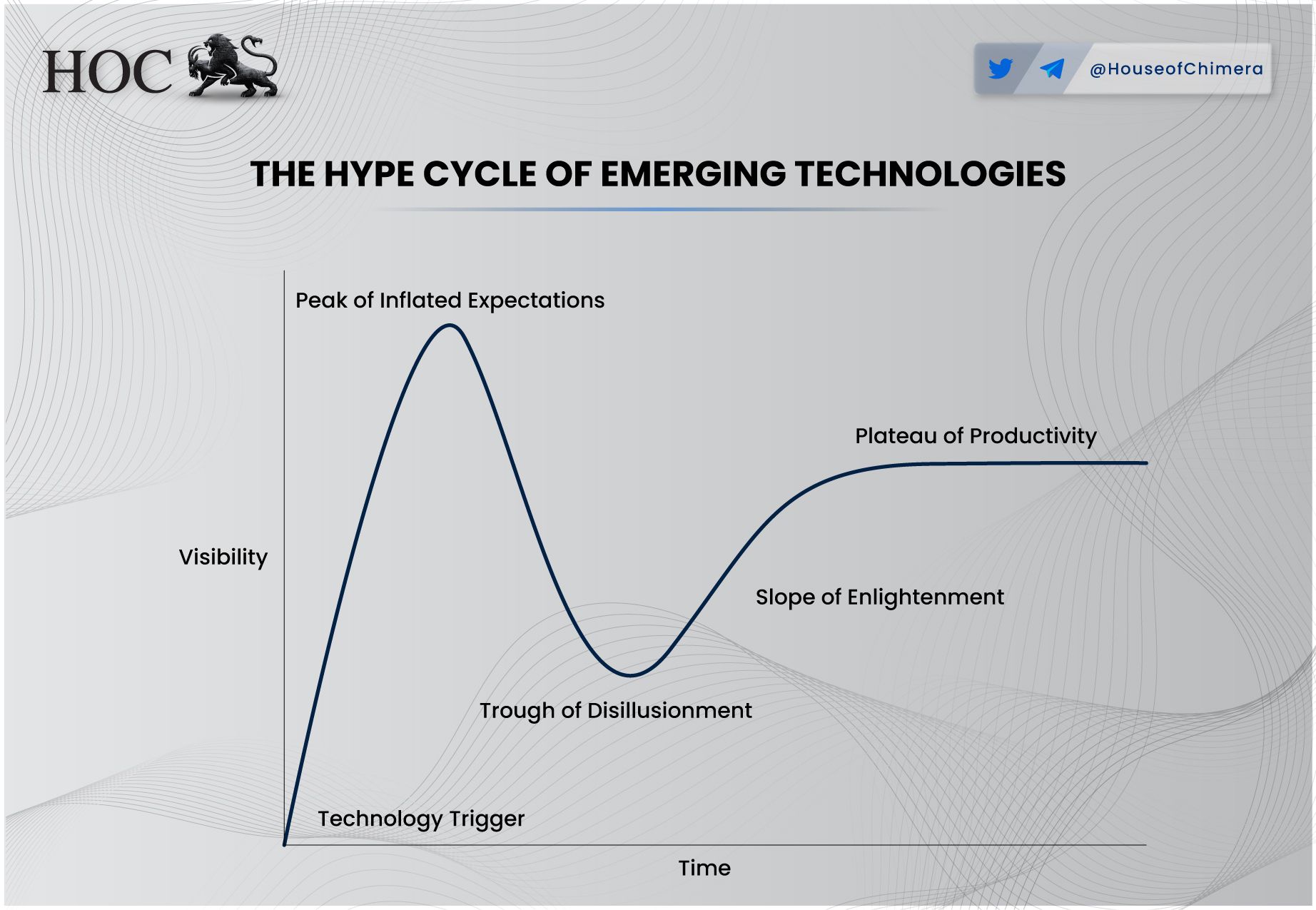

In the early days of DeFi Summer, initial participants were driven by a deep belief in the revolutionary potential of decentralized finance. They saw it as a fundamental way to reshape traditional financial systems. As the space gained momentum, it attracted a growing number of participants. This effect was further amplified by a surge in media coverage, which emphasized the potential of DeFi and fueled a sense of FOMO, drawing in even more users.

The initial surge in attention eventually peaked, giving way to a market driven by short-term speculators seeking quick profits rather than supporting the industry’s core vision. This wave of excessive hype was soon followed by a sharp drop in prices and waning public interest, triggering a prolonged bear market and a period of stagnation. The honeymoon phase, which had sparked high expectations and rapid industry traction, ended, ushering in a slower, more measured period focused on sustainable rather than explosive growth.

DeFi Summer 2.0?

The return of DeFi Summer would feel like an unexpected snow day, or even better, like sipping an ice-cold cocktail on a sunny beach. But like all good things, it might never return, or worse, it might not feel the same. Today's crypto landscape looks markedly different from the 2020–2022 era, often considered the golden age of DeFi.

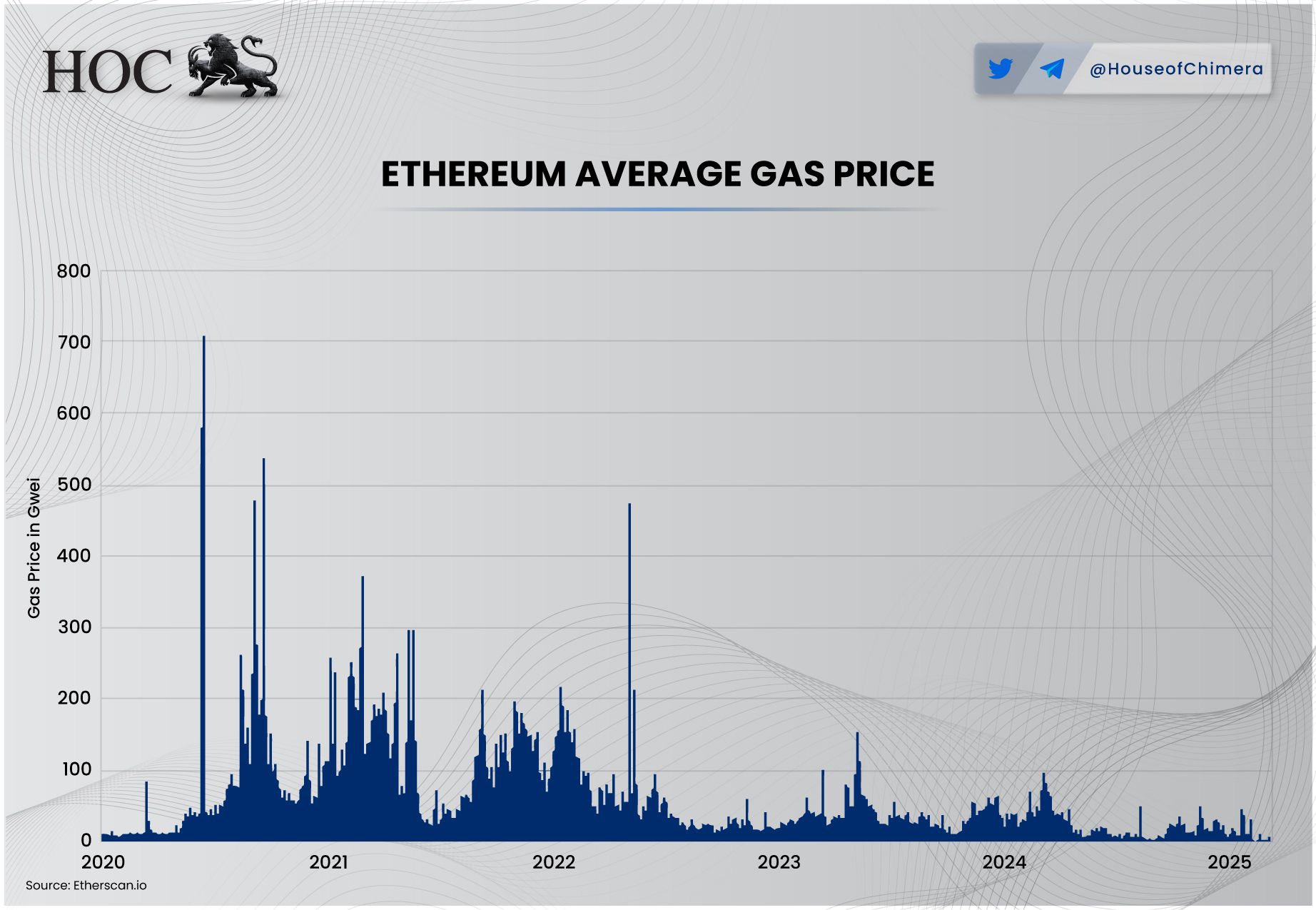

Remember the gas fees on Ethereum during that time? The sheer madness of paying up to 700 gwei, around $100, for a single swap? As painful as it was, it highlighted the overwhelming demand for DeFi and, perhaps more tellingly, just how intensely PvP the market indeed was.

The DeFi industry has evolved and matured significantly compared to its earlier days. It is now more resilient to hacks and has shifted toward a more sustainable growth trajectory. While total value locked (TVL) peaked at $200B in 2022 and has since declined to $112B, the sector has expanded in other key areas. Notably, participation has increased, and decentralized exchange (DEX) volumes have reached new highs, surpassing $50B in daily volume this January, roughly five times higher than the best day in 2022.

The number of Layer 1 and Layer 2 networks has grown substantially. In 2020, around 95% of DeFi activity was concentrated on Ethereum. By 2025, Ethereum’s dominance has dropped to roughly 55–60%, with Solana, Tron, and BSC collectively capturing about 15% of the market, and Layer 2s like Arbitrum holding around 2%.

This growing diversification has shifted the narrative. Between 2020 and 2022, being fast and cheap was a significant advantage due to Ethereum’s high fees and slower performance. However, by 2025, most infrastructure projects will offer low-cost transactions and quick finality. As a result, the ability to swap tokens for pennies in seconds is no longer a unique selling point, and the market has become saturated with DEXs and DeFi protocols relying on these features as their primary differentiator.

This begs the question: what will put your favorite DeFi application on the radar, and potentially could kickstart a DeFi summer? User Experience, I know it’s not a sexy topic, but let me cook here.

The Web3 Nightmare

The Web3 UX is a rollercoaster, not full of joy but rather the opposite. It is filled with redundancy and complexity, making it a digital nightmare. Here are some basics: A Web3 user often needs multiple wallets. Metamask will get you far, but what about non-Ethereum Virtual Machine (EVM) compliant chains like Bitcoin? Solana? SUI? APTOS? SEI? The list goes on.

The next pain point in the Web3 UX is that the user needs to store the seed phrases of all their wallets individually. The funds are gone if the user loses access to these seed phrases. Remember that users need multiple wallets to navigate their favorite chains, precisely as blockchains come and go in the ever-changing and fast-paced crypto industry. A good example is SUI, which became relatively popular within a few months, as TVL increased from 500 million to over 2 billion within 6 months.

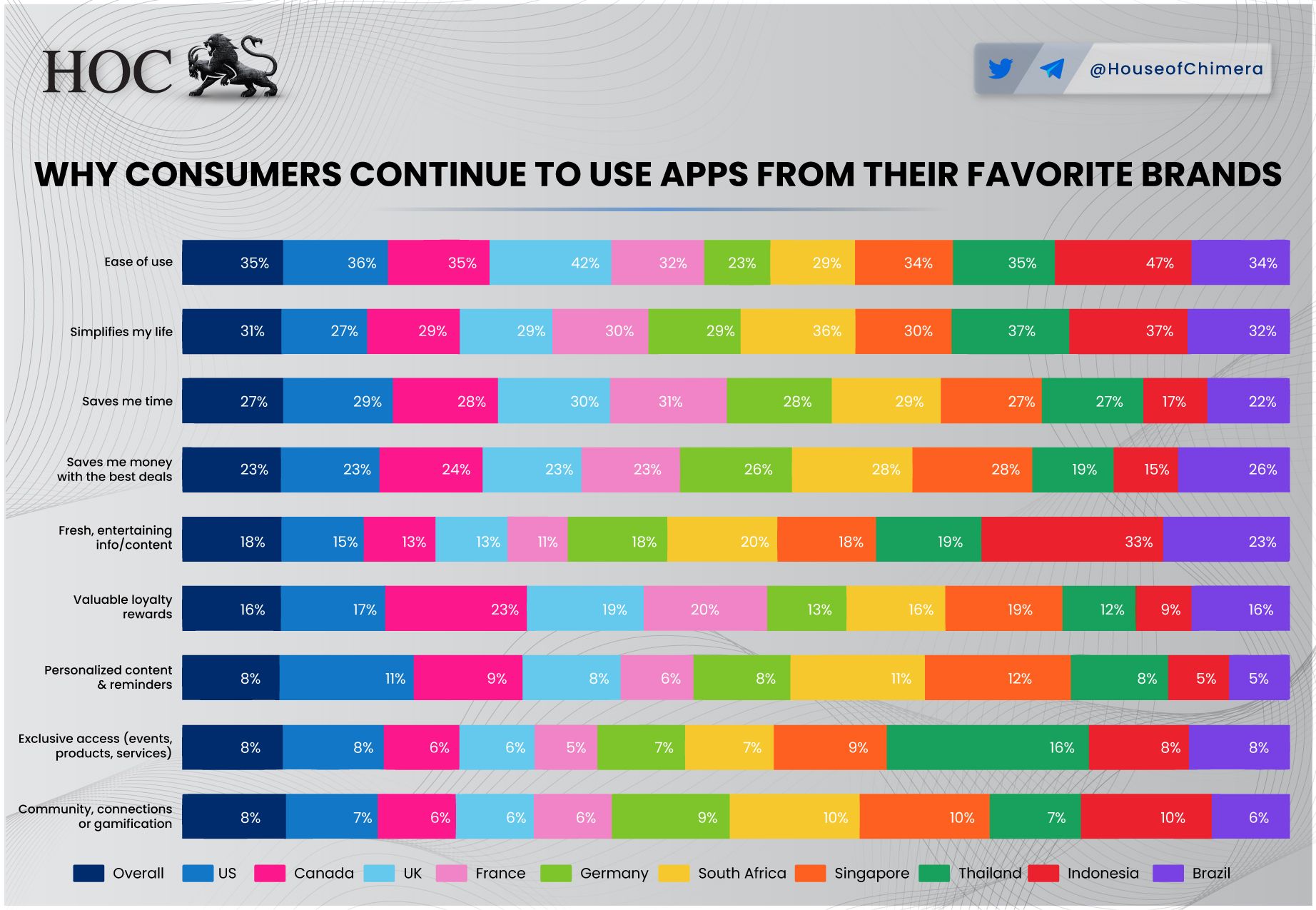

Imagine using a Web2 application and going through multiple hoops and holes just to perform simple stuff. Yeah, right, you will drop that application right away. Users value convenience nearly above everything, even over their privacy (Hi Facebook!). Hence, making an application as convenient as possible should be the absolute goal for most projects, while in Web3, that’s currently not the case.

The UX Summer?!

Fortunately, more Web3 projects are starting to understand that UX isn’t just a meme; it’s a key factor in reaching users beyond the Web3 niche. A prime example is Pump.fun, which made launching a meme coin possible in just a few minutes. The best part? Even normies could do it. That accessibility and the viral nature of memes created the perfect storm. Over 9.2 million coins were launched in under a year, generating more than $611 million in fees.

Love or hate them, meme coins proved a point: Pump.fun was a massive success. Its easy-to-use, casino-like interface created an environment where even teenagers could spin up their tokens. Now, we’re not saying DeFi needs to go full casino-mode, but the lesson is clear: UX matters. As long as Web3 apps are clunky and unintuitive, the average user simply won’t touch them.

DeFi today is still overwhelmingly complex. One wrong step can lead to significant losses. A handful of projects are working to fix that, and one standout is DeFiDotApp. It's the closest a Web3 DeFi app has come to replicating the feel of Web2. With social logins, no seed phrases to remember, no bridges to worry about, and no gas fees, onboarding becomes frictionless. Users can just tap, swap, and go, no extra extensions, apps, or hurdles that might push them away. Every additional step increases the chance they’ll quit the process.

Ultimately, ease of use is what drives retention. Once that’s in place, convenience, like saving time or simplifying tasks, does the rest. In crypto, we have a habit of overengineering things, but simplicity keeps users engaged. If DeFi is to see actual adoption, accessibility has to come first. Projects like @DeFiDotApp have set a new standard, and if others follow suit, we could attract fresh liquidity, the same fuel that powered the original DeFi Summer. A new wave of capital, paired with a sense of euphoria, is precisely what the space needs for another DeFi revival.