Ethereum Institutional Demand: Risks, Opportunities & the Decentralization Paradox

Ethereum Institutional Demand And Its Effect on Decentralization

Hypothesis:

Ethereum is experiencing rapid institutional accumulation through ETFs, corporate treasuries, and direct demand from whales. This raises the question of whether such inflows threaten decentralization, as validator power and governance could become concentrated. The key issue isn’t only who owns ETH, but how that ETH is staked, whether spread through decentralized liquid staking pools or concentrated with custodial validators. This article will analyze on-chain accumulation trends, the operational risks they could potentially introduce, and the possible long-term trade-offs between institutional adoption and decentralization.

Key takeaways:

- Rising Institutional Demand: Institutional interest in Ethereum is increasing through ETFs, corporate treasuries, and whale accumulation, with ETH ETFs exceeding $27 billion AUM by August 2025.

- Yield-Bearing Asset: Unlike Bitcoin, Ethereum offers staking yields of 3% to 6%, making it a yield-bearing, infrastructure-backed asset.

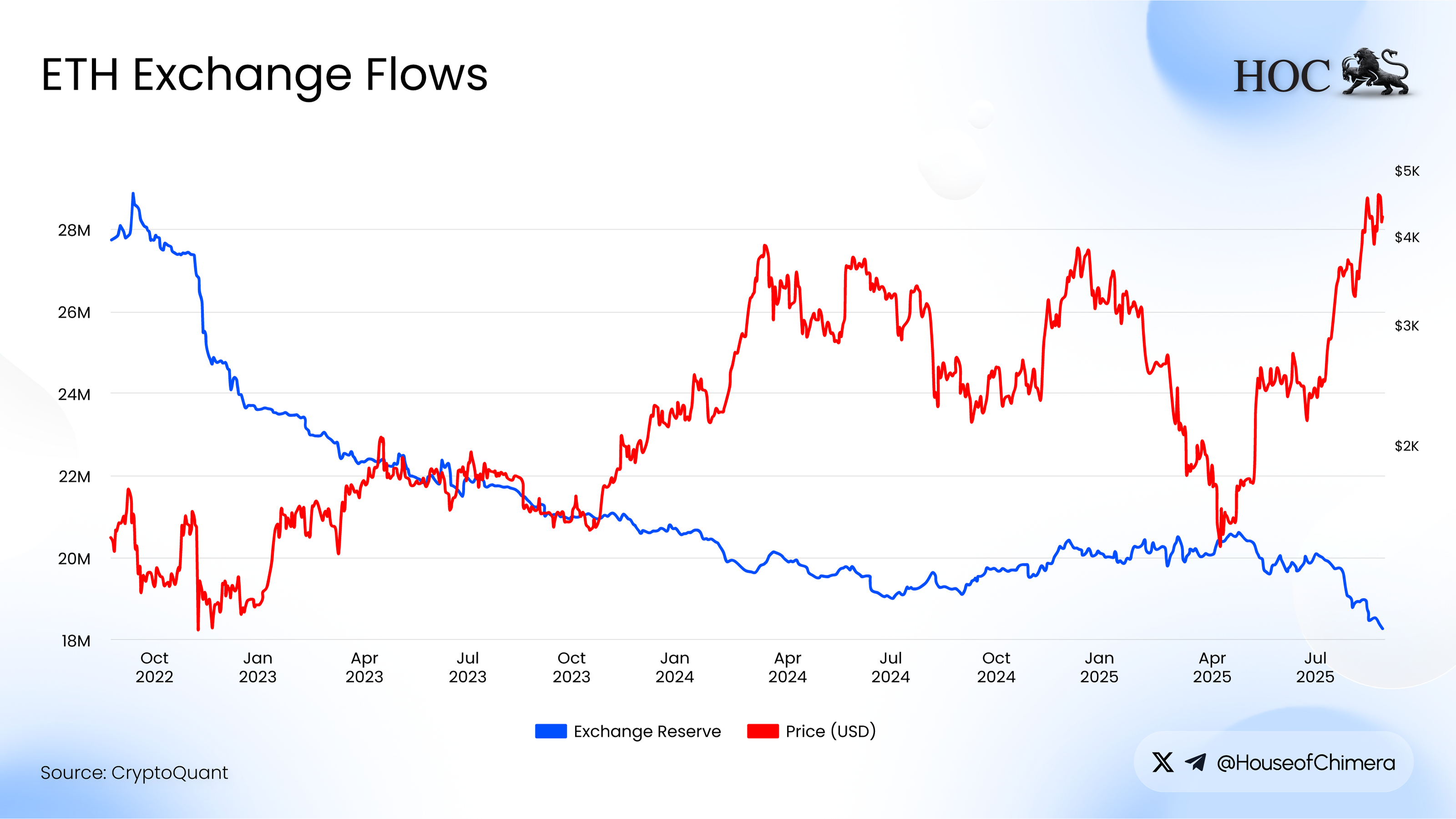

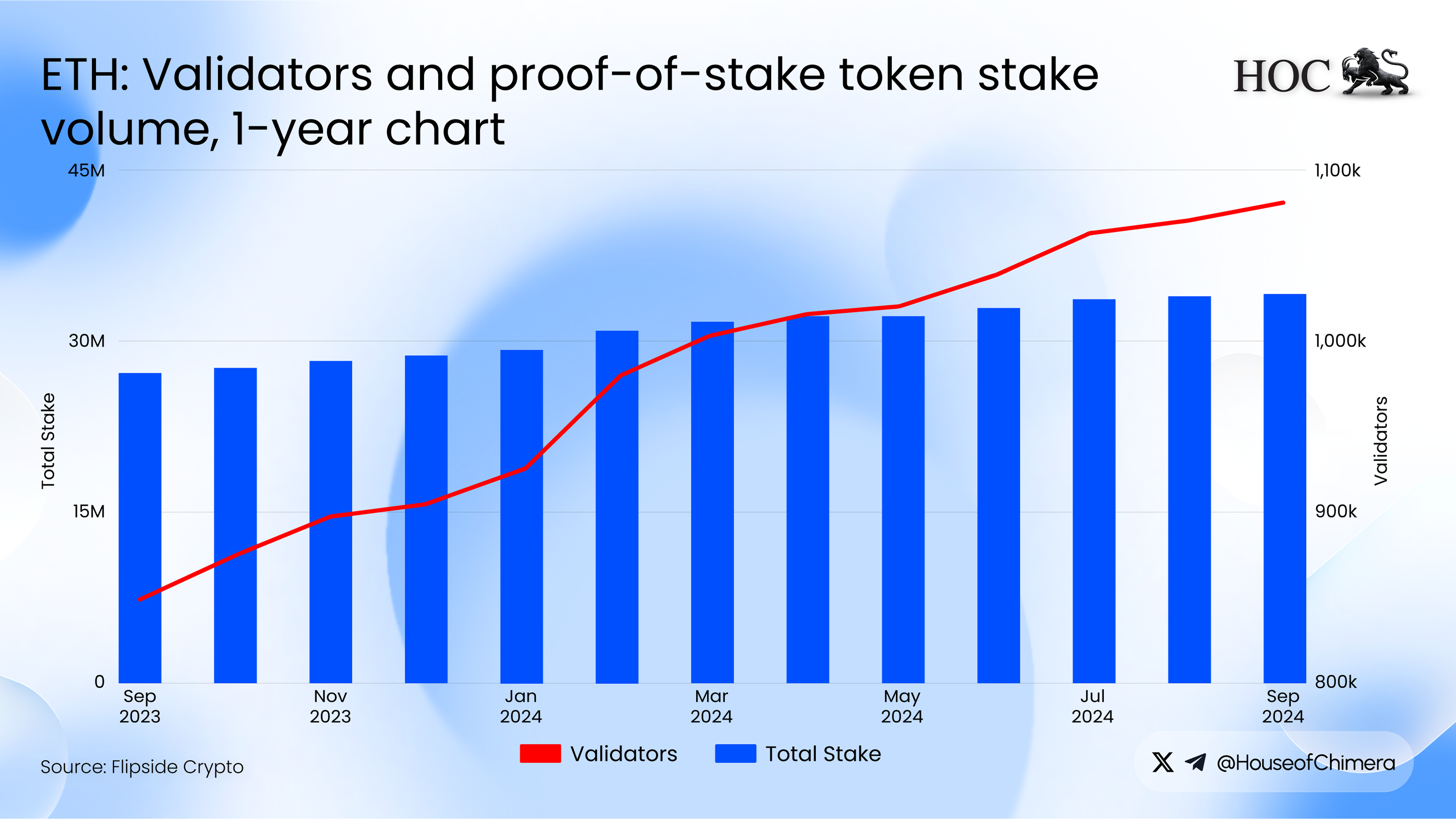

- On-Chain Data Insights: Exchange balances are at nine-year lows, staking participation is nearing 30% of total supply, and the number of validators has surpassed 1 million.

- Concentration Risks: Validator power risks being concentrated in major custodians, such as Coinbase and Binance, while Lido has a large but more distributed share.

- Shifting Governance Power: Governance is increasingly favoring large holders, with institutional treasuries and restaking platforms gaining influence across DAOs and protocols.

- Regulatory Vulnerability: Jurisdictional chokepoints create risks, as U.S.-based custodians dominate staking and custody, leaving Ethereum exposed to regulatory pressures.

- Decentralization Paradox: Institutional adoption can enhance security and legitimacy, but also poses systemic risks if too much control is consolidated.

- Future Outlook: Ethereum’s long-term trajectory could lead to it becoming a global financial infrastructure, or it may risk transforming into an institutionally controlled settlement layer.

Introduction

Ethereum (ETH) is evolving from a platform primarily for developers and early adopters to a key player in traditional finance. With billions of dollars entering through exchange-traded funds (ETFs), corporate treasuries, and significant purchases by large investors (referred to as whales), institutions are becoming major contributors to the demand for ETH.

This transition brings both advantages and challenges. On the positive side, institutional staking lends legitimacy, injects capital, and provides stability. However, there is a more profound concern: while institutional staking may appear to enhance security, it also concentrates power in ways that could jeopardize Ethereum’s decentralization.

Where is the institutional demand coming from - and why?

Institutional demand for Ethereum (ETH) has surged, primarily driven by the adoption of ETH exchange-traded funds (ETFs). By August 2025, these ETFs gained over $27 billion in assets under management (AUM), with BlackRock’s ETHA attracting $16.5 billion in AUM alone’. On August 11, 2025, ETH ETFs experienced a record inflow of approximately $990 million, with nearly $635 million raised via BlackRock.

Goldman Sachs leads as the largest institutional holder of ETH ETFs, with $721.8 million in exposure (288,294 ETH), accounting for 29.8% of total institutional exposure’. Other significant players include Jane Street with $190.4 million and Millennium Management with $186.9 million.

The regulatory landscape significantly facilitated this influx, thanks to the SEC’s 2025 utility token framework and the GENIUS Act, which reduced risks and provided a streamlined approval timeline for cryptocurrency ETFs. This environment allowed institutions to view ETH ETFs as compliant yield-generating instruments, offering staking yields of 3-6%.

July and August saw persistent positive inflows, frequently exceeding 100K ETH, matching peak single-day records. Brief outflows occurred in August during increased volatility, yet the ETH price remained above $3K throughout, indicating steady institutional interest.

Corporate Treasuries

A significant driver is the conversion of cash reserves into ETH by companies, which has led to corporate ETH treasuries reaching $13 billion, representing 3.04 million ETH held by firms that are pursuing strategic accumulation strategies by forming said treasuries. BitMine Immersion Technologies, the largest ETH treasury holder, has 1.71 million ETH tokens ($7.65 billion), featuring an aggressive accumulation strategy, adding 190,500 ETH within a single week, demonstrating the level at which institutional players are storming the market’.

SharpLink Gaming follows with 797,704 ETH ($3.6 billion), as the second-largest ETH treasury holder, having increased its holdings by 141.69% within merely 30 days. After raising $172 million through a public equity offering and converting its balance sheet from Bitcoin to Ethereum, Bit Digital has accumulated over 100,000 ETH. This positions the company as one of the largest corporate treasury firms in the world, led by Ethereum veteran Sam Tabar. These treasuries are driven by the ability to stake holdings to earn yields while also benefiting from price appreciation.

Whale accumulation & Large-Scale Buying

Another pillar of massive demand stems from large-scale whale accumulation, encompassing high-net-worth individuals who make strategic purchases of Ethereum. A notable example occurred on August 26, when a 7-year dormant whale, widely referred to as a “Bitcoin OG”, offloaded close to 25,000 BTC to acquire $2.55 billion worth of Ethereum. They offloaded at least $800 million worth of BTC through Hyperunit, a decentralized protocol for secure cross-chain asset trading on the Hyperliquid platform, and immediately staked that entire amount, while using the remainder to open long positions on the Hyperliquid DEX, highlighting the scale of whale participation’.

Additionally, there has been further activity, with nine whale addresses purchasing a cumulative $456.8 million in ETH in a single coordinated move. They sourced these coins through institutional platforms such as BitGo and Galaxy Digital, a pattern indicating that sophisticated investors are utilizing institutional-grade custody and trading infrastructure to build out their ETH positions, mainly due to ETH’s current massive mindshare and potential price upside.

The trend of whale accumulation also involves previously dormant addresses, as evidenced by a whale that had been inactive for four years returning to purchase $28 million in ETH during a price decline as well as the Bitcoin OG. This behavior demonstrates contrarian buying by institutions during market volatility. Furthermore, over seven days, an anonymous address acquired 221,166 ETH (approx. $1 billion), displaying the sustained nature of large-scale accumulation.

Why is demand gushing into ETH?

Institutional capital is increasingly shifting towards ETH due to three key features: regulatory clarity, yield potential and strategic exposure. ETFs have created a compliant framework, eliminating legal obstacles that previously hindered funds from entering this market. Unlike Bitcoin, ETH offers staking income (ranging from 3% to 6%), making it an attractive yield-bearing asset in a low-return environment. Additionally, ETH is not merely a speculative currency; it plays a crucial role in DeFi, stablecoins, tokenization and rollup ecosystems, positioning it as a “growth asset” aligned with the broader expansion of Web3.

For corporations and whales, the motivations may be even more pronounced. Corporate treasuries can shift idle reserves into productive, yield-generating assets via staking, while whales may see ETH as both a macroeconomic hedge and a leveraged investment in the future of tokenized finance. The emergence of institutional-grade custody solutions provided by firms like Coinbase, BitGo and Galaxy has also reduced operational risks, potentially making significant investments in ETH relatively safer than in previous market cycles.

What Is Currently Happening On-Chain?

Institutional buying has significantly transformed Ethereum’s on-chain landscape since ETF inflows began to accelerate in mid-2025. Unlike in previous cycles, the most notable movement has been out of exchanges and into self-custody, staking contracts, and strategic wallets. This shift indicates a clear pattern of supply consolidation and structural demand.

Firstly, the distribution of wallets is changing. While the number of “mega whales” holding over 100,000 ETH has fallen to a decade low, dropping from more than 200 in 2020 to around 70 today, this trend is not entirely bearish. On the contrary, the number of "shark" wallets (those holding between 10,000 and 100,000 ETH) has risen sharply, increasing from 900 to over 1,000 just in August. Much of this growth has been driven by ETF custodians, corporations, and institutional accumulators. In fact, new wallets have received over 78,000 ETH (approximately $358 million) this month, mainly supplied by prime brokers catering to institutional clients. Mid-sized whales, often comprising public companies or ETF custodians, are now the predominant force, creating a broader but more sophisticated distribution of larger wallet holders.

On the smaller end of the spectrum, retail wallet numbers are declining as individuals move their ETH off exchanges or sell into rising prices. Exchange balances have reached nine-year lows, while balances in non-custodial wallets and staking contracts are steadily increasing. In August, the average net outflow from exchanges was 40,000 ETH per day, and only about 5% of the total ETH supply is currently held on exchanges, down from 15% five years ago. This trend reflects a maturing market in which institutions prefer proper custody and long-term holding strategies.

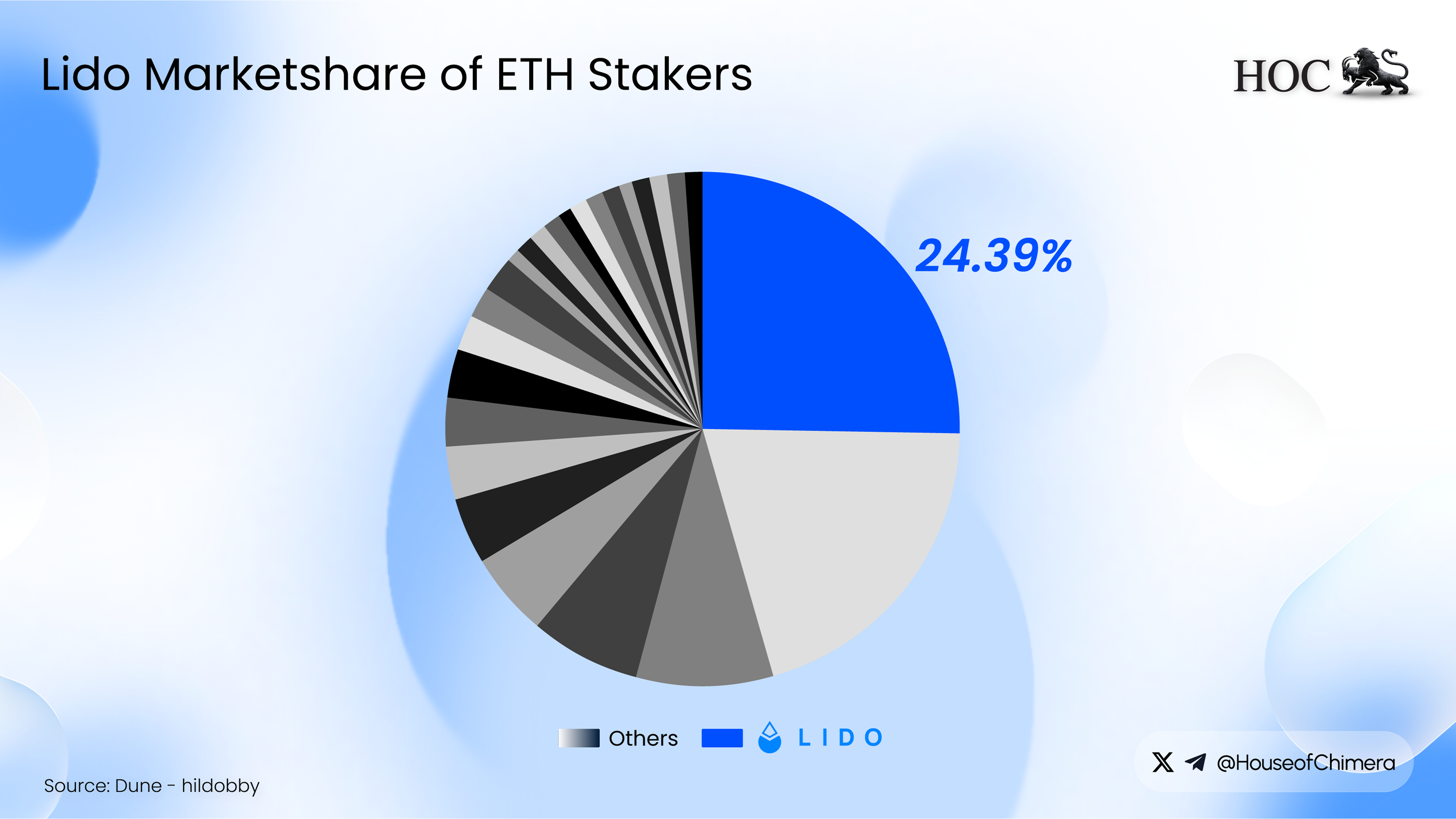

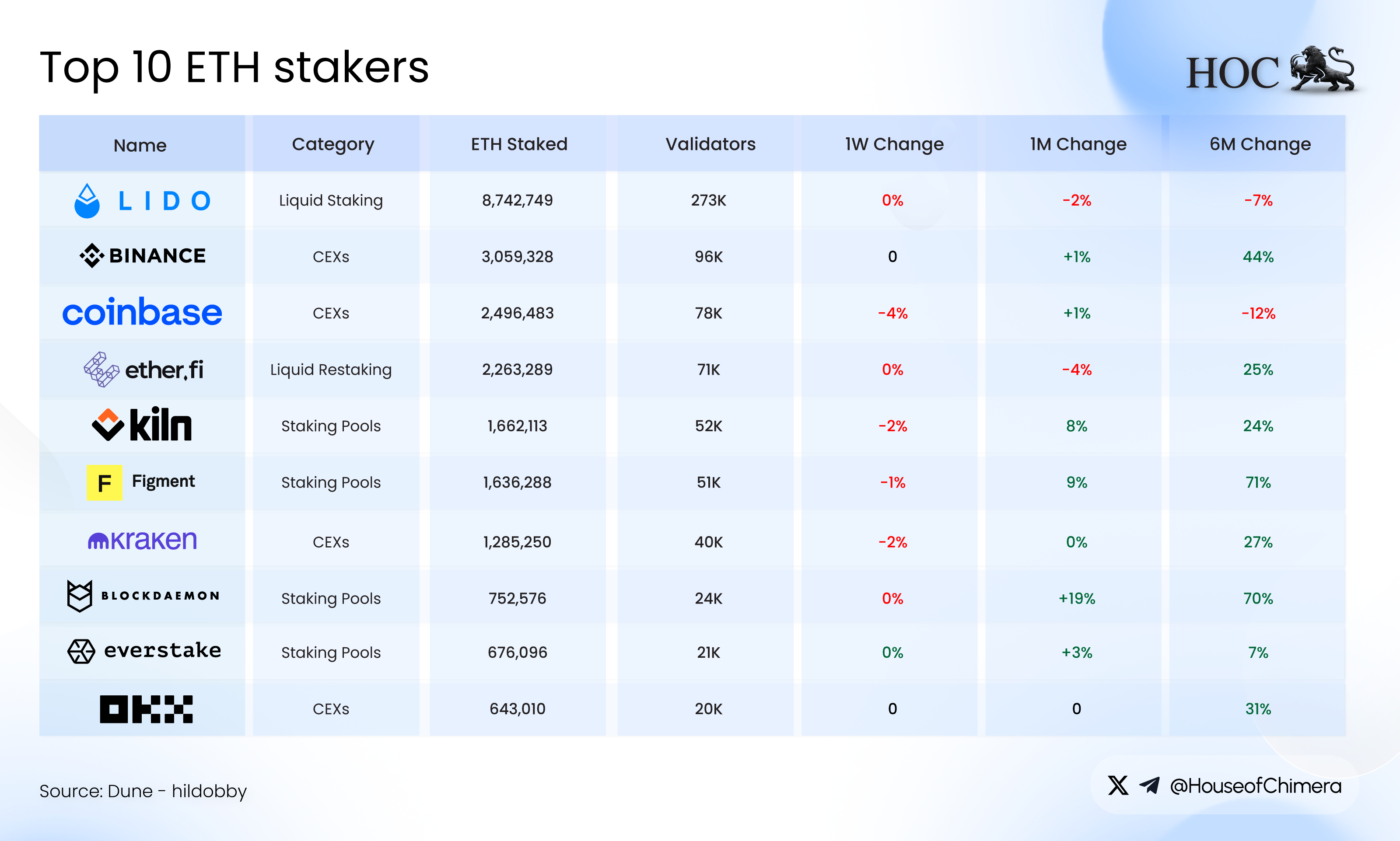

Staking activity shows similar trends. Approximately 29-30% of the total ETH supply is now staked. While Lido’s dominance is waning, currently holding around a quarter of staked ETH, other providers such as Figment, which was the largest gainer of new stakers (almost 344,000), and Coinbase are gaining market share as institutional clients seek regulatory compliance’. The number of validators has reached new highs, surpassing one million, a 30% year-over-year increase driven primarily by corporate and ETF-linked deposits.

Restaking, which involves using staked ETH to secure additional protocols, is also gaining popularity, led by platforms like EigenLayer, which now manages nearly $19 billion and has over 1,500 operators. This trend enhances network security but introduces new risks related to potential slashing events if any issues arise.

Overall, these patterns illustrate the clear on-chain evidence of capital transitioning from retail trading and speculation to longer-term strategies and active participation in network security. The net result is that Ethereum is evolving into a more institutionally held and staked asset, with whales dispersed across a new and expanding class of mid-sized holders. At the same time, exchange and retail balances continue to decline as demand shifts toward yield and custody solutions.

On-chain activity clearly indicates that Ethereum's supply is shifting from retail investors to institutional custody and staking. Consequently, the shift has created a more stable, yield-driven group of holders, but it also means that operational control is becoming concentrated in fewer hands. The next question to consider is whether this growing presence of institutions strengthens or undermines Ethereum’s decentralization and governance.

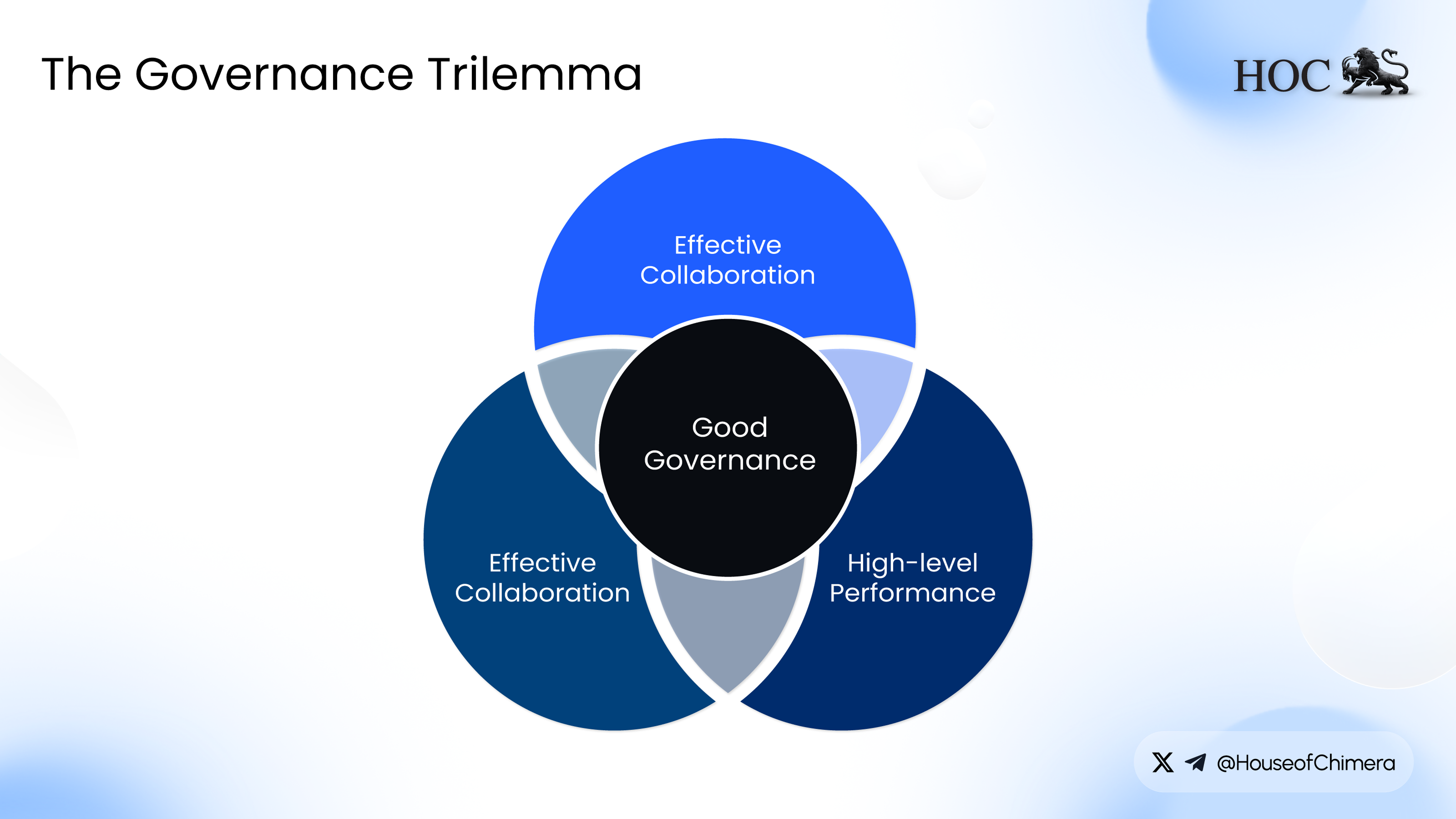

How Does This Affect Decentralization?

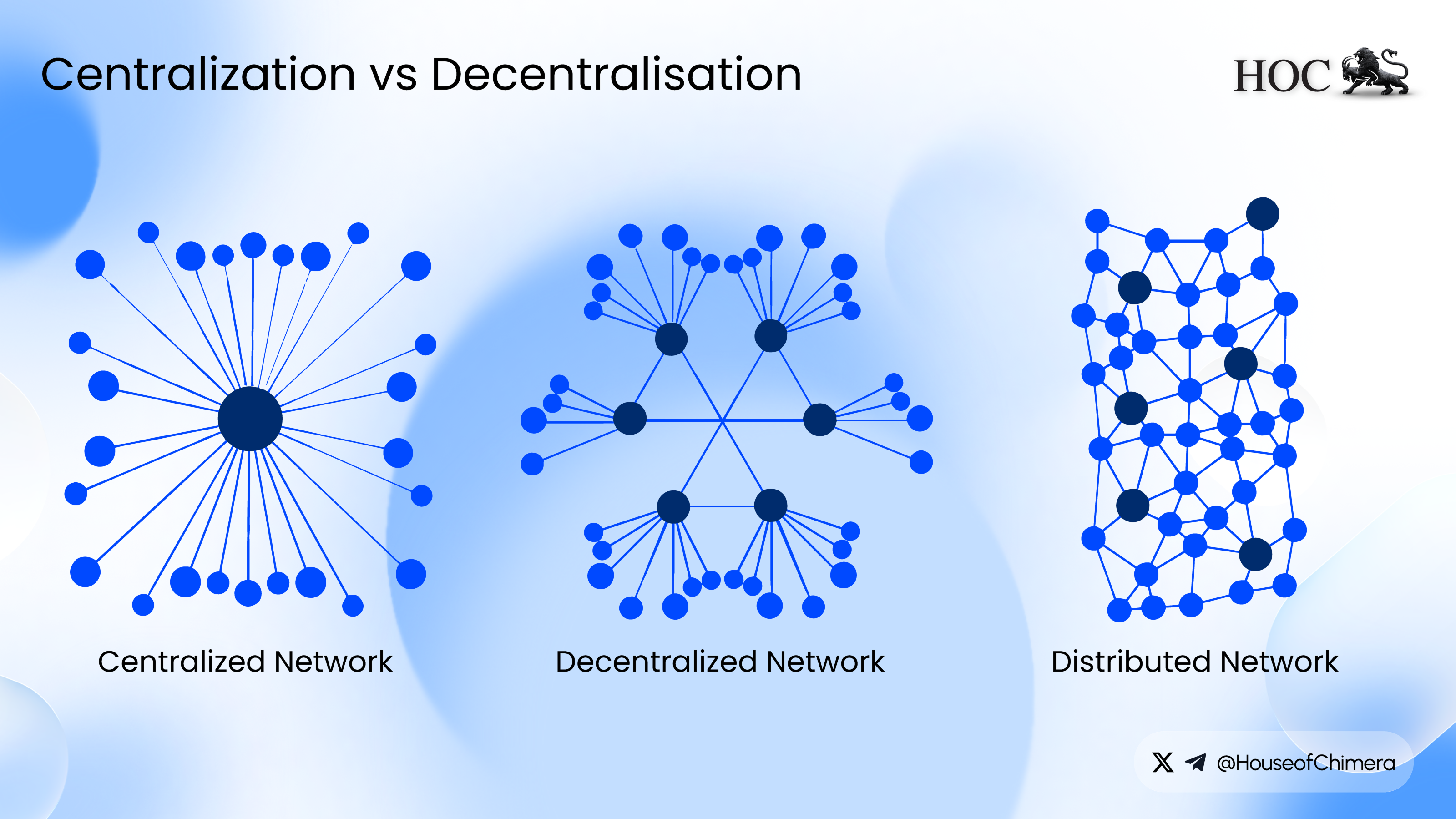

Ethereum has historically attracted attention due to its decentralization, ensuring that no single entity can dictate the network's future. However, with billions of dollars now being invested through ETFs, custodians, and corporate treasuries, this balance is shifting. The question is no longer just about who owns ETH, but also about who effectively controls it. From validators to governance forums, the accumulation of assets by institutional investors is quietly reshaping the power dynamics within Ethereum.

Validator Power Concentration Despite Growing Numbers

At first glance, the Ethereum validator landscape appears to be becoming increasingly decentralized. The network currently operates with over 1 million active validators, showing a 30% increase from the previous year, indicating broader participation in ensuring network security. However, the operational reality presents a different picture. Binance controls 8.5% of all staked ETH (approximately 3 million ETH, valued at around $13.2 billion), followed closely by Coinbase, which controls almost 7%, which amounts to about 2.5 million ETH valued at around $11 billion, as of August 30th, 2025. This makes Binance and Coinbase the largest single node operators in the network, even though Lido has a larger collective share of 24.27%’.

The concentration of cotrol in the institutional staking processes raises significant concerns. Lido, for example, distributes its 8.74 million ETH across multiple independent operators. In contrast, Binance and Coinbase manage 174,000 validators under a single, unified control. Although the exchange has deployed these validators in various locations, including Japan, Singapore, Ireland, Germany, and Hong Kong, it still maintains centralized operational authority. When we consider this alongside other major exchanges, it becomes clear that a relatively small number of entities control validator operations for a substantial portion of Ethereum's security.

The trend of institutional staking is accelerating the concentration of assets in the market. Goldman Sachs’ approximately $720 million in ETF exposure and $13 billion in corporate treasury holdings are primarily flowing via established custodians instead of independent staking operations. The rapid growth of Figment, which now holds a 4.5% market share, illustrates how professional staking services are meeting the increasing demand from institutional investors. However, this growth often comes at the expense of smaller, independent validators who struggle to meet the regulatory compliance standards required by these institutions.

Governance Weight and Institutional Voting Power

Ethereum's role goes beyond transaction processing; ETH is crucial in governance for DAOs like Uniswap and Aave. Institutional holders such as BlackRock and Goldman Sachs have significant latent governance power, despite low participation rates, as claimed by Cong et al., 2025. Furthermore, their research shows that in established DAOs like Compound, the top 5% of voters already control 75.7% of voting power, with institutions like a16z holding dominant positions. As institutional ETH holdings grow, this could lead to coordinated influence over the protocols and network upgrades.

A notable illustration of governance issues transpired within the Uniswap DAO, which is a prominent decentralized exchange, where a singular delegate wallet affiliated with a major venture capital firm wielded substantial influence over the outcome of a proposal to activate the protocol fee switch. On-chain analysis has shown that a16z, one of Uniswap’s largest investors, has strategically distributed $UNI tokens across numerous wallets. Each wallet received just enough tokens to submit governance proposals, collectively controlling a significant proportion of $UNI needed for voting decisions. During the governance dispute over the BNB Chain deployment, a16z allocated 15 million $UNI in support of their favored option, while actually holding close to 55 million $UNI, over 5% of the total supply. Furthermore, even when these voting powers were “delegated” to universities and research institutions, a16z maintained the ability to reclaim them at any moment. This control allowed major token holders to propose and enact decisions without border community consensus, raising considerable concerns in the industry about the integrity of decentralized governance and highlighting how concentrated token ownership can diminish genuine democratic participation in DAOs.

Restaking through EigenLayer allows staked ETH to secure multiple protocols simultaneously. This means that one institution’s staked ETH can influence governance and security across the entire ecosystem. With $19 billion in TVL and more than 1,500 operators, there is a risk that large custodians or pools could dominate the landscape. This dominance could lead to coordinated voting, governance, and risk management that extends beyond Ethereum itself. While this setup can enhance both yield and influence, it also introduces “correlated risk.” Issues or slashing in one protocol could quickly affect many others, amplifying the consequences of any mistake or conflict. As institutional involvement increases, the risks of concentrated control and systemic outcomes become more significant.

Jurisdictional Concentration and Regulatory Chokepoints

One of the most significant threats to decentralization comes from the concentration of jurisdiction among major staking providers. Companies like Coinbase, Gemini, and BitGo, all based in the US, serve as primary custodians for institutional ETH holdings. This creates a potential chokepoint that regulators could exploit. There is historical precedent for this risk: during the 2022 Tornado Cash sanctions, over 52% of Ethereum blocks were constructed by relays that excluded sanctioned addresses, highlighting how regulatory pressure can lead to de facto censorship.

The debate surrounding compliance with the Office of Foreign Assets Control (OFAC) highlights the ongoing tension between the principles of decentralization and the practicalities of regulation. US-based validators could face severe penalties, including potential criminal liability of up to 20 years in prison, for processing transactions involving sanctioned addresses. This creates strong incentives for preemptive censorship.

Implementing Fork-Choice Enforced Inclusion Lists (FOCIL) would require validators to include specific transactions, which would reduce their ability to censor transactions based on legal or regulatory orders. However, this mandate could significantly increase legal risks, particularly for US-based operators. They might encounter regulatory conflicts if they are compelled to process transactions involving sanctioned addresses. Given the precedent set by previous actions from the Office of Foreign Assets Control (OFAC) and the increasing number of custodial validators based in the U.S., it is likely that such proposals would attract heightened scrutiny and potential enforcement actions from regulators. This situation could make the adoption of FOCIL controversial and legally challenging for operators under U.S. jurisdiction.

Additionally, while geographic distribution of validators may offer some level of protection, it is limited when operational control remains centralized within a specific jurisdiction. For instance, Coinbase's global deployment of validators does not eliminate US regulatory authority over its operational decisions. Similarly, institutional ETF custody managed by US-based providers subjects billions in ETH to potential regulatory interference, regardless of the locations of the underlying validators.

Centralization Risks vs. Institutional Benefits

The surge in institutional adoption has mixed effects on Ethereum's decentralization. Positive outcomes include increased validators, enhanced infrastructure, and reduced reliance on retail speculation, with Coinbase demonstrating high uptime and security. Professional staking services like Figment facilitate regulatory compliance, potentially broadening institutional involvement due to upcoming frameworks like the SEC's 2025 utility token regulations.

However, centralization pressures are rising, as institutional needs tend to favor large, professionally managed validators. Complex multi-module restaking benefits those with extensive infrastructure, creating economies of scale that smaller operators struggle to achieve, further consolidating control among sophisticated institutions.

The Decentralization Paradox

Ethereum is currently seeing significant involvement from institutional investors, which highlights a complex issue known as the "decentralization paradox." To the casual observer, ETH appears more secure than ever, as large institutions are staking billions, operating professional infrastructure, and lending the network an aura of legitimacy and stability. This gives the impression of enhanced security, with improved uptime, reduced risks of slashing, and more predictable operations. However, this situation can amount to pseudo security. The increasing concentration of staking power among a small number of custodians introduces systemic vulnerabilities. This consolidation of control undermines decentralization, making Ethereum more susceptible to coordinated failures, regulatory pressures, or censorship.

Institutional participation has brought benefits, including improved resilience, deeper staking, enhanced infrastructure, and reduced volatility. However, it has also shifted governance and restaking power towards larger holders. The most significant risk lies in jurisdiction: Ethereum’s technical decentralization loses significance if regulators can pressure a few custodians to enforce censorship.

Moving forward, the challenge will be to harness the long-term advantages of institutional involvement without undermining the network’s core principle of decentralization. Whether Ethereum evolves into a resilient decentralized infrastructure or becomes dominated by institutional control will depend on how this balance is managed in the coming years.

Long-Term Impact?

Should the prevailing trend of restaking and institutional accumulation persist, the long-term dynamics of Ethereum may undergo a substantial transformation. The rise of ETFs, corporate treasuries, and significant whale wallets as influential entities indicates that an increasing volume of ETH is likely to be retained, staked, and governed by a more concentrated cohort of sophisticated investors and institutional custodians. This transition could foster greater stability and vital liquidity, ultimately positioning Ethereum as a fundamental pillar for global settlements, tokenized assets, stablecoins, and programmable finance.

On the positive front, institutional capital plays a pivotal role in enhancing infrastructure, mitigating volatility, and bolstering network security. Significant protocol upgrades, such as Pectra and Dencun, are further refining the network’s efficiency and utility, enabling Ethereum to facilitate over $28 trillion in annual stablecoin transactions while retaining a 61% dominance in DeFi TVL. The flywheel effect suggests that increased institutional staking could lead to a tighter supply, thereby pushing ETH towards a deflationary model and supporting price targets up to $25,000 by 2028, contingent upon regulatory clarity and ongoing adoption.

However, there are considerable trade-offs to contemplate. Should ETH remain predominantly concentrated within custodial services and pooled platforms, a significant risk arises that validator power, voting influence within DAOs, and operational control could become increasingly centralized. Such centralization would undermine the fundamental objectives of censorship resistance and decentralization. Institutional restakers on platforms like EigenLayer, which currently boasts a TVL of $19 billion and continues to expand, may evolve into validators with extremely high levels of influence. These entities could potentially wield considerable influence over outcomes across multiple networks if governance transitions from a passive to an active state.

Another significant concern is jurisdictional risk. Substantial staking via US-based custodians, such as Coinbase and Gemini, raises concerns about regulatory chokepoints. This scenario raises concerns that a limited number of entities, possibly even the regulators of a single nation, could alter the network's operational framework or impose compliance measures. The tension between global accessibility and local governance could likely present a considerable challenge as traditional finance increasingly permeates the cryptocurrency ecosystem.

The institutional adoption of Ethereum is enhancing its legitimacy and utility as a programmable infrastructure. However, it is simultaneously redefining the concept of decentralization. Should current trends persist, the network may become increasingly professionally managed and resilient, yet it could also become more vulnerable to centralized influence and regulatory intervention. The principal challenge for the Ethereum community and its ecosystem will be to uphold diversity in governance and operational fragmentation. In this manner, the burgeoning institutional investments can continue to fortify, rather than undermine, the foundational principles of decentralized finance.