Flying Tulip’s Revenue-Backed Model: A Bold Answer to DeFi’s Incentive Crisis

Introduction

DeFi has matured rapidly over the past few years, but one structural issue continues to undermine even the most promising protocols: misaligned incentives. Projects launch with ambitious roadmaps but rely heavily on token emissions, early liquidity, and short-term investor cycles to stay afloat. The result is a landscape where teams focus on boosting token prices, users chase temporary rewards, and long-term product development gets sidelined.

Flying Tulip steps into this environment with a very different mindset. Instead of relying on the typical Web3 funding mechanics, the project introduces a revenue-backed economic model that eliminates emissions entirely and forces the protocol to earn its success organically. It’s a surprisingly straightforward approach, but one that could shift how DeFi products are built and sustained.

The Incentive Problem Holding DeFi Back

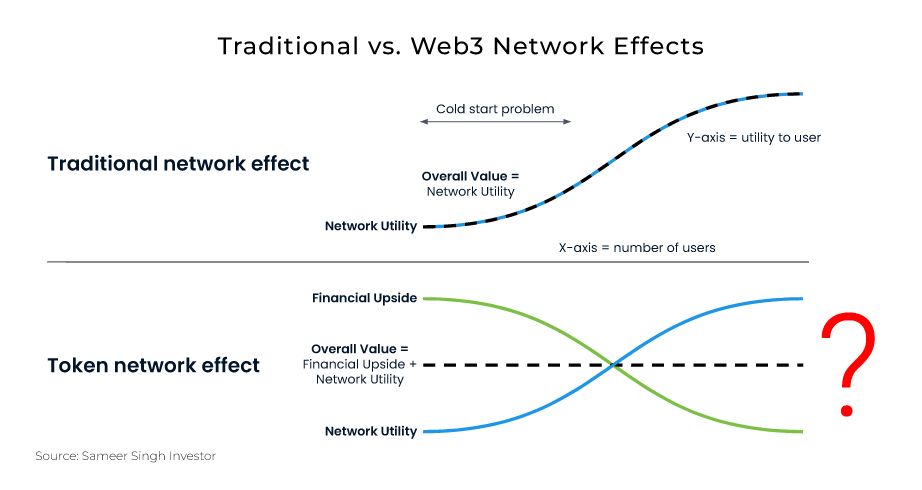

The research paper Fixing DeFi’s Broken Incentives identifies a consistent pattern across the industry: protocols unlock liquidity far too early, teams receive token allocations long before meaningful adoption, and users flood in to farm airdrops or capture emissions before moving on to the next opportunity.

This dynamic creates constant churn. Liquidity spikes when incentives are generous, then collapses as soon as rewards taper off, something we’ve seen repeatedly across L2s, DEXs, and yield farms. Because teams and early investors often gain liquidity within 24 months, priority naturally shifts toward sustaining short-term excitement instead of building long-lasting economic systems. It’s a cycle that drains value from projects and leaves very little room for sustainable growth.

Flying Tulip’s model aims to realign these incentives by removing the mechanisms that create them in the first place.

A Revenue-Driven Architecture: How Flying Tulip Breaks the Cycle

Flying Tulip’s approach is simple but radical: the protocol has no team token allocation, no emissions, and no treasury set aside for future unlocks. Everything, from developer salaries to infrastructure costs, is funded by the actual revenue generated by the ecosystem’s products.

This model forces discipline. The protocol must build tools and markets that users genuinely want, because the only way the team survives is through utilisation, not speculation. It’s a return to fundamentals in an industry that often moves in the opposite direction.

At the heart of this ecosystem is a suite of integrated DeFi products, including a volatility-aware AMM, a hybrid AMM and CLOB execution model, perpetual futures, impact-based lending, a yield-bearing stablecoin (ftUSD), and a real-time insurance market. Each product can function independently, but they’re designed to strengthen one another, allowing liquidity and revenue to move across the system instead of remaining siloed.

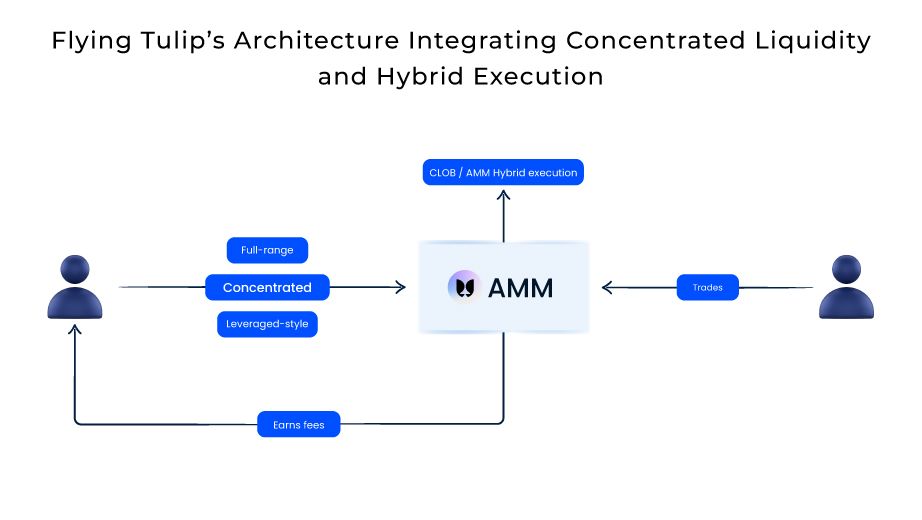

A Closer Look at the Ecosystem

Flying Tulip’s AMM is built to respond dynamically to shifting market conditions. Rather than relying on a fixed curve, it adapts in real-time to volatility, flattening during stable periods to minimize slippage and moving toward a more protective structure during turbulent markets. This allows traders to benefit from tighter pricing without compromising the safety of liquidity providers. The AMM also integrates seamlessly with a central limit order book, enabling the execution engine to source the best available price at any moment, a hybrid approach that blends the efficiency of automated liquidity with the precision of order-book trading.

The lending system follows a similarly responsive design. Instead of relying on static LTV ratios that ignore execution risk, impact-based lending adjusts borrowing power based on liquidity depth and expected slippage during liquidation. This creates a more accurate reflection of real market conditions and helps prevent bad debt.

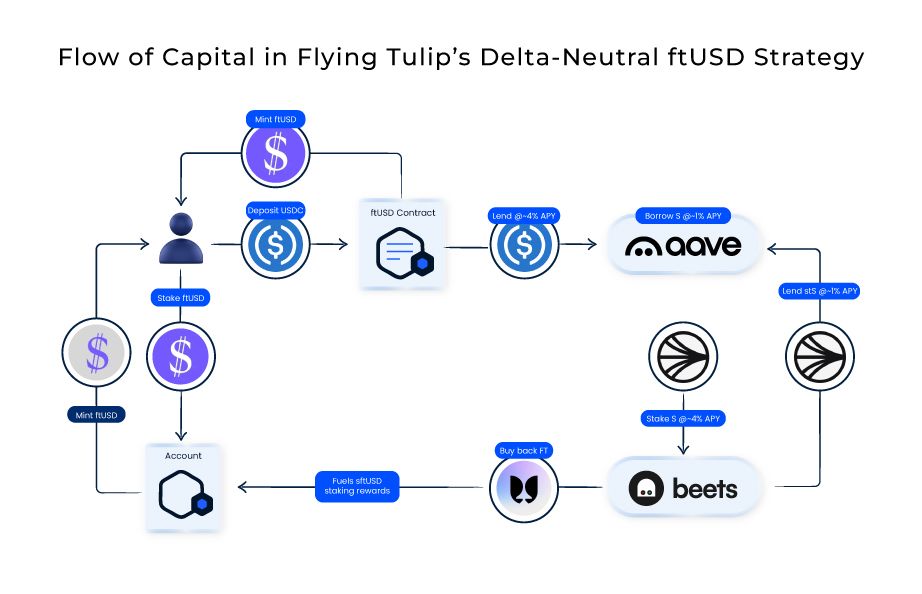

Flying Tulip’s stablecoin, ftUSD, brings another layer of utility. Users can hold it as a simple settlement asset or stake it to receive sftUSD, which earns yield from delta-neutral strategies and other low-risk deployments. The key difference is that the yield isn’t generated through emissions or synthetic incentives, but through actual market activity.

The insurance market rounds out the ecosystem by offering continuous, streaming coverage rather than prepaid, fixed-term contracts. Coverage behaves more like a borrowable resource: users pay premiums only while their positions are active, while liquidity providers earn a steady yield as long as demand persists.

Together, these components form a tightly integrated network of revenue streams that reinforce each other rather than compete for liquidity.

A Sustainable Funding Model Built on Real Yield

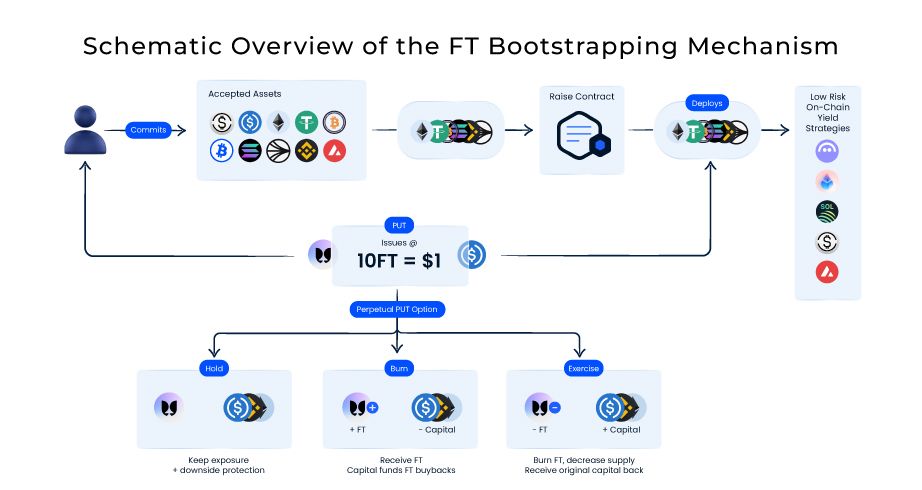

Flying Tulip’s initial capital raise is also used differently from traditional token sales. Instead of selling tokens to fund development, the project raises stablecoins and major assets directly. These assets are held in a diversified vault designed to generate consistent, low–risk yields across high-liquidity venues.

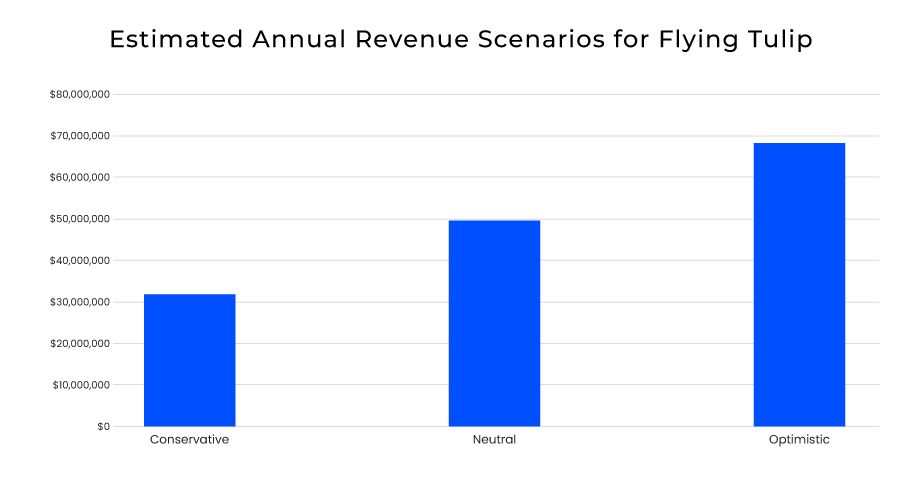

The research paper’s backtesting indicates that this vault could generate approximately $68 million annually from yield alone, with the majority of this coming from stablecoin deployments on platforms such as Aave, Syrup, Athena, and Ethena. Additional returns are generated from staked ETH, SOL, BNB, AVAX, and Sonic positions, all of which are selected based on liquidity depth and risk-adjusted performance.

A portion of this yield covers operating costs, while surplus revenue is used to buy back and burn FT tokens on the open market, a design that increases scarcity without relying on inflation.

The Pro-Rata Put Option: An Unusual but Effective Mechanism

One of Flying Tulip’s most intriguing features is the perpetual pro-rata put option granted to early contributors. This mechanism gives them the right to redeem their FT tokens at the value of their original contribution. If they choose to redeem, the tokens they return are permanently burned, reducing the circulating supply and giving remaining holders a larger proportional share of the ecosystem.

This creates a natural stabilising effect. The put option establishes a psychological and mechanical price floor, while the burn mechanism steadily enhances token scarcity as redemptions occur. Over time, this feedback loop helps reinforce long-term value while giving early contributors a clear, risk-controlled exit path.

Where Flying Tulip Fits in the DeFi Landscape

In an industry dominated by protocols that depend on inflationary incentives, Flying Tulip has positioned itself as a counter-model, one focused on sustainability, capital efficiency, and genuine utility. Its integrated design avoids the fragmentation seen in many DeFi ecosystems, where each product operates independently and competes for liquidity. Instead, revenue flows between products, creating a cohesive environment where value generation is shared.

This approach stands apart in a landscape filled with short-lived yield farms, hyper-financialized point systems, and tokenomics designed around temporary hype cycles. But as competition intensifies and users become more discerning, protocols that can sustain themselves without continuous emissions may gain a meaningful advantage.

Flying Tulip’s long-term success will ultimately depend on adoption, liquidity, and the strength of its product suite, but the foundation it has built offers a refreshingly grounded alternative to the typical DeFi playbook.

The Bigger Picture

Flying Tulip challenges many of the assumptions that have shaped DeFi’s early years. By eliminating emissions, removing team allocations, and reinforcing value through real revenue and adaptive design, it represents a shift toward a more sustainable model for decentralised finance.

To explore Flying Tulip’s full architecture, economic framework, and revenue projections, the complete research paper provides a comprehensive examination of the protocol’s design philosophy and long-term vision.