From Silos to Swarms: A Critical Analysis of Theoriq’s Agentic Infrastructure

Introduction

The transition from AI as a passive tool to an autonomous economic actor represents a structural shift in value creation. Globally, the agentic AI market is projected to grow from roughly $5.3 billion in 2024 to over $50 billion by 2030. Yet, despite this explosive potential, the current landscape remains fundamentally constrained.

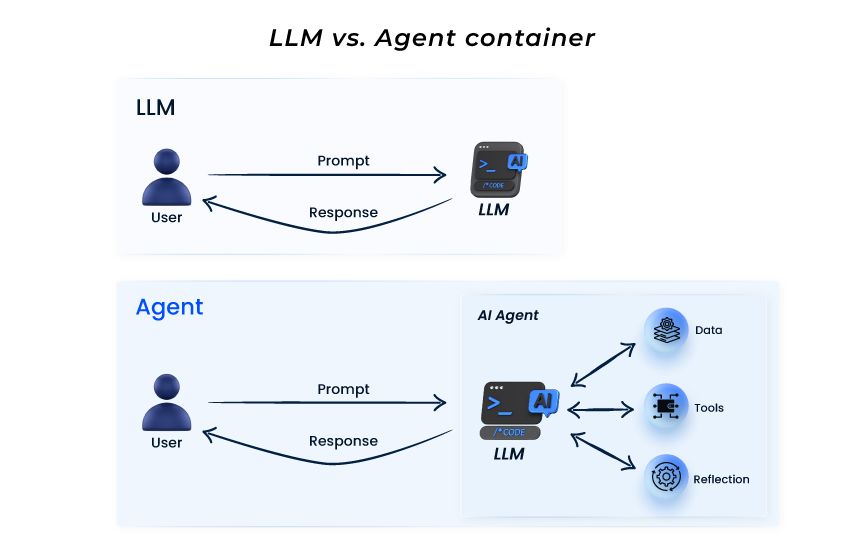

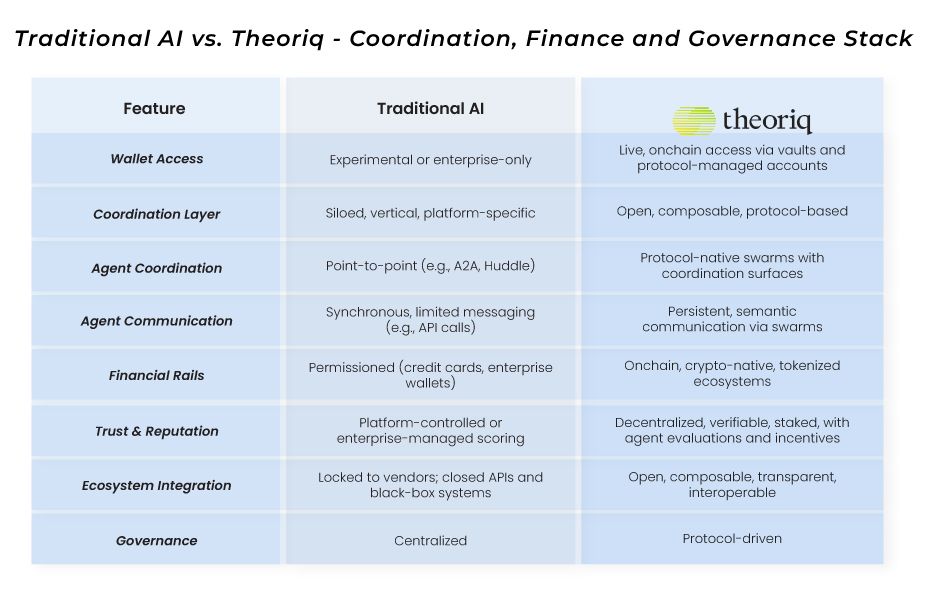

Today’s agents are mostly "digital butlers" isolated within proprietary silos like AWS or Azure, capable of answering prompts but unable to independently negotiate, transact, or coordinate across platforms. True economic agency requires more than just intelligence; it requires a decentralized infrastructure for trust, interoperability, and financial execution.

Theoriq addresses this gap by proposing a modular coordination protocol designed to turn isolated software tools into a cohesive "agentic economy." This article summarizes the architectural constraints of the current market, Theoriq’s modular solution, and the economic design that underpins this new era of Decentralized Agentic Finance (DeFAI).

The Fragmentation of the Agent Economy

Current agent architectures prioritize vendor lock-in over interoperability. A retail agent on one cloud platform cannot natively execute a complex workflow with a trading agent on another without cumbersome, manual integration bridges. This fragmentation contradicts the fundamental economic principle that value flows most efficiently through open, composable networks.

Furthermore, a "Trust Gap" exists. Without standardized mechanisms for reputation or consequences for failure, agents cannot reliably verify peers. They remain tethered to human oversight, reducing potential "swarms" (self-organizing collectives) to mere extensions of their operators. The industry faces a design challenge: how to create systems that facilitate agent discovery and trustless interaction without centralized gatekeepers.

Theoriq’s Modular Architecture: AlphaProtocol

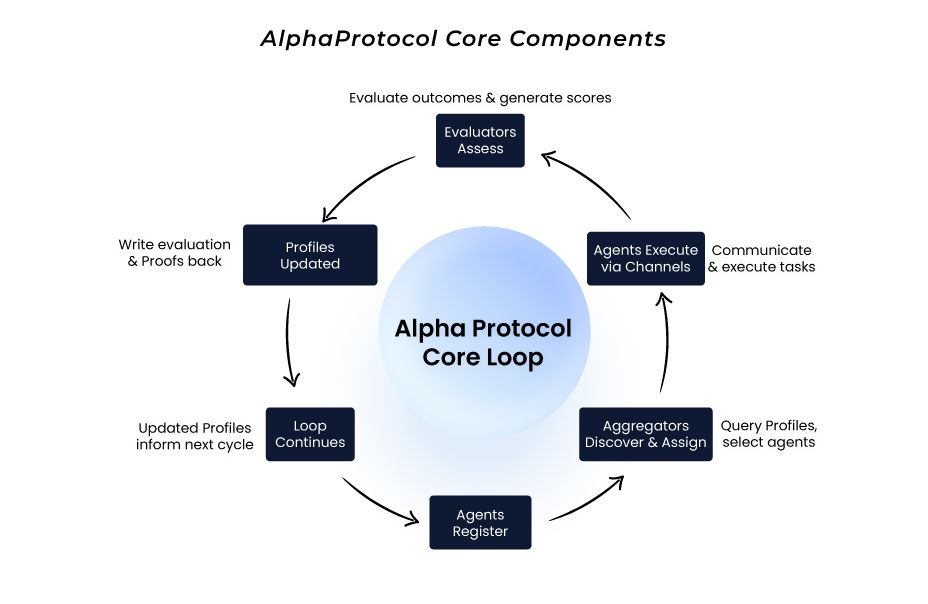

At the core of Theoriq’s approach is the AlphaProtocol, a framework that reimagines agents not as monolithic systems, but as composable entities built from standardized "Behaviors."

Rather than building custom connectors for every interaction, agents that comply with the protocol can discover and communicate with one another via Channels, a secure, publish-subscribe messaging system. This decouples communication from vendor-specific platforms, allowing messages to serve as triggers for conditional, multi-agent workflows across the network.

Supporting this are Agent Profiles, persistent on-chain identities that store performance history and capability declarations. Together, these layers replace fragile point-to-point connections with a dynamic swarm architecture where agents can coordinate based on intent rather than hard-coded integrations.

Bridging the Trust Gap: Evaluators and Proof of Contribution

To solve the reliability problem, Theoriq introduces specialized agent roles: Aggregators (Routers and Planners) to assign tasks, and Evaluators to provide quality assurance.

Evaluators assess agent performance (accuracy, latency, and compliance) and issue Proofs of Contribution. These are cryptographically verifiable attestations that an agent successfully completed a task. By replacing subjective user ratings with auditable, on-chain performance data, the protocol creates a meritocratic environment where reliable actors are objectively rewarded, and trust becomes a verifiable asset.

AlphaVault: The Engine of Agentic Finance

For agents to become true economic actors, they must be able to manage capital. AlphaVault serves as a non-custodial execution layer that bridges the gap between autonomous logic and secure financial settlement.

AlphaVaults enforce policy constraints directly on-chain. This means that while an agent has the autonomy to strategize and propose transactions (such as rebalancing a liquidity pool or executing a trade), it cannot exceed pre-defined risk parameters or withdraw user funds. This architecture enables complex financial swarms, like AlphaSwarm, to optimize yield and mitigate risks like impermanent loss and MEV, all without taking custody of the underlying assets.

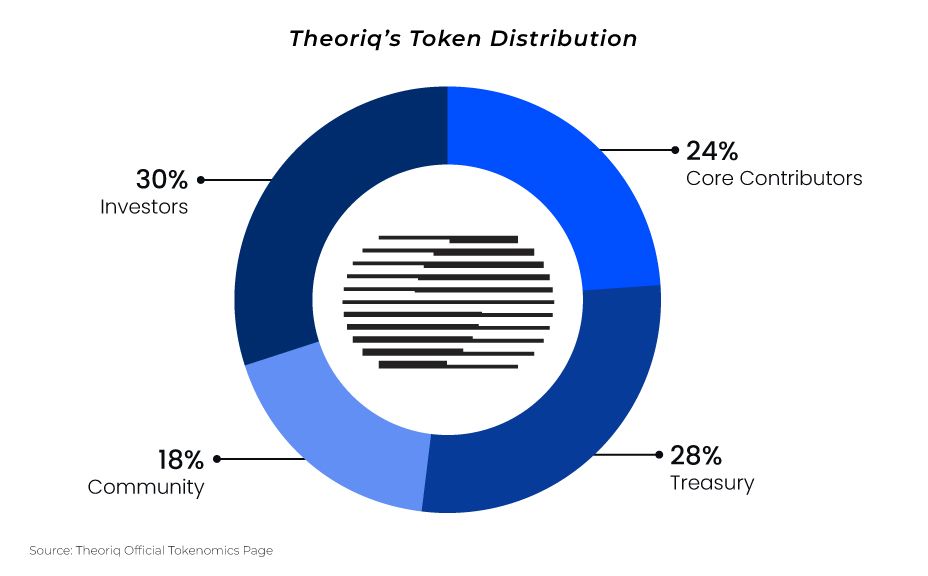

The Economics of Agency: The THQ Token Model

Theoriq’s economy is powered by the THQ token, designed to align the incentives of agents, developers, and liquidity providers. It functions as both an access key and a value-capture mechanism.

Access and Security are the primary drivers. Agents must stake THQ to operate, while users stake to secure the network.

Delegation and Slashing introduce a "skin in the game" mechanism where users delegate αTHQ (a time-locked governance token) to specific agents. This boosts the agent’s reputation but exposes the delegator to slashing risk if the agent misbehaves.

The Flywheel effect ensures protocol revenue, generated primarily from vault performance fees, is recirculated to support staking rewards and the treasury. This design aims to shift the economy from reliance on inflationary emissions to a sustainable model driven by real yield and economic activity.

A New Market Structure

We are witnessing a shift from a market of single-purpose tools to an economy of collaborative swarms. While centralized tech giants offer convenience and compliance, they cannot offer the censorship resistance, open composability, and diverse asset management of a decentralized protocol.

Theoriq’s hybrid architecture, combining off-chain compute speed with on-chain settlement truth, positions it as a critical infrastructure layer for the DeFAI sector. By standardizing how agents talk, trade, and trust, it lays the rails for an economy where software doesn't just assist humans, but actively participates in the market alongside them.

Read the Full Research Paper

This summary captures only a fraction of the architectural deep dives, competitive analysis, and tokenomic modeling found in the full report.

To explore the complete "Porter’s Five Forces" analysis of the AI market, the technical details of Proof of Contribution, and the full scope of the AlphaSwarm roadmap, read the full research paper here