Building the Rails for Internet Capital Markets: A Guide to Dabba Network’s DePIN Connectivity Model

Introduction

Internet access is now an essential requirement for economic participation, yet nearly 2.6 billion people still remain offline globally . In India, more than half of the population lacks stable connectivity despite the country being one of the world’s fastest-growing digital economies. This gap isn’t simply technical. It is structural, economic, and deeply tied to the limitations of traditional telecom models.

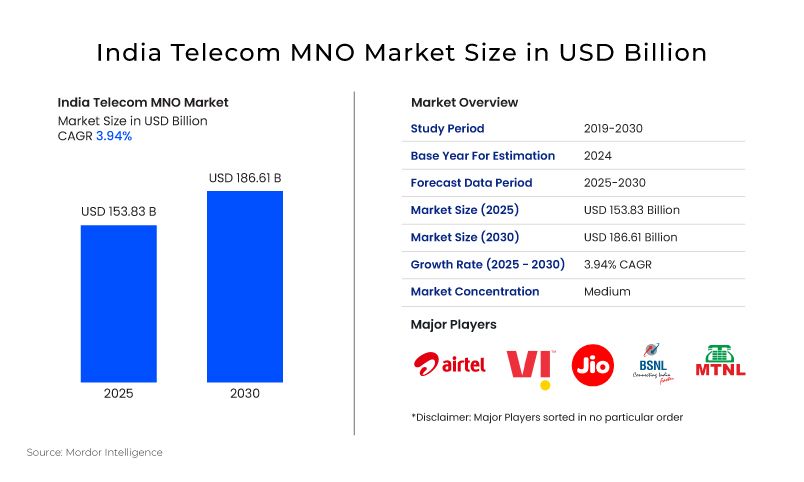

India’s operators have spent almost 20 billion USD on 5G spectrum auctions, making it one of the most expensive markets in the world . With such high upfront costs, telecoms naturally prioritize urban, high-income regions where returns are predictable. Rural, peri-urban, and low-income communities are left waiting because the economics simply do not support their inclusion.

Dabba Network presents a different path. Instead of following the capital-heavy, spectrum-dependent logic of legacy telecom, Dabba builds a decentralized connectivity marketplace that connects global hotspot owners, Local Cable Operators, and everyday broadband users. It blends DePIN, token incentives, and India’s fragmented last-mile operator ecosystem into a cohesive, demand-led system that grows only where real users exist.

This article summarises the model, its incentive structure, its competitive position, and why it matters for the future of Internet Capital Markets.

Why Traditional Connectivity Models Struggle

The economics of Indian telecom create a structural barrier to inclusive connectivity. Spectrum pricing is several times higher than in markets like Germany, the United Kingdom, and South Korea. Operators must recoup these costs, which inevitably shifts deployment toward high-revenue environments and away from the regions where connectivity would be most transformative.

At the same time, many households face tight budget constraints. Even affordable data plans can represent a notable share of income. Wi-Fi offers a more cost-effective alternative for consistent bandwidth, but centralized telecom models have historically struggled to deploy and maintain last-mile Wi-Fi networks at scale.

The result is a national landscape where millions are excluded from digital participation, not due to technological limits but because the underlying incentives are misaligned.

Dabba Network’s Marketplace Architecture

Dabba operates as a coordination layer rather than a traditional telecom provider. It brings together global participants who purchase hotspots, local operators who handle deployment and maintenance, and households that subscribe to affordable broadband.

India’s network of more than 150,000 Local Cable Operators is central to this design. Once the backbone of cable TV and neighborhood networks, many LCOs have faced steep subscriber losses in recent years, with 93 percent reporting declines and more than 31 percent reducing staff . Dabba gives them a new revenue model with transparent on-chain settlement and predictable token rewards.

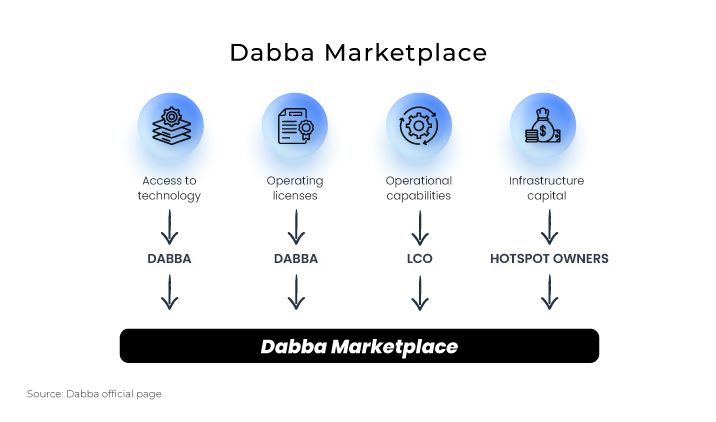

The marketplace illustrates how Dabba coordinates access to technology, operating licenses, bandwidth providers, hardware manufacturers, and hotspot owners in one integrated system .

This is not a telecom company attempting to scale through centralized capital. It is a distributed network that grows organically through local expertise and global participation.

A Deployment Model Driven by Real Demand

Unlike models that build infrastructure first and hope users appear later, Dabba’s network expands only when a paying subscriber requests a connection. LCOs install hotspots directly at subscriber locations, ensuring that each deployment serves an active, verified user.

This removes the inefficiency of idle hardware and the speculative hotspot overbuying seen in earlier DePIN networks. Every device exists because someone needed it. As a result, Dabba’s network has scaled to tens of thousands of hotspots while maintaining strong utilization.

By late 2025, the network had reached nearly 29,000 hotspots, close to 200,000 connected devices, and around 80,000 daily active users, processing tens of terabytes of bandwidth each day . These are real subscribers consuming real data, not synthetic usage.

How Hotspot Deployment Works

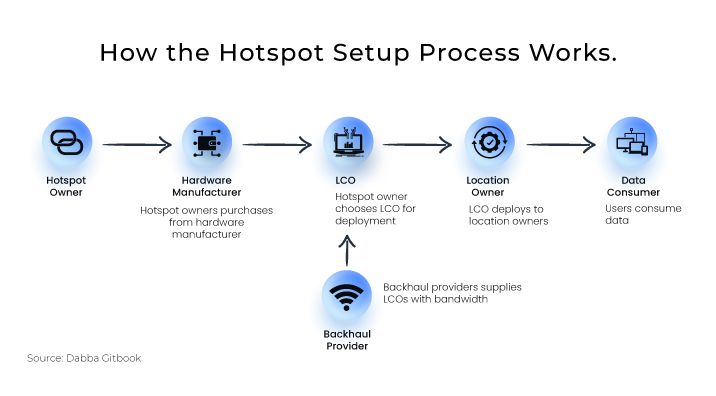

The hotspot onboarding pipeline consists of four coordinated steps, each verified on-chain.

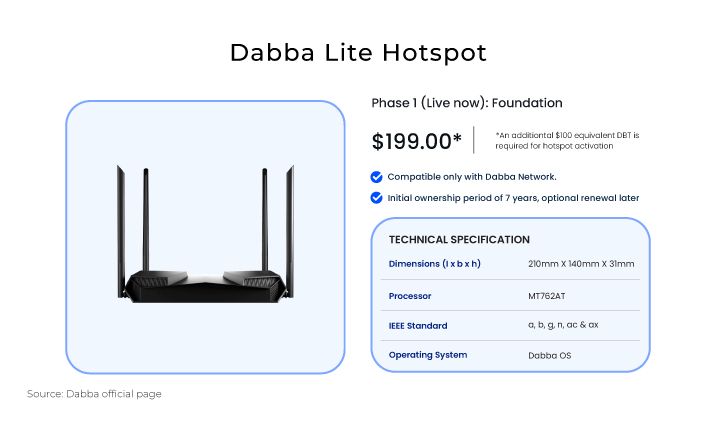

- Ownership and Registration

A hotspot owner purchases a Dabba Lite device for 199 USD and burns 10 DBT to mint an ownership NFT linked to the device. - Leasing to LCOs

Through the Dabba Explorer, owners select an LCO and pay 70 DBT for a seven-year lease agreement. - LCO Commissioning

To activate the hotspot, the LCO burns 10 DBT, creating an immutable verification of installation and operational responsibility. - Marketing and Activation

Owners pay 10 DBT to a marketing partner to drive local awareness and subscriber adoption.

Across these stages, approximately 30 USD worth of DBT is burned, creating a direct connection between physical deployment and token scarcity.

Once deployed, the hotspot owner receives all epoch rewards and distributes fixed shares to LCOs, backhaul providers, hardware manufacturers, and location owners through the Explorer interface.

Inside the DBT Token Model

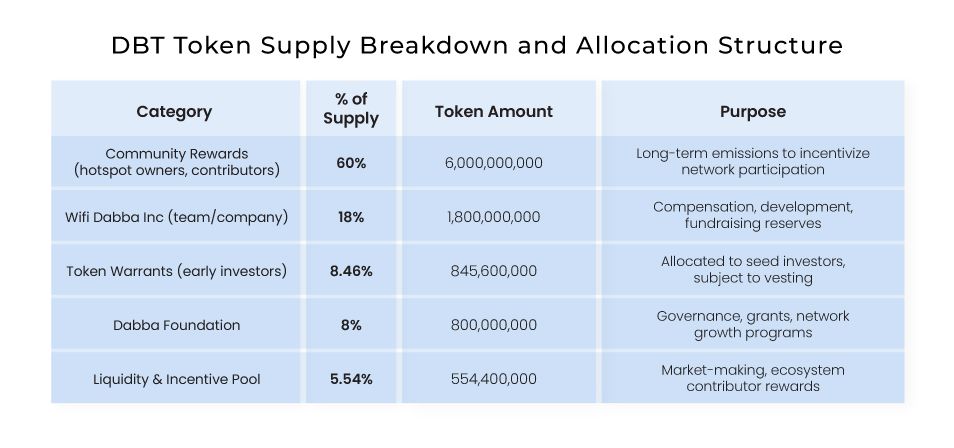

The DBT token underpins coordination, ownership, and reward distribution across the network. It has a fixed maximum supply of 10 billion tokens, with 60 percent reserved for long-term community rewards.

Emissions begin at 600 million DBT in the first year and decline by 10 percent annually. This establishes predictable inflation early on and increasing scarcity as the network matures.

Burns occur through hardware onboarding, KYC functions, advertising, software services, and, most importantly, data consumption. Data Credits are priced at 0.012 USD per gigabyte, and each purchase triggers a corresponding burn. Over time, data usage becomes the dominant contributor to deflation.

Rewards begin with a Universal Basic Income model to support rapid early onboarding and later shift toward performance-based incentives that reward high-uptime, high-throughput hotspots.

Dabba’s Competitive Position

Dabba’s goal is not to compete directly with major telecoms. Instead, it fills the connectivity gaps that large operators cannot serve profitably.

Consumer alternatives such as Starlink are priced far above the budgets of most Indian households. Starlink’s monthly fees and hardware requirements place it almost ten times higher than typical broadband plans, effectively removing it from contention in mass markets.

Within the DePIN sector, competition is more direct. Projects like Helium, Roam, Wayru, and XNET all target decentralized wireless growth. However, Dabba’s integration with LCOs and its demand-driven deployment strategy give it a structural advantage.

High real-world usage reflects the effectiveness of the underlying incentive model and local operator integration.

Scaling Beyond India

The marketplace approach can extend naturally to other regions with fragmented last-mile operators and underserved populations. Indonesia, the Philippines, Mexico, and Nigeria all have market conditions where distributed deployment and community-led maintenance can outperform traditional telecom economics.

Each region would require customized regulatory alignment and partnerships with local operators, but the fundamental model remains transferable.

A Broader Foundation for Internet Capital Markets

Reliable connectivity is the first prerequisite for participation in Internet Capital Markets. Without stable bandwidth, communities cannot interact with decentralized financial rails, digital services, or modern economic systems.

Dabba’s model creates the physical layer for that participation. It coordinates global capital, local deployment expertise, and tokenized incentives into an infrastructure network that can scale sustainably in regions where traditional models fail.

By aligning incentives around real usage rather than emissions or speculation, the system offers a credible path toward long-term, community-driven connectivity.

Read the Full Research Paper

This summary captures only a portion of the architecture, analytics, and market insights in the complete report.

To explore every model, chart, incentive mechanism, and data source in detail, you can read the full research paper here: