Deep Dive: Linea and What You Need to Know Before TGE

Linea: Everything You Must Know Before Its TGE

Linea once declared that “Linea is the Ethereum L2 built to serve one purpose: to strengthen Ethereum.” After Ethereum’s strong price growth over the past 2 months and as it approaches a new peak, Linea is the project most eagerly awaited by the community thanks to the upcoming TGE information.

This article will provide information and in-depth analysis related to Linea that you may need to know before the TGE takes place.

Quick Takeaways about Linea

- Founded by ConsenSys (Joseph Lubin, Ethereum co-founder), backed by $725M funding, leveraging products like MetaMask & Infura for ecosystem growth.

- Uses zkEVM Type 2 with ZK proofs for faster, more secure transactions, improving Ethereum’s scalability.

- Focuses on Ethereum-aligned design with $ETH for gas fee, Dual-burn mechanism, native yield via Lido staking, and Linea Stack, which is a toolkit that helps projects easily deploy new Layer 2s (L2s).- Over 400 partners in DeFi/NFT/AI; TVL peaked at $1.2B; recovering pre-TGE with strong DEX growth like Etherex.

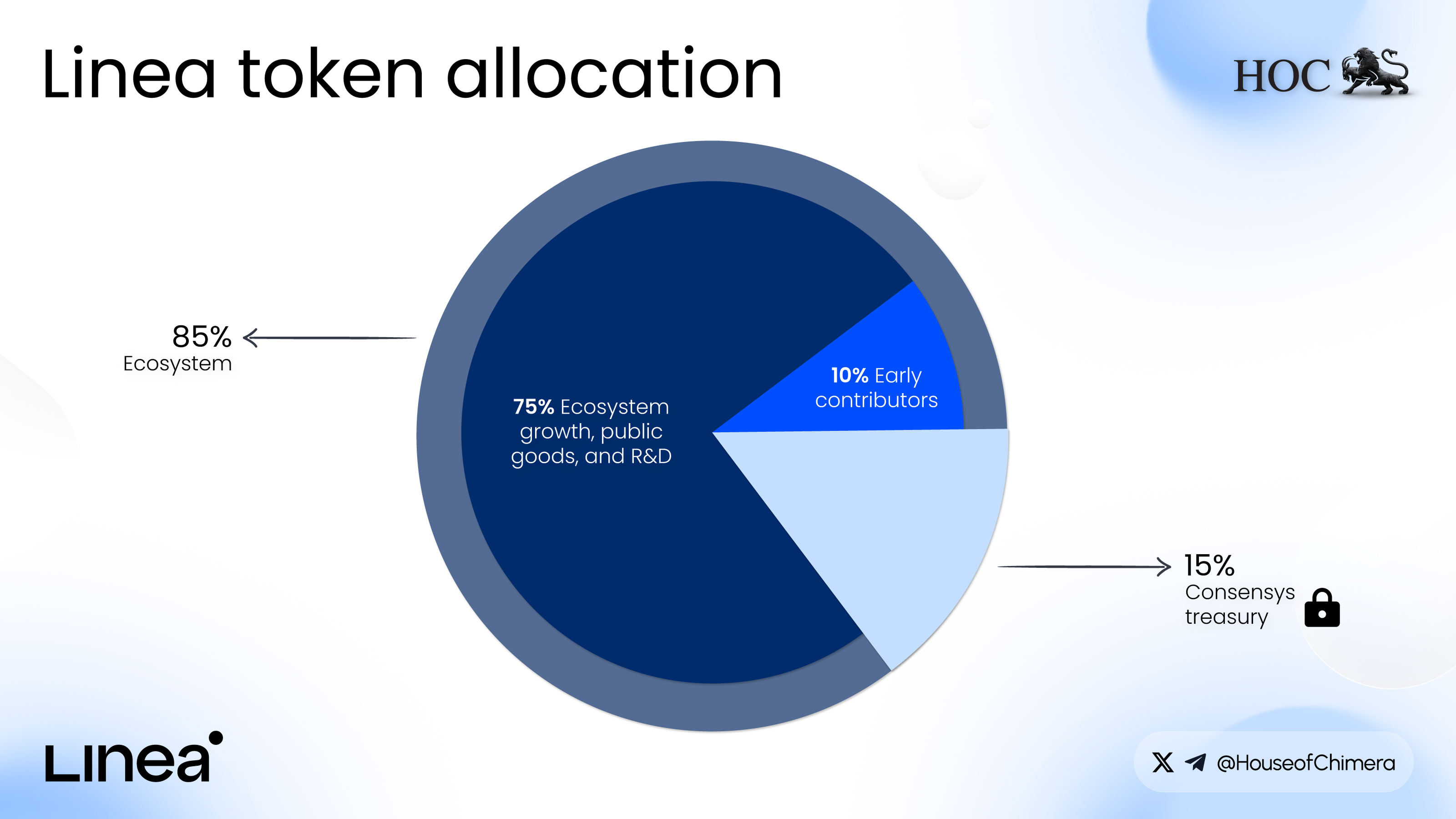

- Tokenomics with no VCs, 85% allocated to the ecosystem.

- Backed by ConsenSys resources; aims for Type 1 zkEVM by 2026.

An idea from Ethereum’s pioneers

Linea is a L2 born from the strategic vision of ConsenSys, one of the leading companies in the Ethereum ecosystem. The main founder of ConsenSys is Joseph Lubin, who co-founded Ethereum alongside Vitalik Buterin and other pioneers in 2014. With extensive experience from Wall Street (formerly worked at Goldman Sachs) and a key role in building Ethereum, Lubin has led ConsenSys to become the “cradle” of essential products in the Ethereum ecosystem, such as Infura and MetaMask, which now have over 30 million monthly users.

Linea was first introduced in 2023, when ConsenSys launched its testnet under the name ConsenSys zkEVM. By July 2023, the project officially launched its mainnet under the name Linea, symbolizing the continuous “flow” of data and value on Ethereum. ConsenSys, the parent company of Linea, has raised $725 million from major investors such as Microsoft, SoftBank, Dragonfly Capital, and Coinbase Ventures. The team behind Linea includes experts from Ethereum’s open-source community, with an Ecosystem Council consisting of ConsenSys, ENS, Status, EigenLabs, and SharpLink, which is the largest ETH-holding company in the world.

Linea's Technology

The core technology of Linea is zkEVM, which is a version of the EVM that uses zero-knowledge proofs (ZK proofs) to verify transactions off-chain before submitting them to Ethereum’s base layer.

The Problem of Ethereum

On Ethereum’s development journey, to stay competitive against the rise of other Layer 1s (L1s) like Solana, Ethereum must solve the scalability problem. Rollups are considered the most optimal solution and the foundation for the current L2 systems. Rollups are divided into two types:

- Optimistic rollups

- ZK rollups.

Optimistic rollups are compatible with the EVM, allowing developers to build dApps easily. In contrast, ZK rollups offer superior advantages over optimistic rollups in terms of security and speed but lack full EVM compatibility, making dApp deployment more difficult. Therefore, to solve the problem of ZK rollups not being EVM-compatible, zkEVM was created to allow developers to deploy dApps directly in the EVM environment without needing to change code or rewrite smart contracts.

How does a rollup work?

Rollups work by aggregating multiple L2 transactions into a batch, then submitting that batch to L1 for verification. The key difference is that Optimistic rollups submit fraud proofs to L1, while ZK rollups submit validity proofs (or ZK proofs).

- Fraud Proof: Assumes all transactions are valid unless proven otherwise. This process takes 7 days before the transaction is verified and recorded on L1. This is also why withdrawals from L2 to L1 take 7 days.

- ZK Proof: Each batch submitted to L1 comes with a cryptographic proof that immediately verifies the validity, offering higher speed and security. Therefore, withdrawals from L2 to L1 with ZK rollups only take a few hours.

Classification of zkEVM

According to Vitalik, zkEVM is divided into four main types, each with a different level of compatibility with the EVM.

- Type 1 (fully Ethereum-equivalent): Perfect compatibility with Ethereum, but lower scalability.

- Type 2 (fully EVM-equivalent): Perfect equivalence at the VM level, improved but relatively lower scalability.

- Type 2.5 (EVM-equivalent, except for gas costs): Equivalence at the VM level + better scalability, but not compatible with all dApps & tools (although most).

- Type 3 (almost EVM-equivalent): Easier to build + better scalability, but not compatible with all dApps & tools (although most).

- Type 4 (high-level-language equivalent): Easiest to build + highest scalability, but less compatibility with dApps & tools.

Linea is a Type 2 zkEVM, meaning it is fully EVM-equivalent but not quite Ethereum-equivalent. That is, it looks exactly like Ethereum “from within”, but has some differences on the outside, particularly in data structures. A Type 2 ZK-EVM is capable of running all existing applications on Ethereum without any code modification. However, it needs to make a few minor infrastructure changes to simplify development and speed up proof generation. Type 2 strikes a better balance between compatibility and performance than Type 3 and Type 4, and it has the potential to evolve toward Type 1.

Linea’s Gas Fee Update

Linea has undergone a significant upgrade, reducing gas fees with the transition from Alpha V1 to Alpha V2. In V1, transactions on Linea were aggregated into a single batch and submitted to L1 via a ZK proof. Starting from V2, Linea has updated the system to allow multiple batches to be combined into a single aggregator proof, reducing the fixed cost from 1 batch/proof to 30 batches/proof. After this update, gas fees on Linea dropped by 66%, making it the 7th cheapest L2 in terms of transaction fees, thereby significantly improving user experience.

Linea Core Features

Unlike many L2s following the token-first model, Linea remains loyal to Ethereum. Linea’s Core Features focus on three key pillars:

- Ethereum-aligned

- Native yield

- Network-of-rollups.

Dual-burn Mechanism

The Dual-burn mechanism works by using the $ETH collected from user transaction fees to increase the value of the token, where 20% of the fees are burned in $ETH, and 80% are used to buy & burn $LINEA.

At present, daily transaction fees on Linea are around $12k, but recently started to trend upward, reaching approximately $70k on August 13. To create real impact on the price of both $ETH and the future $LINEA token, the key challenge for Linea is to attract and retain users, proving that its model is effective.

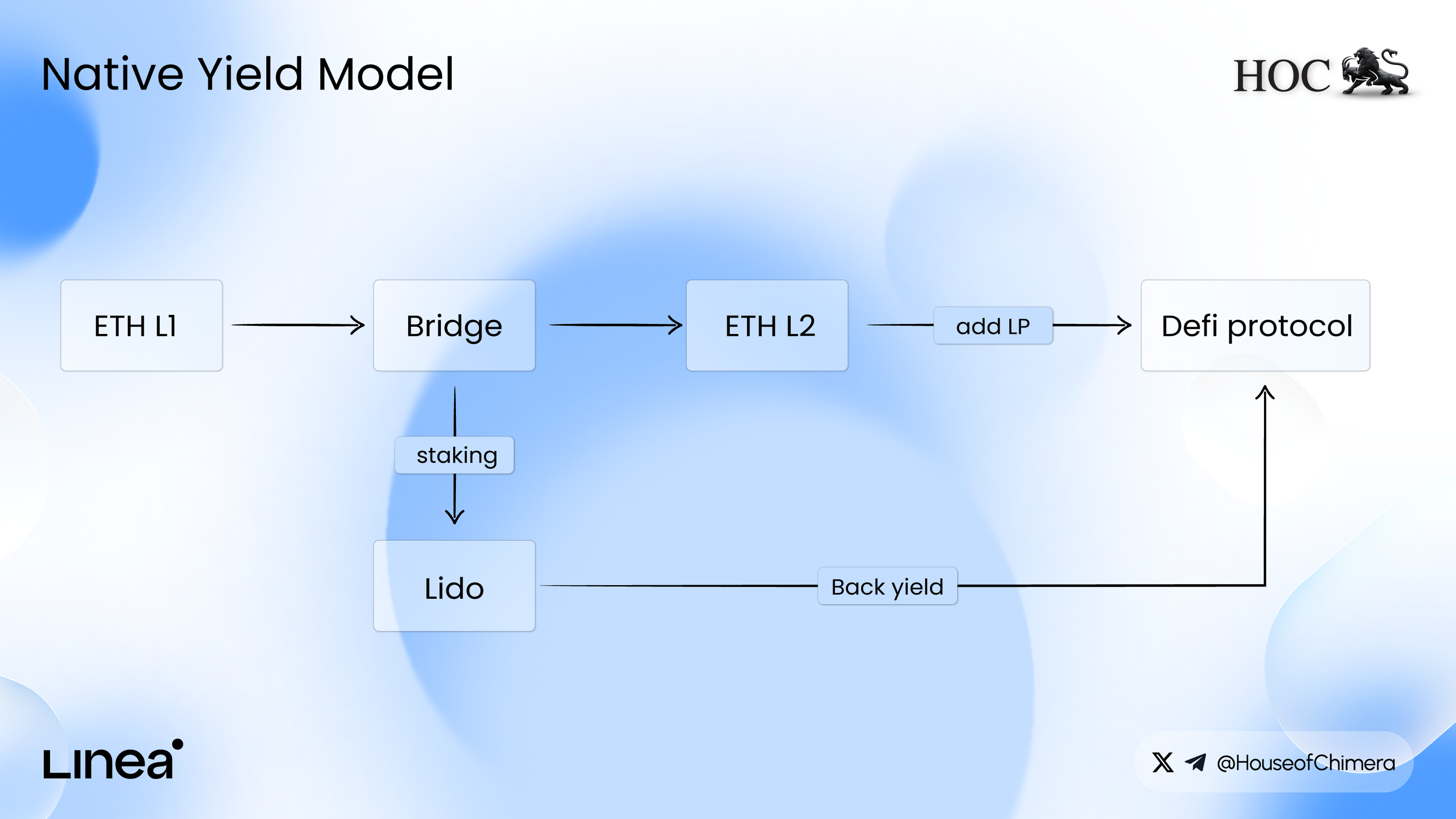

Native Yield

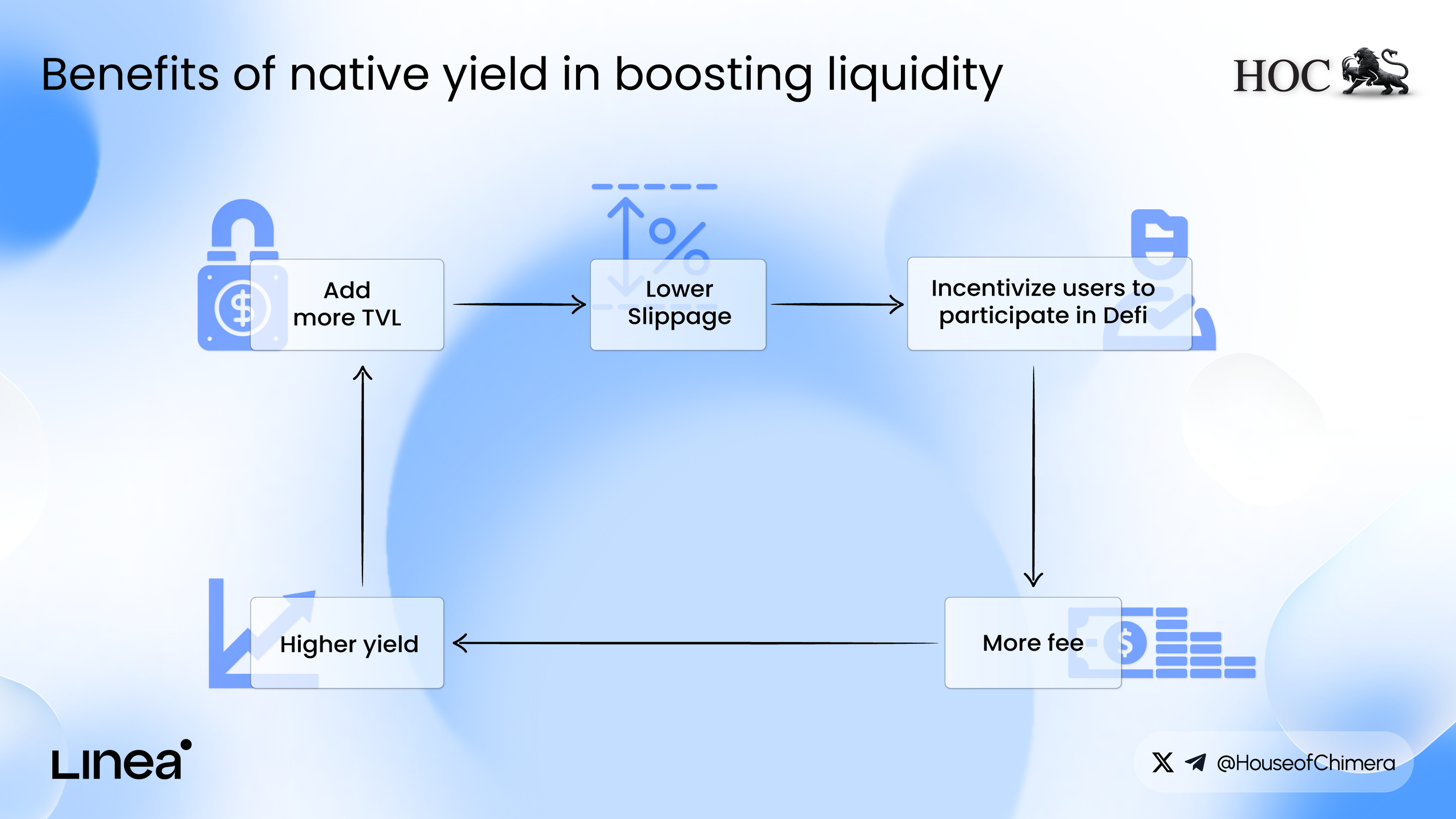

On most other L2s, $ETH is only used to pay for transaction fees. However, on Linea, users can also earn native yield by staking within the network. Linea has partnered with Lido, a decentralized staking solution that allows bridged $ETH to be automatically staked on their platform. The yield generated is then redirected back to L2 to support liquidity (DEXs, lending, perps) and fund incentive programs.

Yield from staking not only retains long-term capital on Linea and reduces liquidity providers exiting the protocol after incentives end, but also acts as a direct driver for TVL, trading volume, and transaction fees. When these metrics remain high, the dual-burn mechanism can operate at full effectiveness, putting downward pressure on supply and increasing long-term token value.

These mechanisms can help attract the $ETH holder community and create the potential for a liquidity flywheel within the Linea ecosystem, as seen with Blast. With a similar native yield mechanism, Blast once reached over $2.22B in TVL before rapidly declining due to the absence of major DeFi protocols like Aave and a lack of standout dApps to retain users post-airdrop. However, Aave is already live on Linea, and with notable names like @eigen_labs and @Consensys behind it, Linea may avoid repeating Blast’s mistakes.

Network-of-rollups model

Not only does Linea build its own zkEVM L2, but it also introduces Linea Stack, a toolkit that helps projects easily deploy new L2s, similar to OP Stack or Polygon SDK. Notably, Status is the first L2 project built using Linea Stack. This strategy allows Linea to:

- Create network effects from multiple chains using the same technology, ensuring that individual blockchains can interoperate and function as a unified system, support each other technically, and attract users, similar to the relationship among projects in Optimism’s Superchain.

- Target revenue from infrastructure, not just gas fees.

Ecosystem momentum

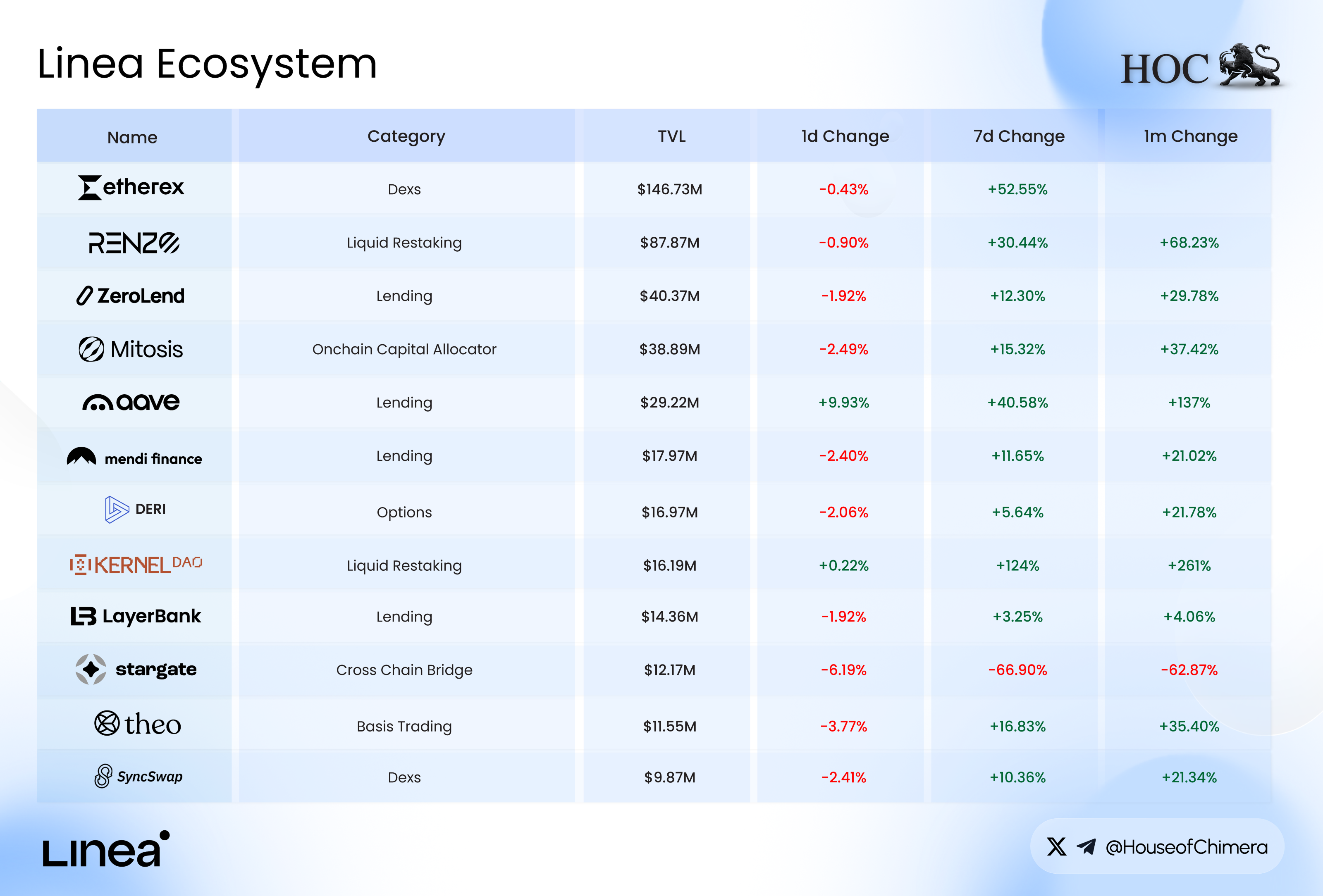

DeFi on Linea is taking shape. The liquidity backbone centers around DEXs and lending protocols, featuring familiar names like Aave, PancakeSwap, and SushiSwap, along with supporting components such as Stargate (bridge) and Satori (perps). In addition, Linea has over 400 partners across DeFi, infrastructure, NFTs, and AI, covering all the essential pieces for Linea to stay aligned with future narratives.

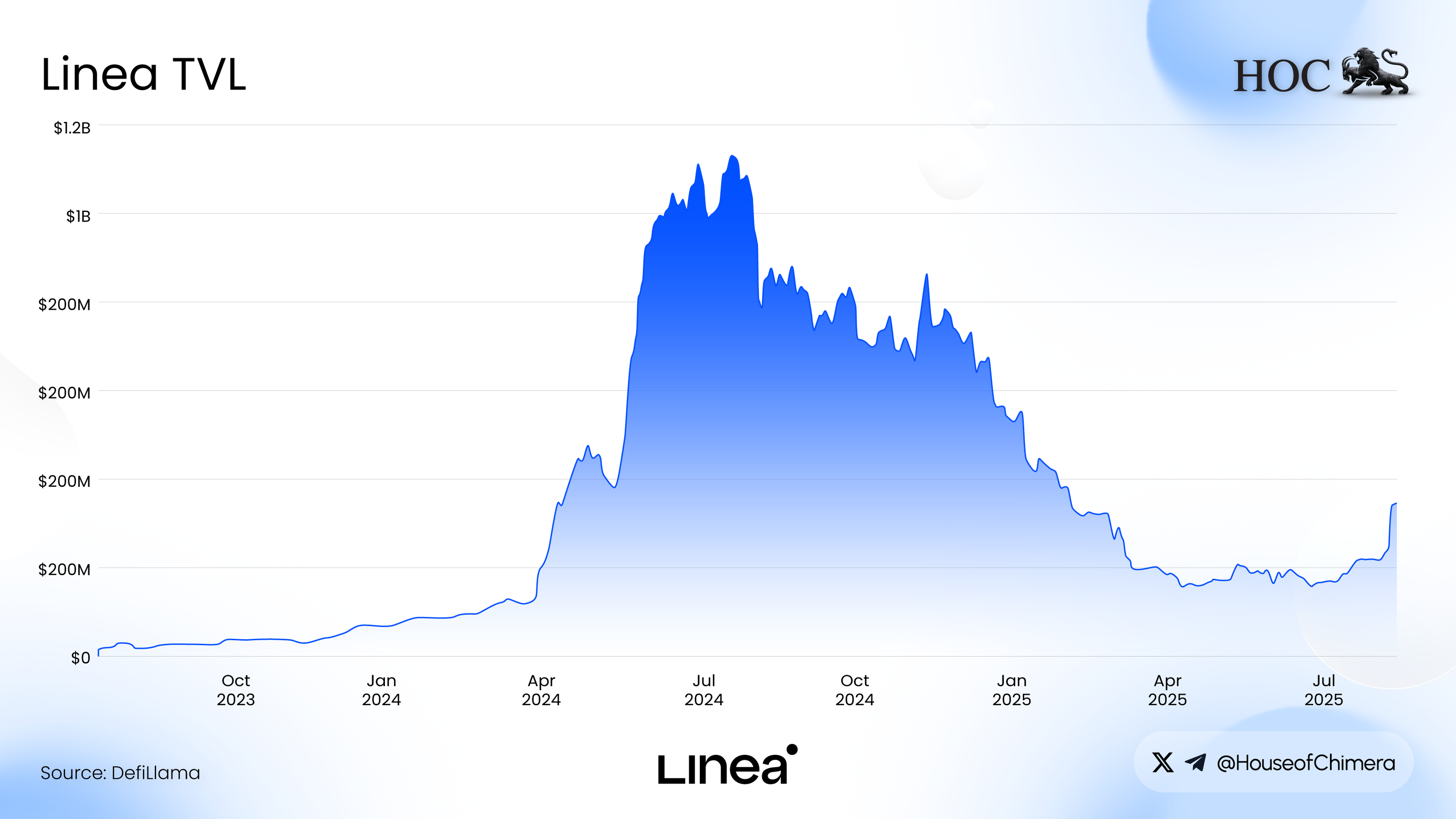

Linea’s TVL peaked at $1.2 billion following the launch of the Linea Surge program in May 2024, which was a points-based incentive campaign designed to attract TVL and activate the DeFi ecosystem, running until November 2024. The campaign created a strong acquisition effect, driving around 800k daily active addresses (DAA) and rapidly boosting both TVL and user numbers. However, both TVL and DAA dropped significantly after the program ended, highlighting the unsustainable retention, a common problem with large-scale incentive campaigns where the primary user motivation is short-term rewards rather than long-term ecosystem value.

Currently, Linea’s TVL is recovering, partly due to the rising price of $ETH and the pre-TGE momentum, which has drawn increased attention to the ecosystem. In the pre-TGE phase, Linea’s TVL grew by approximately 60%, even without any incentive program. Etherex, a DEX on Linea, surpassed $120M in TVL just two weeks after launch, indicating that capital is starting to flow back into the Linea ecosystem.

Tokenomics with no VCs

Instead of allocating tokens to VCs, Linea’s tokenomics aims to put the ecosystem first, directing the majority of funds toward users, builders, Ethereum public goods, and R&D.

Distribution Overview:

- 10% Airdropped to early contributors and users (fully unlocked)

- 1% Strategic builder airdrop (discretionary)

- 4% Liquidity providers from the Linea Surge (unlocked)

- 60% Ecosystem Fund (long-term growth, grants, infra)

- 15% Consensys Treasury (5-year lockup, non-transferable)

Fund management is handled by The Linea Consortium, a group of credible Ethereum organizations that have made significant contributions to strengthening Ethereum, including @eigen_labs, @ensdomains, @SharpLinkGaming, @ethstatus, and @Consensys.

However, $LINEA currently does not have a specific utility: it is not used for gas and currently has no governance rights. While other Ethereum L2s use token utility primarily for voting governance, in the case of $LINEA, the project has announced: “There is no tokenholder governance in the LINEA system”. This is a deliberate and strategic action for the token to not be used for governance. Instead, strategic decisions regarding token emissions, grants, incentives, and fund allocations are overseen by the Linea Consortium. The main source of revenue comes from ETH transaction fees, so token holders only benefit indirectly through the mechanism that burns 80% of those fees. Additionally, since ConsenSys (the parent company of LINEA) is a traditional company, this may be a way for the project to limit legal risks from the SEC by not assigning any use case to the token until there is a clear regulatory framework.

The token is set to be released at the 10th of September, 2025.

Advantages and Future Outlook of Linea

Advantages

Financially, Linea did not raise funds directly, but its parent company, ConsenSys, has raised $725M - a large enough amount to support long-term development of the project. In addition, ConsenSys holds core Ethereum products like MetaMask and Infura, which can easily support builders and applications within the Linea ecosystem. Moreover, by launching after other L2s like Arbitrum, ZkSync, and Blast, Linea has the opportunity to learn from and leverage their strengths, while avoiding the weaknesses that led to failures.

The Future of Linea

According to the roadmap, Linea aims to achieve its primary goal of becoming a Type 1 zkEVM by Q1 2026. Following that, by Q2 2026, performance is expected to reach 0.5 gGas/s (approximately 5,000 TPS), which would fulfill the objective to scale Ethereum, deliver a great user experience, and enable real-time proofs on Ethereum. However, that goal is still a long way off. In the near term, the most important updates from Linea will be the implementation of the dual-burn mechanism and Native Yield. Overall, Linea can be seen as a bold experiment: building a public good L2 with ETH native yield, no VCs, and currently no direct token utility, with a mission of positioning itself as an L2 that brings value back to Ethereum. However, this “no token utility” approach also raises important questions. While it helps reduce regulatory risks and reinforces an Ethereum-first alignment, the lack of inherent utility could affect $LINEA’s long-term value capture and token demand. Whether this model can prove sustainable remains to be seen. Lets wait and see how Linea will strengthen Ethereum.