Unlocking HyperLiquid’s Extraordinary Growth: Top Lessons from a Multi-Billion-Dollar Empire

From Zero to a Multi-Billion Dollar Empire: What’s Behind Its Extraordinary Success?

In 2016, Arthur Hayes introduced perpetual futures, forever changing crypto markets. Eight years later, Hyperliquid took that same instrument and rewrote the rulebook, driving evolution in decentralized perpetual exchanges (Prep DEX). Hyperliquid’s superior on-chain transparency and seamless, CEX-like trading experience quickly propelled it past competitors like dYdX, even drawing attention from market leader Binance.

What factors have driven Hyperliquid’s rapid success? Let’s dive in.

The Genesis of Hyperliquid

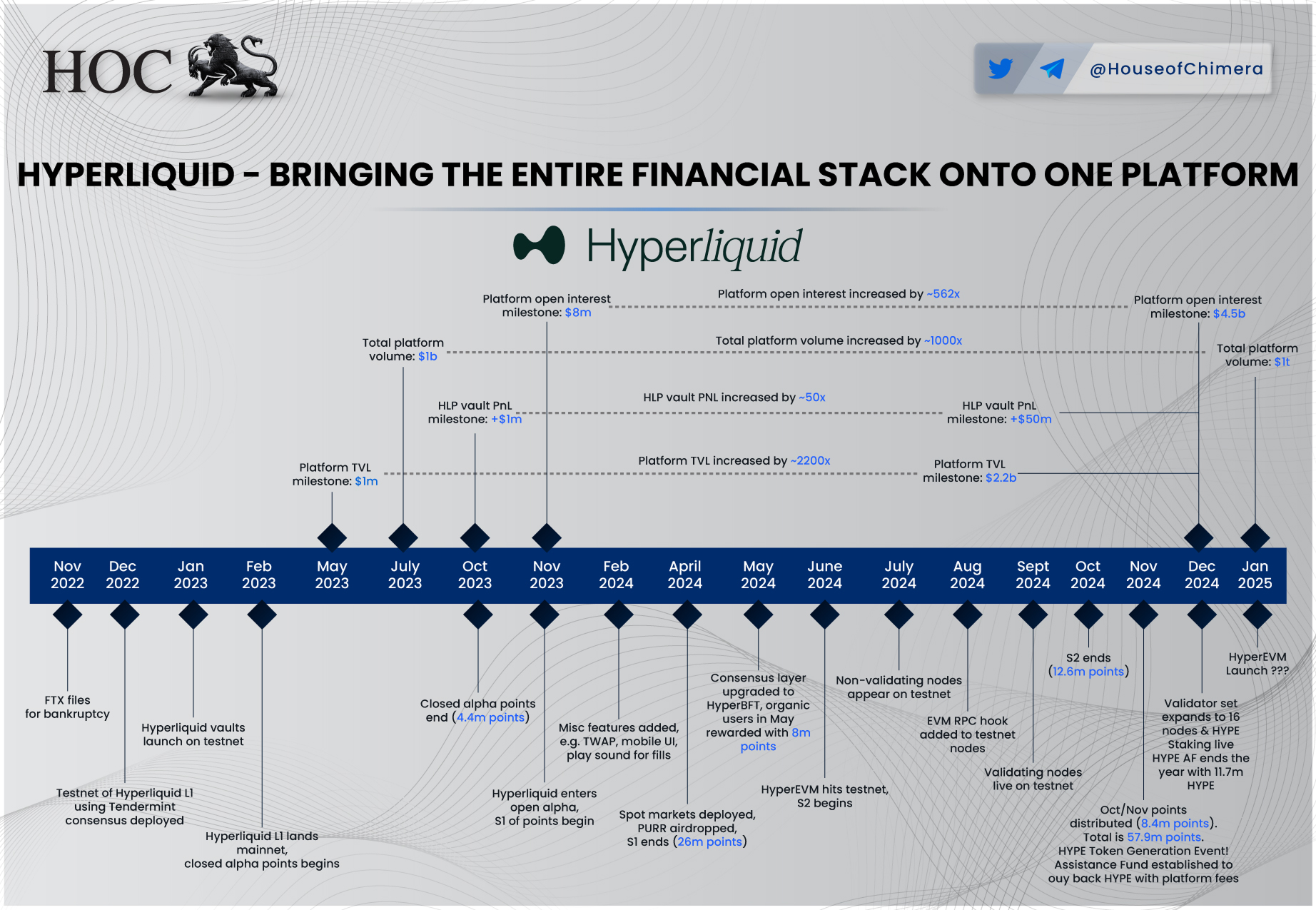

Hyperliquid is a decentralized perpetual derivatives exchange (Perpetual DEX) built on its proprietary Layer 1 blockchain, launched in 2023 by Harvard alumni Jeff Yan and Iliensinc. A bold vision drove the founders: to develop a DEX that offers the smooth user experience of CEXs while fully preserving blockchain transparency and decentralization.

Instead of adopting the common practice of deploying on existing blockchains, the Hyperliquid team developed their own Layer 1 blockchain optimized specifically for ultra-high trading performance. This laid the groundwork for Hyperliquid to become one of the most groundbreaking DeFi trading platforms in the 2024-2025 period.

Market Context at Hyperliquid’s Launch

When Hyperliquid debuted in 2023, the DeFi market was undergoing a significant shift, triggered by the collapse of FTX in late 2022. This crisis severely eroded trust in CEXs, prompting users to seek decentralized solutions that offered greater control over their assets without relying on intermediaries.

However, DEX faced numerous challenges at the time, including slow transaction speeds, high slippage, complicated user interfaces, and notably poor risk management in derivative products, such as perpetual futures. While platforms like GMX, dYdX, and Perpetual Protocol dominated the market, they were limited by outdated infrastructure and partial order books or AMM models. Against this backdrop, Hyperliquid emerged as a refreshing innovation, seamlessly integrating the performance of CEXs, user-friendly interfaces, and a fully on-chain architecture, setting a new standard for decentralized derivatives trading.

Technical Architecture of Hyperliquid

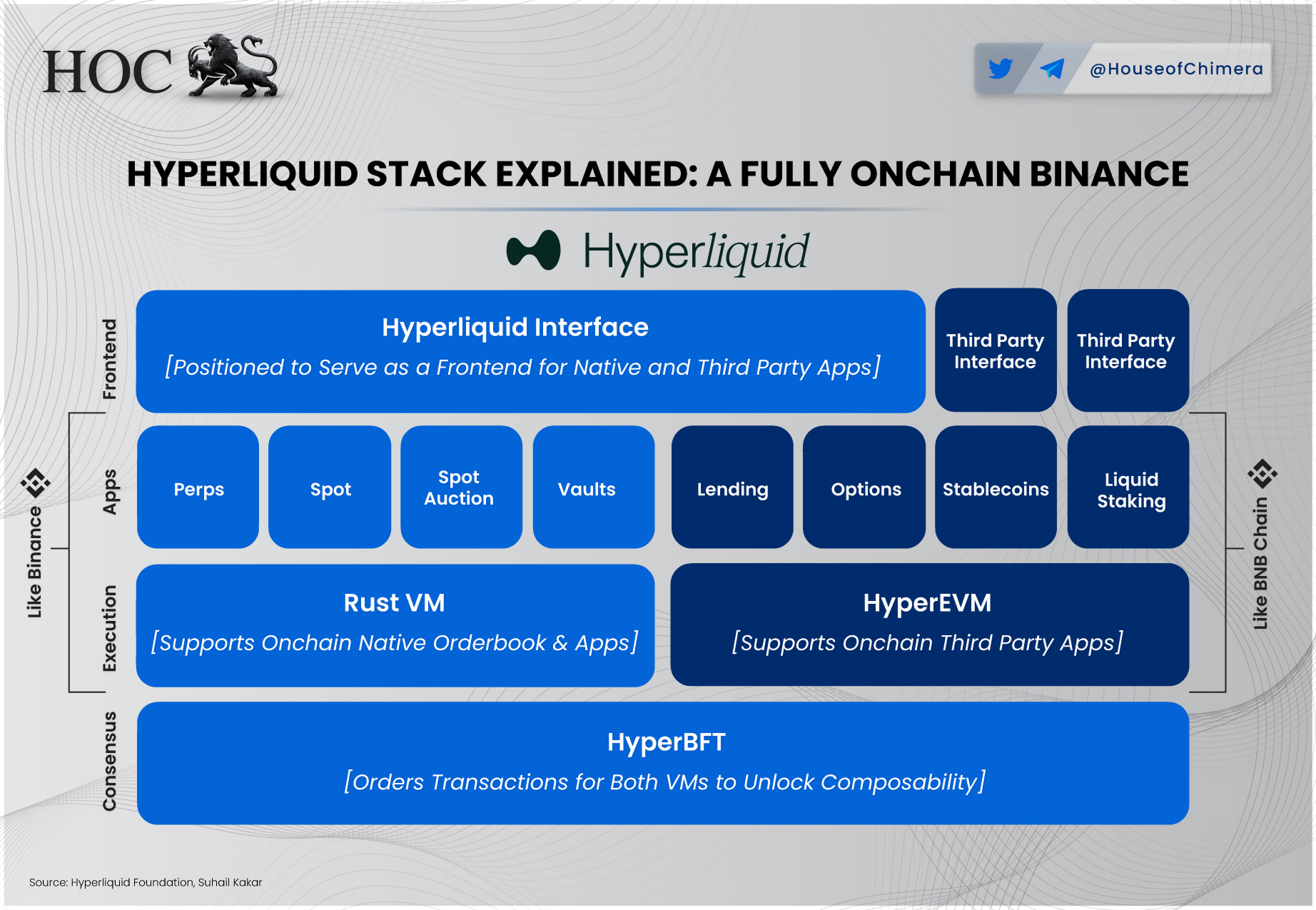

Instead of accepting the technical limitations of existing blockchains, such as Ethereum, Arbitrum, or Optimism, which are constrained by network latency, high gas fees, and scalability issues, Hyperliquid adopted a bold yet strategic path: building a specialized Layer 1 blockchain. This bespoke infrastructure was meticulously designed solely for trading derivatives, delivering unparalleled speed and an exceptional user experience. Its ambitious goal is to become the "AWS for liquidity," providing robust liquidity infrastructure akin to Amazon Web Services' comprehensive cloud services.

Jeff Yan, Hyperliquid’s founder, identified liquidity inefficiency as one of DeFi's most significant pain points, resulting in high slippage and a poor user experience. To tackle this issue, Jeff envisioned a platform capable of supplying liquidity across the entire DeFi ecosystem, much like how AWS provides foundational infrastructure globally.

Consensus

HyperBFT, like most modern consensus algorithms, builds on Hotstuff and subsequent improvements. Unlike Ethereum and Tendermint, HyperBFT can sequence transactions continuously without waiting for the current block's hash to finalize. Therefore, consensus doesn’t block execution. The two processes run in parallel.

Moreover, HyperBFT distinguishes itself by not embedding a synchronous timescale within its consensus during normal block production. This means that HyperBFT doesn’t require validators to wait for a specific time window to agree on a block. Blocks are generated as swiftly as validators reach a quorum through effective communication, exhibiting a property known as "optimistic responsiveness". This innovation leads to improved confirmation latency, faster block production with block times limited only by network delay, and better scalability. Both the algorithm and networking layers are custom-optimized to meet the specific demands of the Layer 1 blockchain.

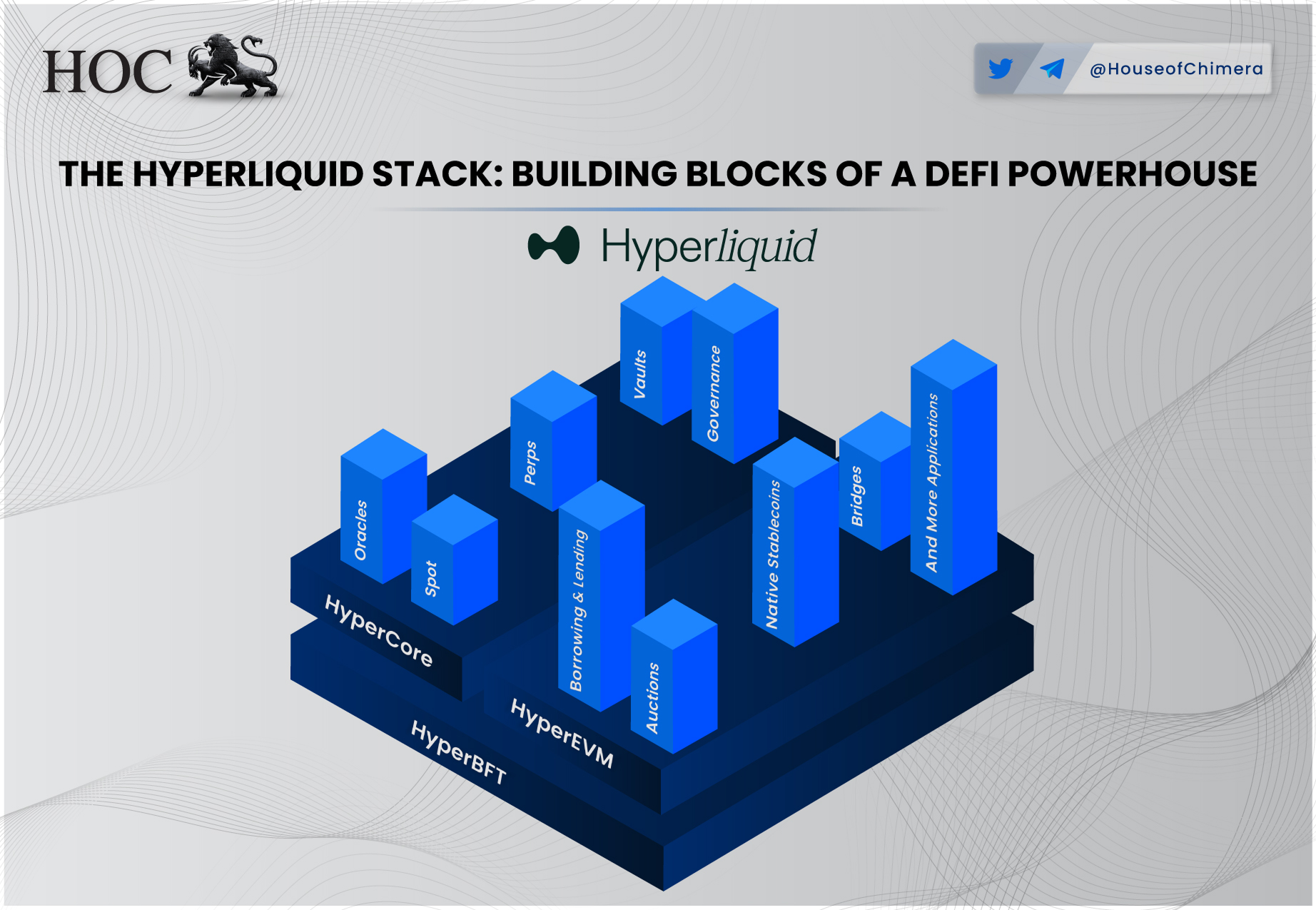

Hyperliquid’s state execution splits into two main components: HyperCore and HyperEVM.

HyperCore

HyperCore focuses entirely on on-chain perpetual futures and spot order books. Every order placement, cancellation, trade, and liquidation occurs transparently, benefiting from one-block finality provided by HyperBFT. Currently, HyperCore supports throughput of 200,000 orders per second, with ongoing improvements to node software continuously boosting performance.

HyperEVM

HyperEVM brings Ethereum's familiar general-purpose smart contract capabilities directly to Hyperliquid’s blockchain. The HyperEVM is not a separate chain, but rather, secured by the same HyperBFT consensus as HyperCore. This enables the HyperEVM to interact directly with parts of HyperCore, such as the spot and perpetual order books. Builders can plug into a mature, liquid, and performant on-chain order book with HyperCore + HyperEVM on Hyperliquid.

Let’s keep it simple:

- HyperCore: Exchange (perpetual/spot order books), native staking, vaults, and oracles.

- HyperEVM: An EVM-compatible smart contract layer for building and deploying decentralized applications.

Hyperliquid Core Features

Hyperliquid is widely recognized as a leading Perpetual DEX.

To establish this distinctive position, Hyperliquid has several core features:

Order Book Mechanism

Hyperliquid utilizes a Central Limit Order Book (CLOB), the exact trading mechanism provided by CEXs such as Coinbase and Binance. This system matches buy and sell orders at the best available price at any given moment, a model also used by traditional stock exchanges, such as the NYSE.

Historically, one issue with CEXs has been that buy and sell orders are off-chain data. This has led to persistent concerns among traders about potential market manipulation, as algorithms could theoretically manipulate these virtual figures without transparency. Hyperliquid resolves this issue by creating a fully on-chain order book system. However, the CLOB model demands low latency to enable market makers to continuously open and close positions effectively. This is why Hyperliquid has developed its independent blockchain, allowing complete algorithm optimization and customized fee adjustments.

The critical question arises: Would you opt for a platform that guarantees transparency and delivers speeds comparable to a CEX, or would you prefer a traditional CEX whose underlying mechanisms remain uncertain?

Why use a CLOB and not an AMM?

While AMMs provide a liquidity edge over CLOBs by allowing passive liquidity provision and minimizing the need for active order management, they fall short in supporting advanced order types, accurate price discovery, and high-frequency trading (HFT) capabilities that CLOBs offer. In addition, AMMs face issues such as Impermanent Loss and Slippage.

On CEXs, market makers continuously supply buy and sell orders across multiple price levels using automated algorithms. Hyperliquid’s CLOB mechanism operates in much the same way but with one key difference: all order data is on-chain, and every quoted amount represents real capital. Therefore, for the CLOB mechanism to succeed, beyond the infrastructure aspect, it also requires a good liquidity mechanism to ensure that user buy and sell orders are executed immediately, while preserving the security and integrity of the entire system.

Liquidity Mechanisms – Vaults & Market Making

One of Hyperliquid’s core principles is that liquidity should be democratized, meaning anyone can participate in providing liquidity.

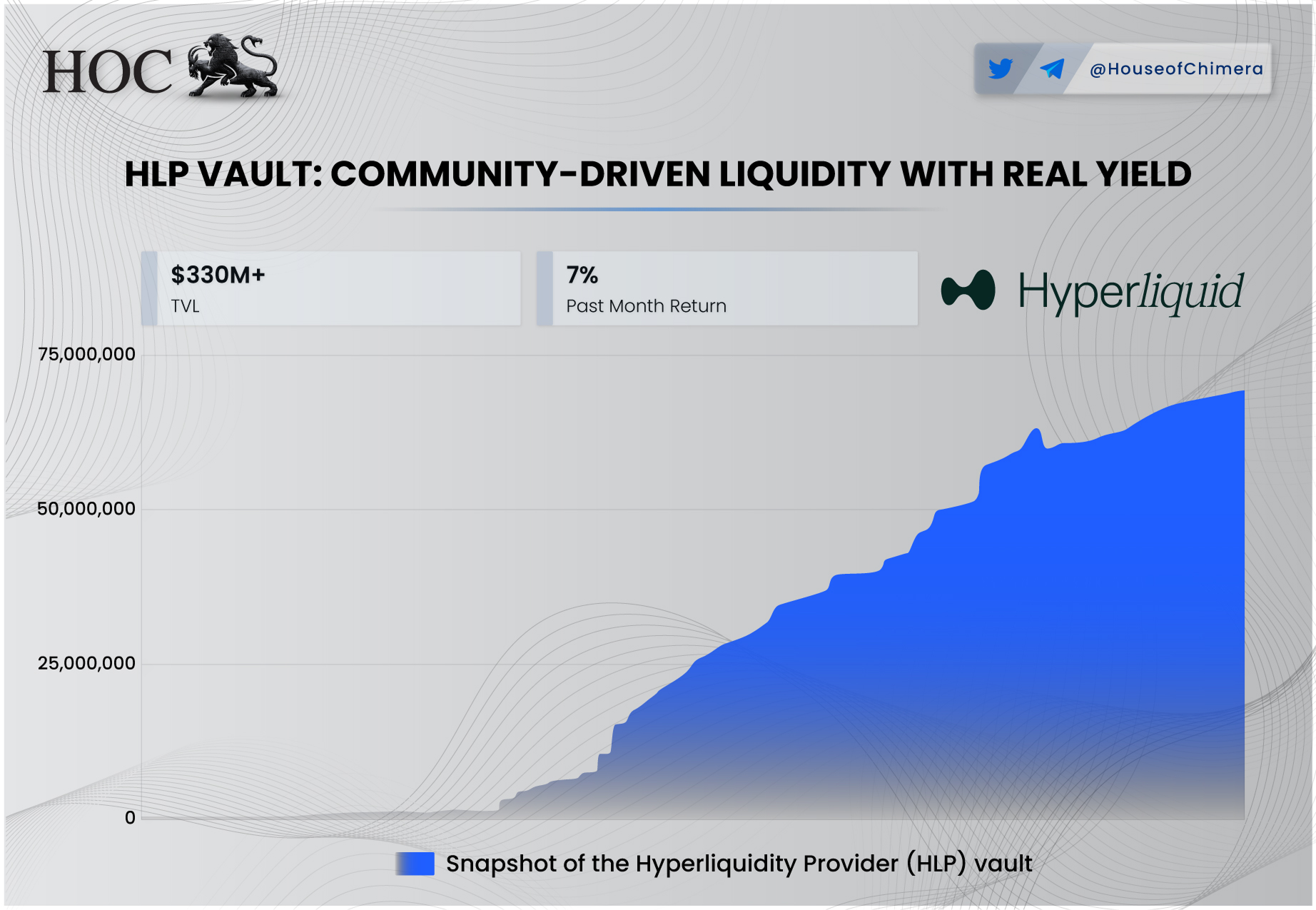

Hyperliquid introduces the Hyperliquidity Provider (HLP), a protocol vault that does market making and liquidations and receives a portion of trading fees.HLP democratizes strategies typically reserved for privileged parties on other exchanges by allowing anyone in the community who can contribute liquidity to the vault and share in its P&L. HLP is fully community-owned. For perpetual trading, HLP can give deep and tight liquidity based on CEX perpetual and spot prices.

Additionally, one cannot overlook HIP-2 (Hyperliquidity), a critical improvement proposal defining a fully decentralized, on-chain liquidity strategy embedded directly into Hyperliquid’s block transition logic. Hyperliquidity actively participates in the native order book by quoting live bids and asks, consistently maintaining a tight 0.3% spread that refreshes every 3 seconds. This mechanism ensures immediate trading capability for HIP-1 tokens, particularly valuable in their early phases of price discovery.

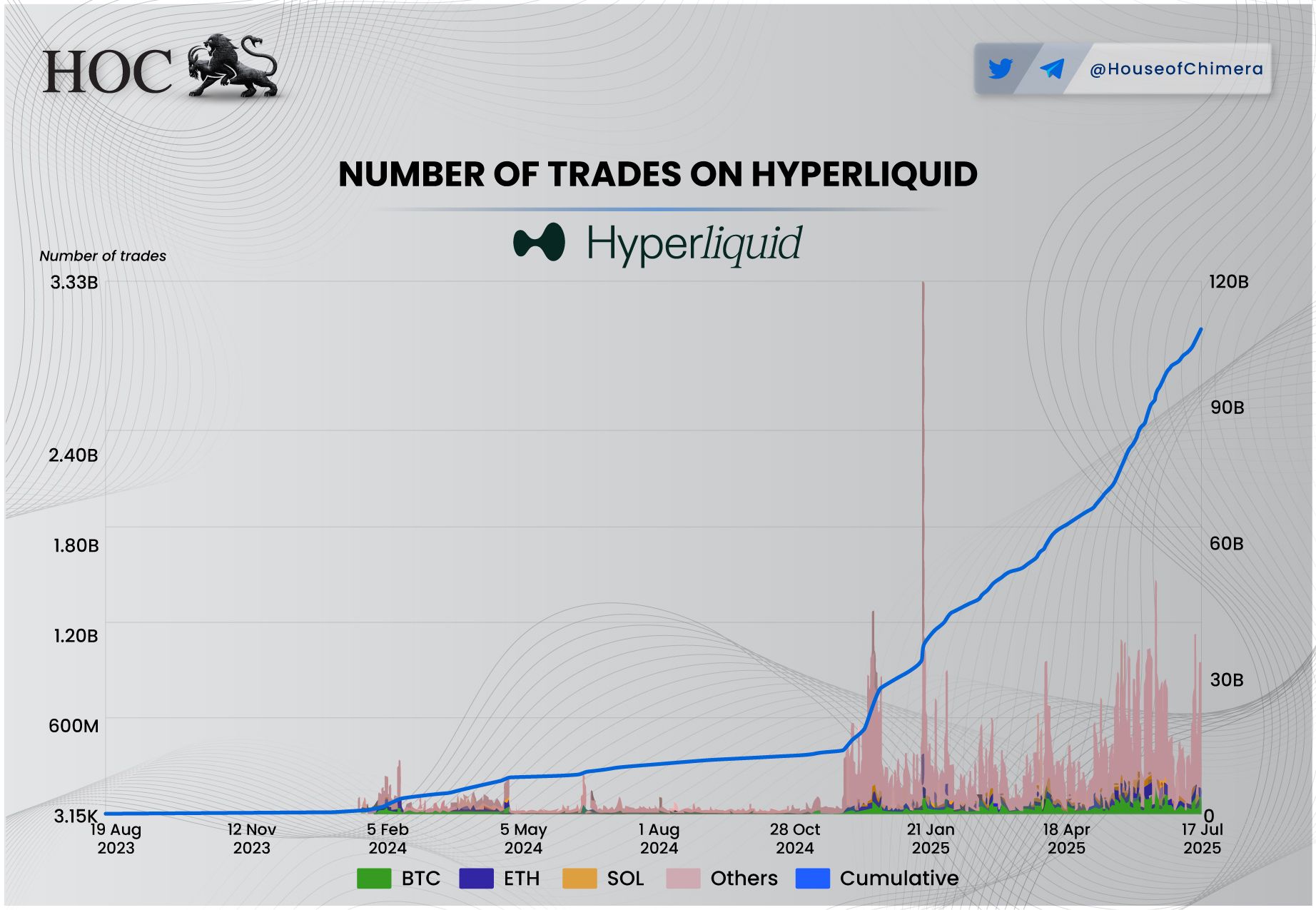

Due to its robust technical features and liquidity mechanisms, Hyperliquid has rapidly achieved remarkable results.

Impressive Metrics

Unlike most large projects, Hyperliquid neither raised funds from VCs nor conducted a pre-sale, and steered clear of short-term marketing campaigns. Jeff Yan’s philosophy is clear: A good product speaks for itself - No VCs, No hype, Just code.

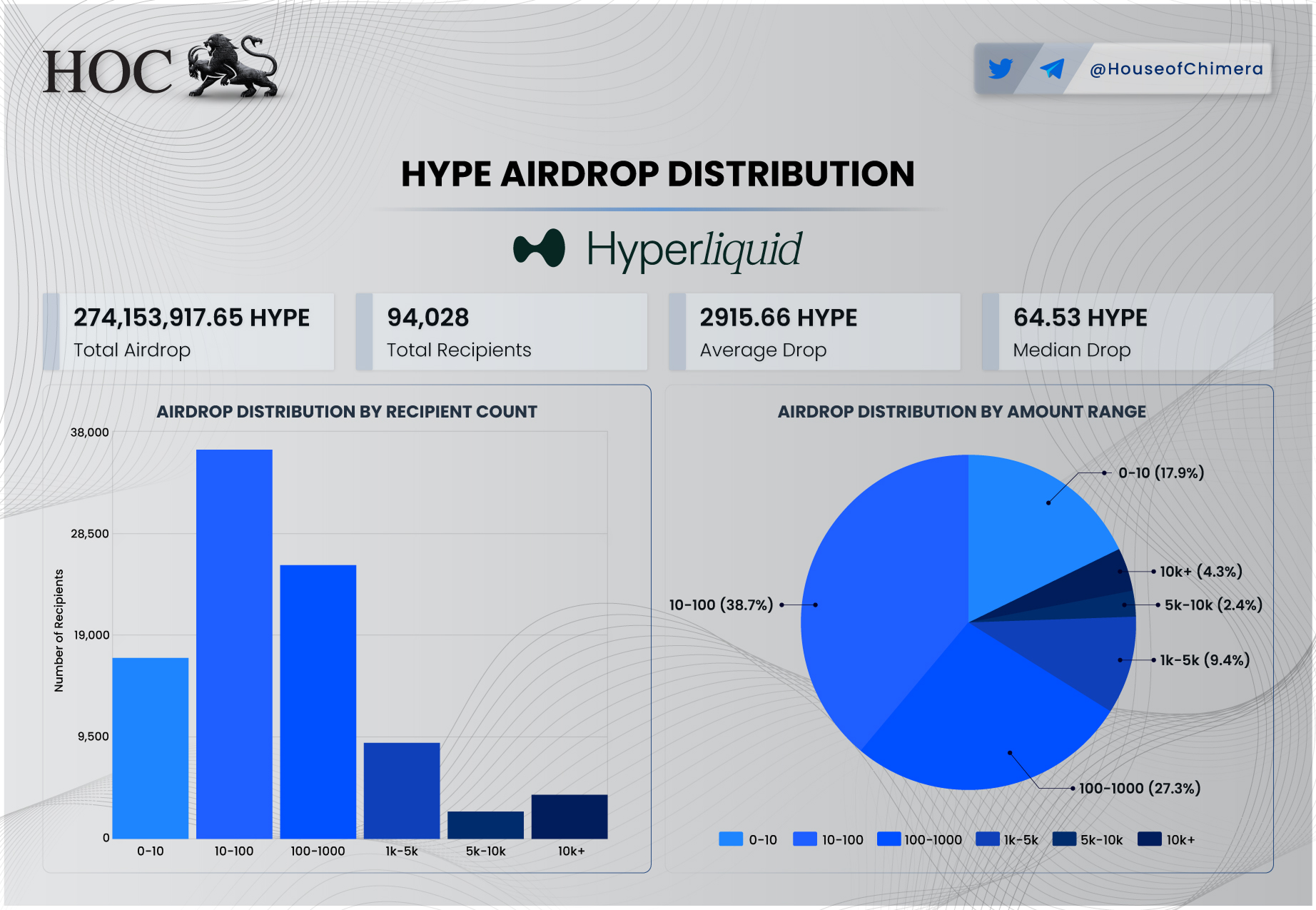

The highly successful airdrop of Hyperliquid speaks volumes about the team's vision, proving it to be correct. The total number of wallet addresses that received the Hyperliquid airdrop was 94,000, and on average, each wallet received 2915.64 HYPE token (over $10,000) at the time of the Token Generation Event (TGE) (each HYPE token was priced at $3.9).

Hyperliquid airdropped up to 31% (equivalent to 310 million tokens) of the total HYPE token supply to users at the time of the TGE, with all tokens fully unlocked and excluding the involvement of VCs, CEXs, and market makers. Despite this, the token price continued to rise steadily after the TGE, reaching approximately $32 per token on December 22, 2024. This demonstrates the quality of the product and strong community support.

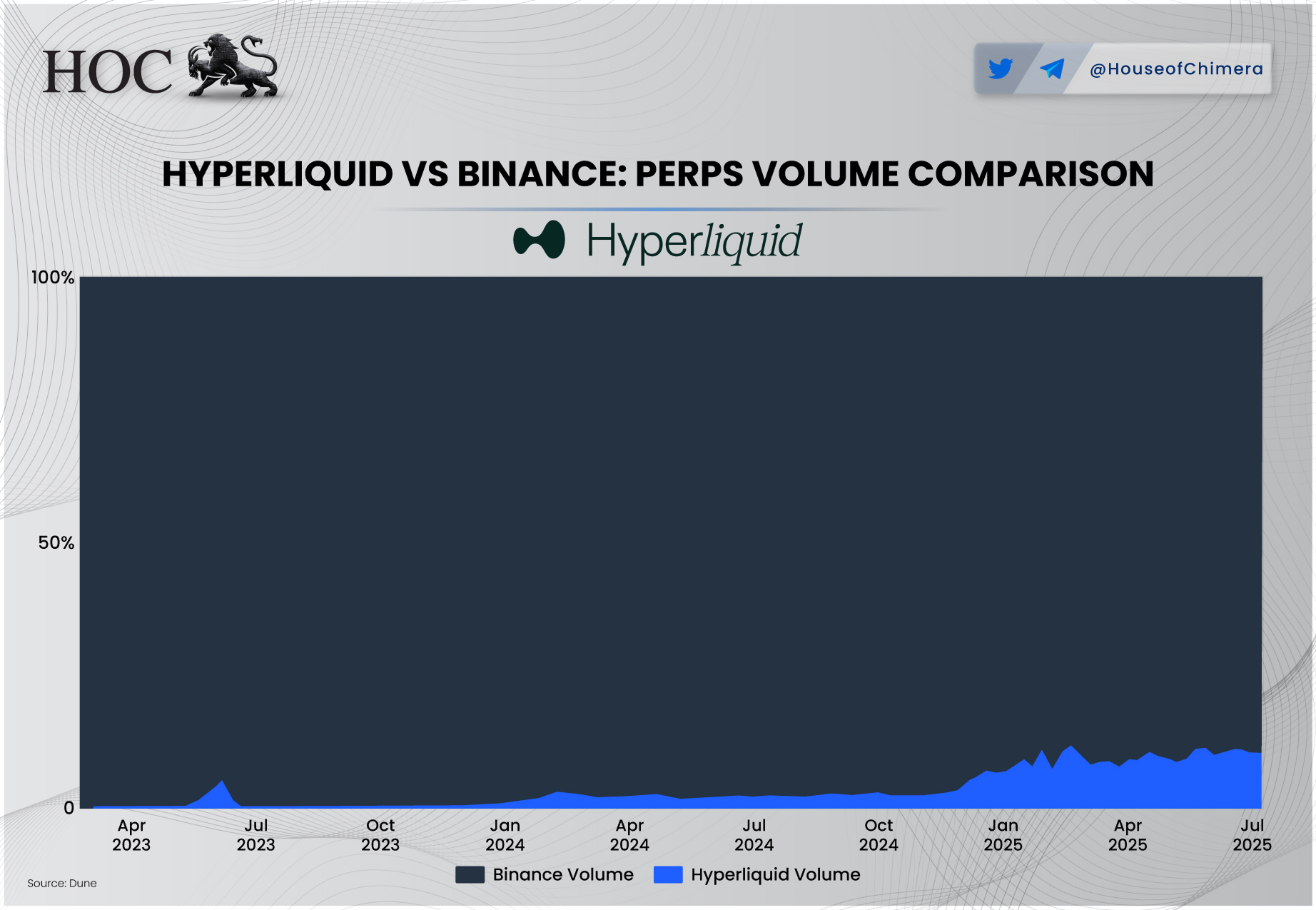

The trading volume ratio between Hyperliquid perps and Binance perps has also increased significantly, rising from approximately 2.8% in November 2024 to over 10% at present.

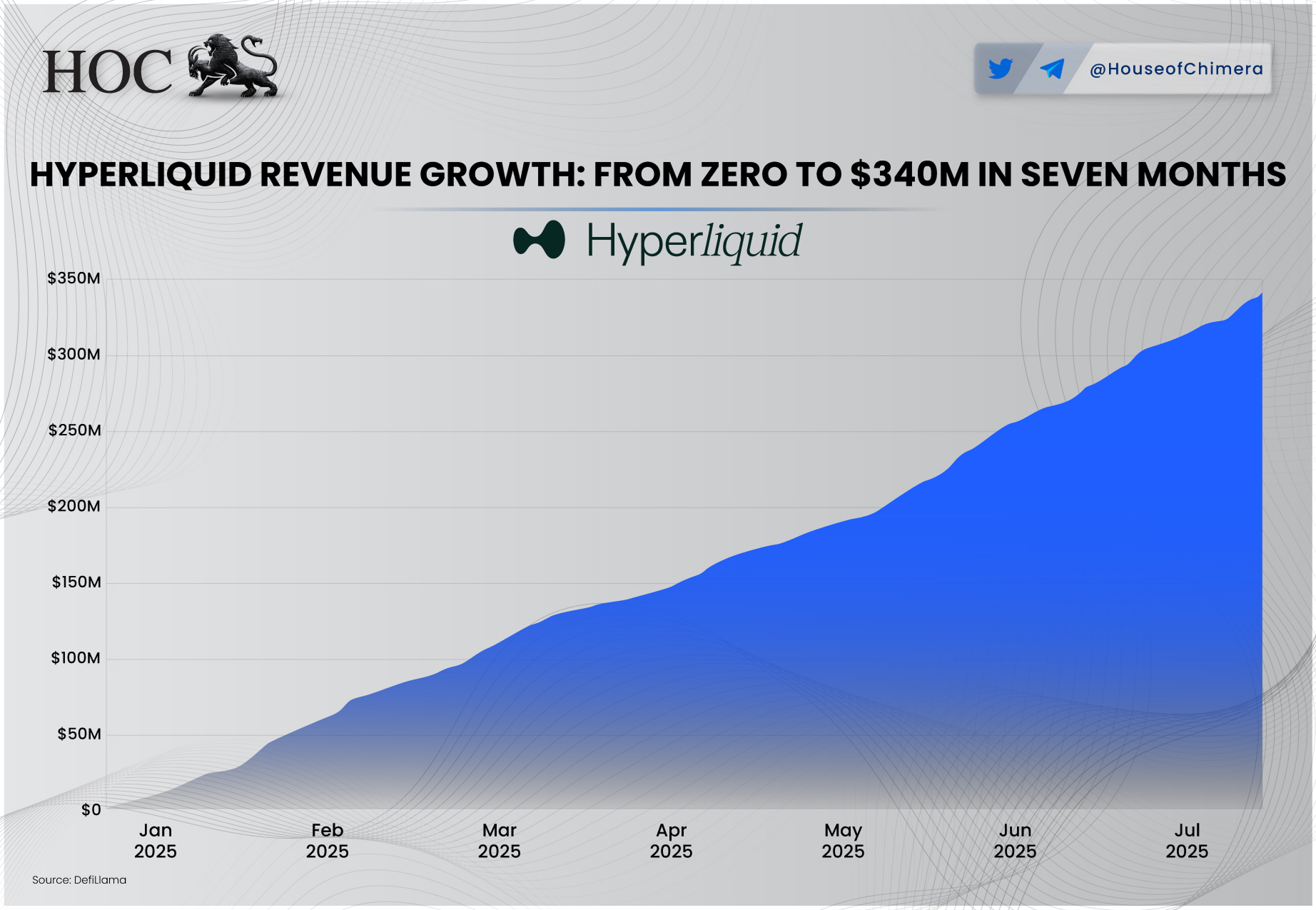

Hyperliquid's revenue has also grown rapidly since December 2024, reaching approximately $340M at present.

However, any product that experiences explosive growth is bound to encounter some issues, and Hyperliquid is no exception.

Hyperliquid Incidents

Any product aiming for mass adoption must undergo tests of its limits - Hyperliquid is no exception. The JELLYJELLY Meme Coin incident serves as a notable example.

The HLP vault on Hyperliquid is responsible for managing liquidity and supporting the system during forced liquidations. The liquidator vault can take over positions that are below 2/3 of the maintenance margin. However, the downside is that the platform can suffer significant losses if it falls prey to a manipulation attack. A whale manipulated the mechanics, resulting in a major stress test of the system, causing a $12M unrealized loss for Hyperliquid.

The situation began when a trader opened a $6 million short position on JELLYJELLY, a low-cap token valued at around $10 million at the time. The trader then deliberately removed margin, forcing Hyperliquid’s liquidity vault (HLP) to inherit and automatically liquidate the massive short position. However, after the HLP vault inherited the position, this trader allegedly purchased large amounts of JELLYJELLY, pumping the token’s price on-chain. As the price surged, HLP suffered a $12 million unrealized loss. If JELLYJELLY continued to rise, the entire $200M+ in the HLP vault could have been liquidated entirely.

In the end, Hyperliquid had to delist JELLYJELLY and invoke their emergency mechanism: they overrode the oracle price (ignoring the inflated market price), reset the liquidation price to $0.0095 - the original short price, and force-closed all positions. This action prevented further losses and even secured a $700K profit for HLP.

The swift and decisive handling of the JELLYJELLY incident highlighted the team's robust crisis management capabilities, further solidifying user trust. However, it also raised critical questions regarding the true decentralization of Hyperliquid's operational governance.

Could Hyperliquid’s Success Be Replicated?

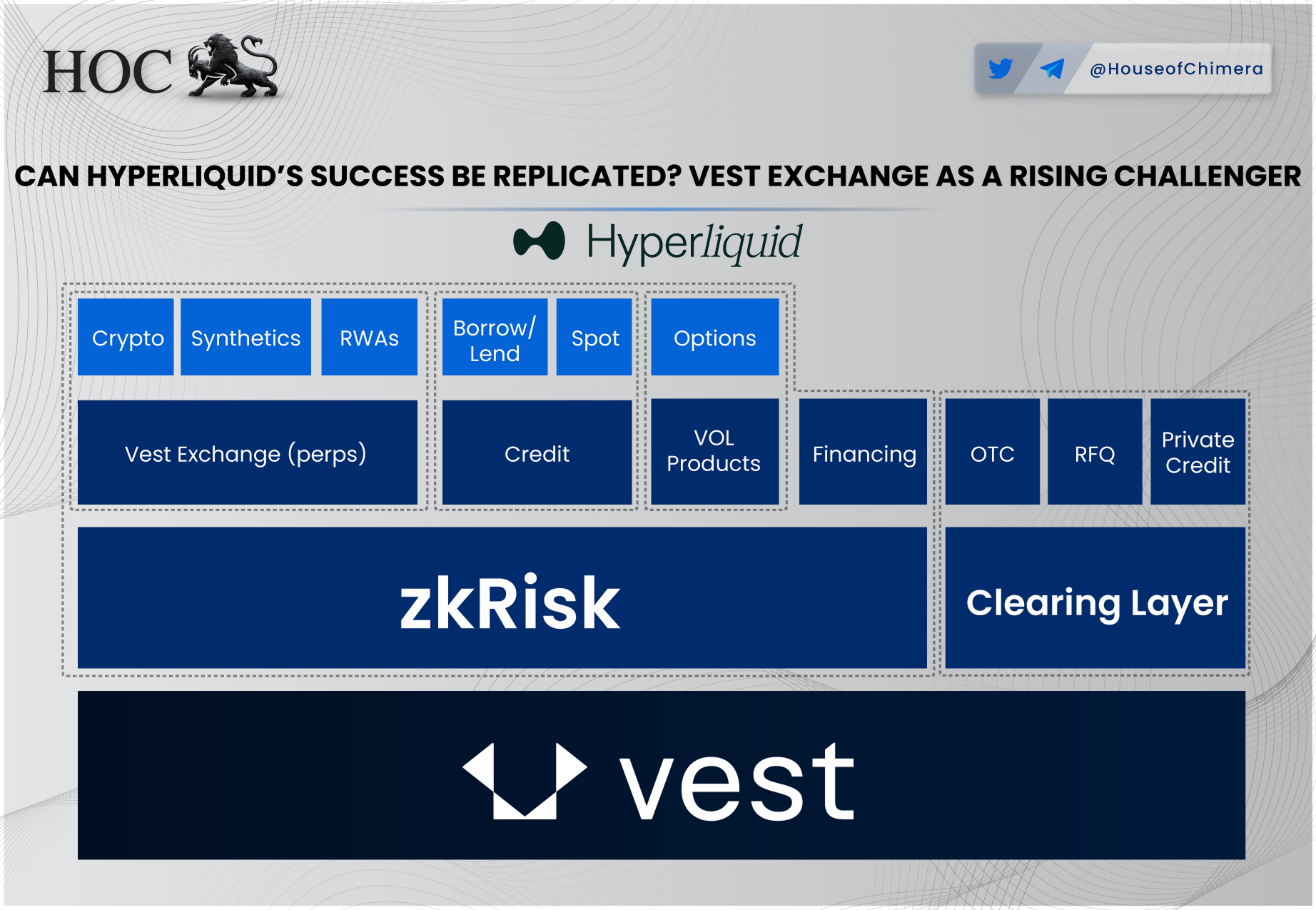

While Hyperliquid has undoubtedly achieved notable success, it also faces significant limitations. The "JELLY" incident exemplifies how large leveraged trades can trigger system-breaking chain reactions due to flawed risk logic. Emerging Prep DEXs such as Vest Exchange may offer solutions to these vulnerabilities.

Vest Exchange employs an Automated Market Maker (AMM) combined with itsproprietary risk-assessment engine, zkRisk, to proactively monitor and adjust trade pricing in real-time, prioritizing risk mitigation over profit maximization. When a trade significantly increases systemic risk, such as opening a significant short position on an illiquid token, zkRisk immediately calculates and applies a corresponding risk premium, accurately reflecting the heightened exposure.

This proactive, risk-based pricing mechanism effectively discourages manipulative tactics similar to those witnessed during Hyperliquid's JELLYJELLY incident, rendering potential exploits prohibitively costly and impractical.

Overall, Hyperliquid's current success can be attributed to four main factors:

- An effective marketing campaign featuring a popular airdrop that garnered strong community support.

- A robust Layer 1 blockchain infrastructure.

- User-friendly UI/UX in its final product.

- Rapid and efficient crisis management.

Looking ahead, the blockchain space remains a fertile ground for considerable growth opportunities, paving the way for continuous evolution in decentralized applications and products. Quality platforms, driven by innovative solutions to existing problems, will undoubtedly emerge and thrive. Given these conditions, the appearance of another successful application similar to Hyperliquid is entirely plausible, provided it effectively addresses existing shortcomings and harnesses emerging technologies to deliver enhanced value to users.