The U.S. Debt Crisis: Slowly, But Then, All at Once

The Great Disconnect

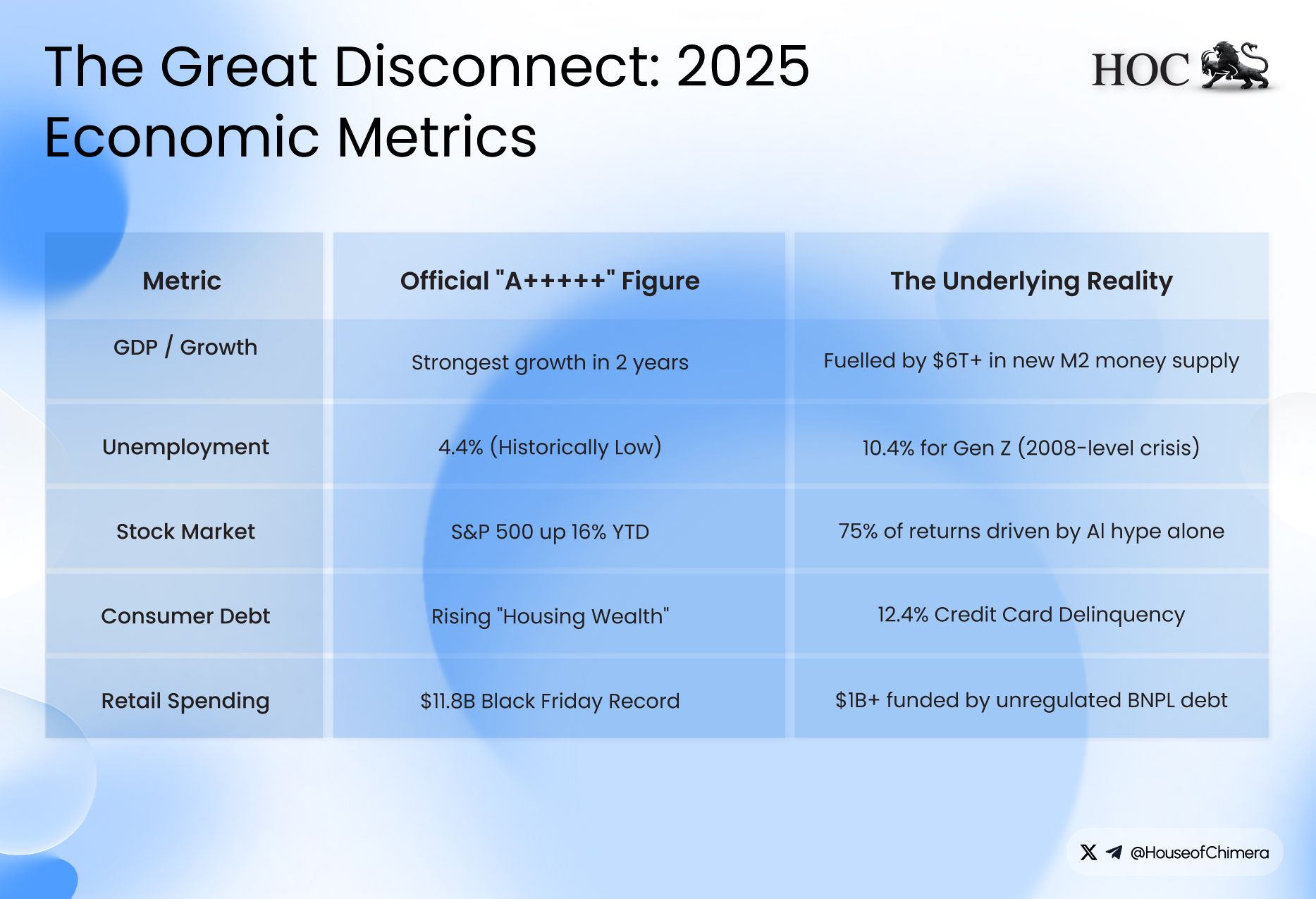

The U.S. economy is supposed to be great, or as President Trump has lately been calling it, ‘an A+++++’ economy. GDP numbers have been rising; in fact, Q2 showed the most substantial quarterly growth in nearly two years, despite the tariffs that were predicted to tank the economy. Unemployment rates remain historically low at 4.4%, a figure close to pre-COVID levels. The stock market, despite facing some headwinds lately, is still enjoying one of its best years, with the S&P 500 up about 16% year-to-date.

All these parameters clearly show that the U.S. economy is in a great state, right? Well, the issue is that many critical numbers are going unnoticed in the big picture. Essentially, they have gotten lost in translation, resulting in a fragile economy propped up by inflated metrics that paint a romanticized picture of reality.

But beneath the headlines, the foundation is rotting. The 'resilience' is purchased on credit, the 'growth' is fueled by shadow debt, and the 'stability' is a facade masking a consumer stretched to their absolute limit. This isn't a story of recovery; it is a story of a pressure cooker waiting to blow. As Hemingway famously wrote about bankruptcy, it happens in two ways: gradually, then suddenly. We are currently in the 'gradually' phase, but the 'suddenly' phase is closer than the data suggests.

Printing Prosperity

The COVID-19 outbreak had a significant global impact, both financially and socially. The economy and, therefore, consumer behavior have shifted to more short-term gratification and satisfaction. The long-lasting financial impact is truly remarkable, as the FED has increased the money supply (i.e. M2) from 15 trillion USD to 21.75 trillion USD in 24 months, an increase of 45%, which has never been seen before in such a quick succession. While after COVID-19 the M2 has decreased for a short time, it is again rising, and is currently at the peak levels of 23 trillion USD.

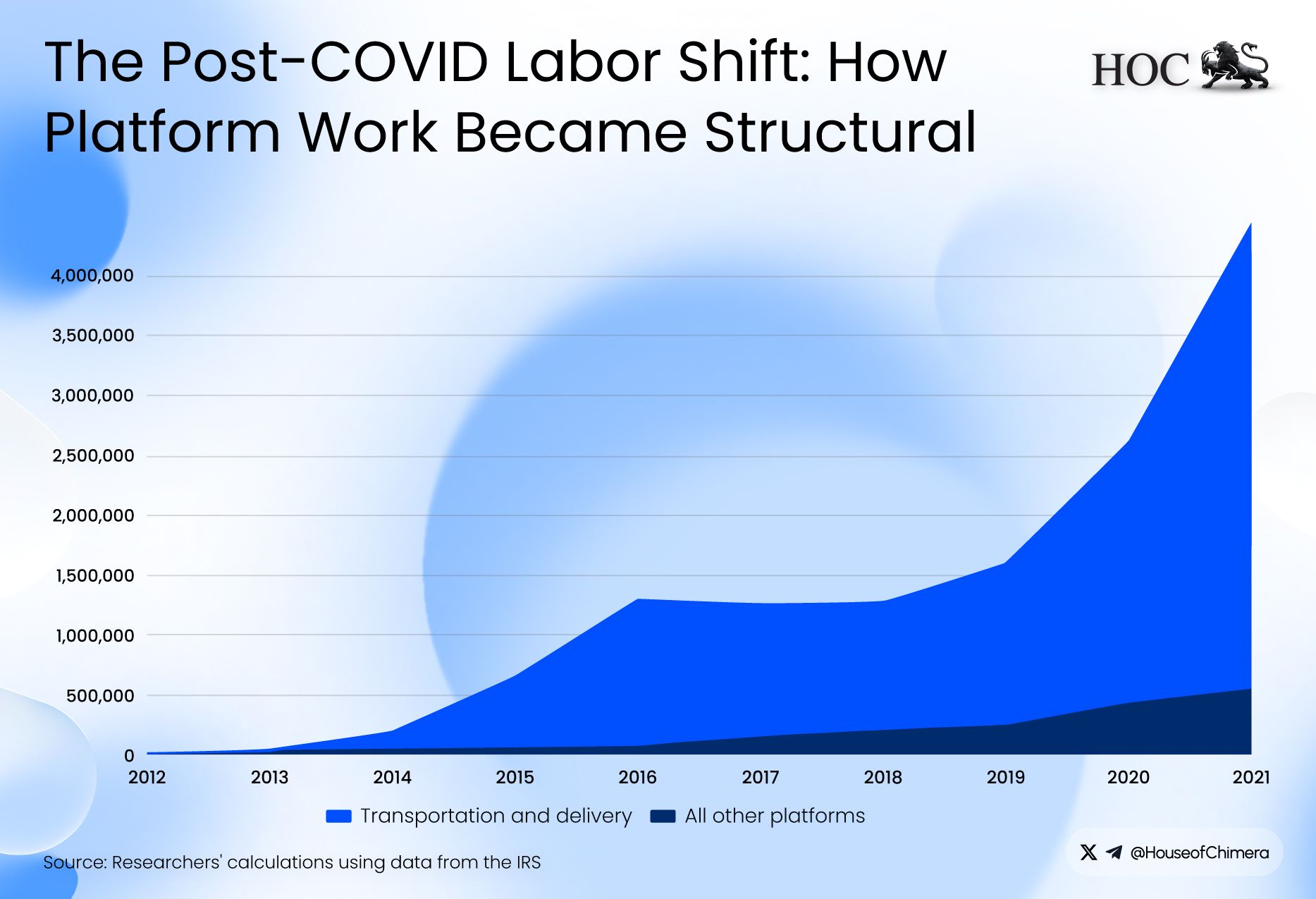

By contrast, the labor market has undergone a significant transformation in the aftermath of COVID-19, with the gig economy emerging as a firmly established form of employment. The number of people earning income from jobs where assignments are delivered through online platforms increased by 3.1 million between 2020 and 2021, with the most significant growth occurring in transportation and food delivery. The effects of COVID-19, and the changes it brought are still very much observable in the current economic landscape.

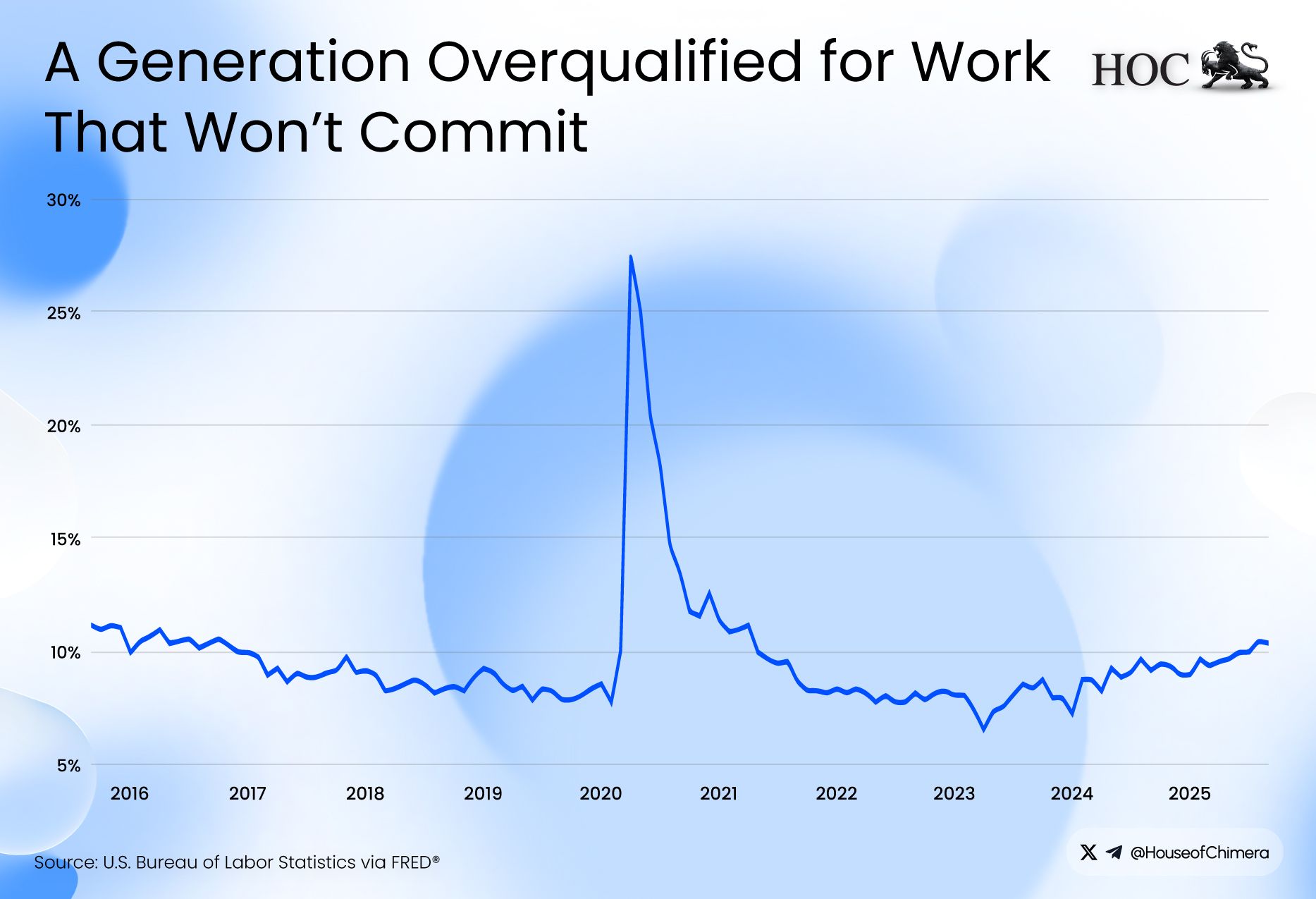

Degree Required, Experience Demanded, Gig Work Offered

The ‘COVID-19’ generation, or Gen Z, has been struck the hardest. After COVID-19, job openings have been falling dramatically for junior positions, and the unemployment rate for Gen Z is 10.4% as of September 2025, on par with pre-recession 2008 levels. The real unemployment rate of Gen Z is expected to be significantly higher, as many have resorted to the gig economy, whereby highly educated individuals are forced into the gig economy (i.e. Uber drivers), trading career stability for the insecurity of short-term contracts. This is not surprising, as the labor market is squeezing out entry-level jobs that require significant experience, among other factors, leading to a highly competitive market for starters. However, the first cracks in the gig economy are starting to appear.

A basic economic pricing concept is supply and demand: if demand exceeds supply, the price is expected to rise in a free market. In a market where supply exceeds demand, the opposite will happen. This is exactly where the issue arises: there is a massive oversupply in the gig economy, leading to lower prices in isolated markets such as Uber. This is observable, as the same Gen Z is struggling financially to repay their ever-mounting student debt, creating a pressure cooker.

According to a recent study of The Institute for College Access & Success (TICAS), more than four in ten borrowers (i.e. 42%) make tradeoffs between loan payments and covering basic needs. At the same time, one-fifth of those surveyed are either delinquent or in default. The total expected federal student loans that went into default is over 140 billion USD. Borrowers generally enter default on their federal student loans after being delinquent for more than 270 days. As a result, the number of defaulted federal student loan borrowers could surge to over nine million within weeks, with several million additional defaults occurring in the months that follow.

Default carries serious consequences. Beyond negative credit reporting, which can make it harder to secure housing, transportation, or employment, the government has strong collection powers. These include administrative wage garnishment, seizing federal tax refunds, and offsetting federal income and benefits, including Social Security. Earlier this year, the Education Department announced that collection activity on defaulted federal student loans would resume.

This leads to a situation that TICAS has described as a ‘default cliff’, a rapidly shifting sequence of events in which many ex-students are unable to repay their loans due to a weak job market.

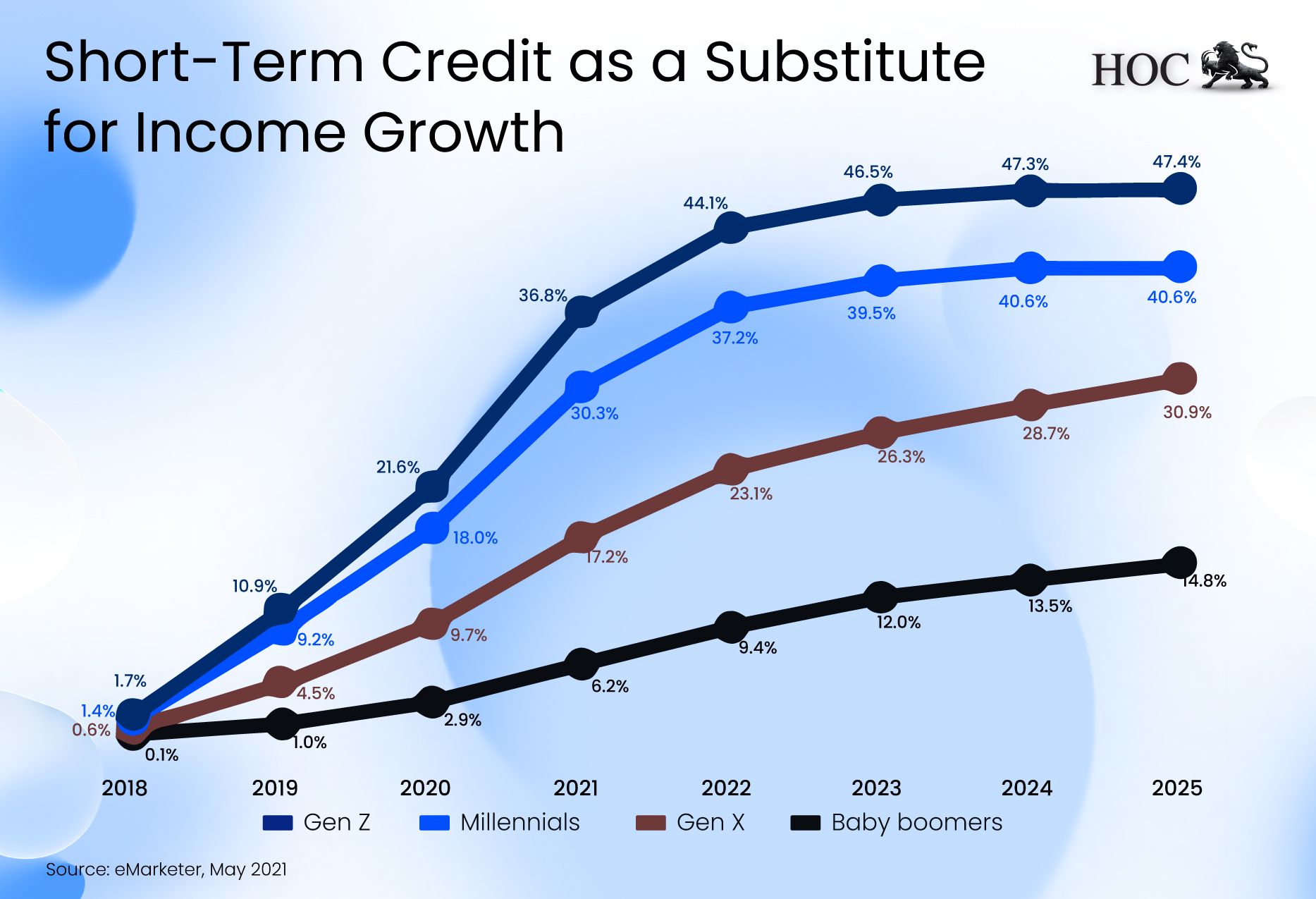

Buy Now, Default Later

In any normal functioning economy, you would expect that the overall expenditure of Gen Z would decrease, but luckily for us we do have Buy-Now-Pay-Later (BNPL) to save the day. Recent Black Friday data shows online spending hit a new record of $11.8 billion. In the U.S., BNPL accounted for $747.5 million of that total, up 8.9% year over year, according to Adobe Analytics. Adobe also projected BNPL spending would exceed $1 billion by the end of Cyber Week, suggesting consumers were willing to keep buying even without having the cash on hand.

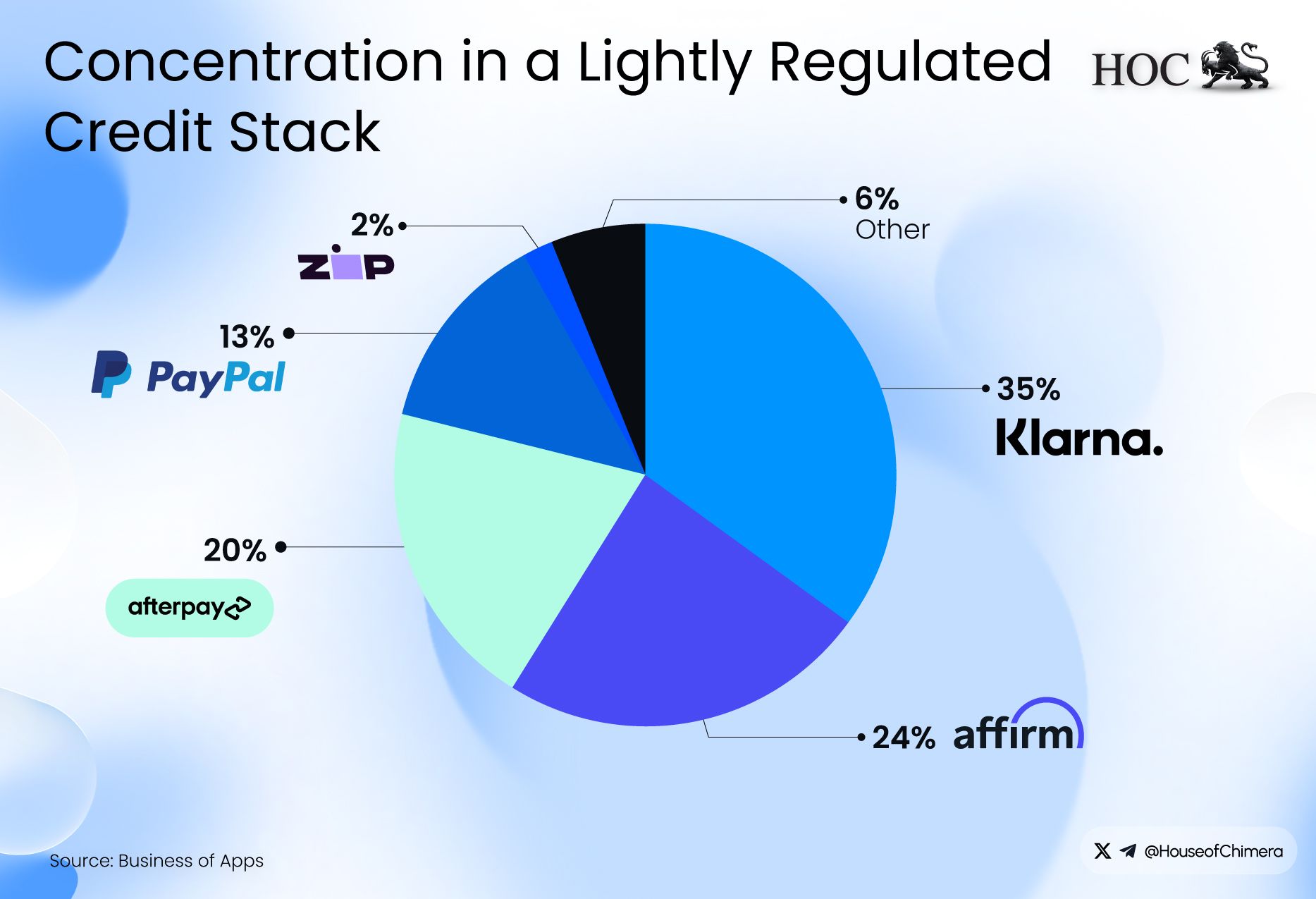

BNPL is not a new concept; it is essentially short-term credit, but it has scaled rapidly by exploiting a regulatory gap. Because BNPL products do not qualify as credit cards, they fall outside the scope of Regulation Z. This is mainly because they typically do not charge interest and require repayment in four installments. As a result, BNPL remains unregulated, mainly at the federal level in the U.S., and, like most unregulated credit markets, it operates like the Wild West.

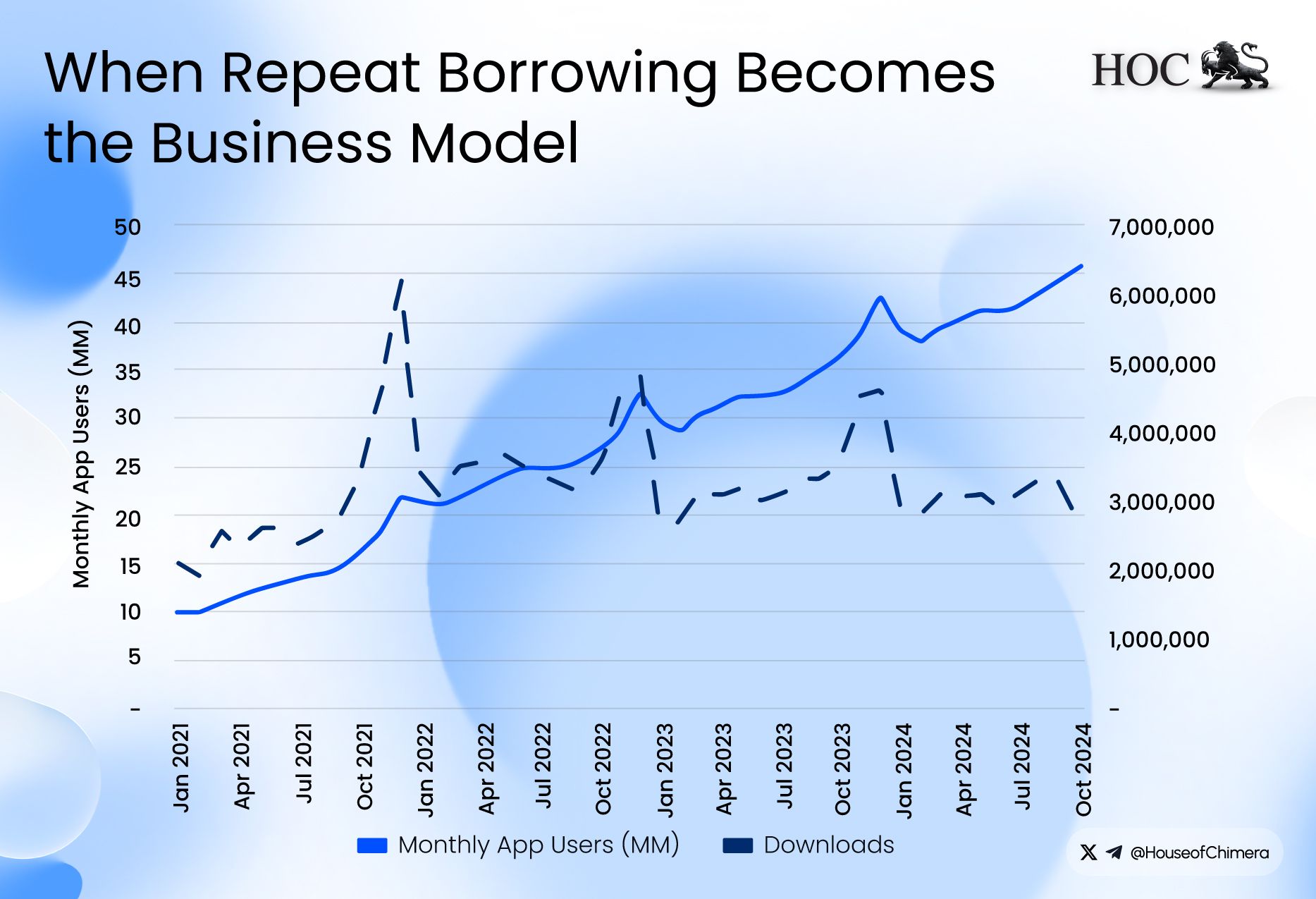

In 2023, BNPL users took an average of 6.3 loans per lender, up 11 percent from 5.7 in 2022. Additionally, the inflation-adjusted average annual amount borrowed per lender rose by 14 percent, increasing from $745 in 2022 to $848 in 2023. The borrower profile is equally troubling. As of 2022, nearly two-thirds of borrowers had low credit scores, and subprime or deep subprime applicants were approved in 78% of cases. Given that economic conditions have deteriorated for many subprime groups over the past three years, especially in auto lending, these figures are likely even higher today. Unfortunately, as BNPL is not regulated anymore by the Consumer Financial Protection Bureau (i.e. CFPB) after 2023, BNPL companies do not have to disclose any data, leading to relatively old data.

BNPL default rates are accelerating. According to Lending Tree, 42% of BNPL users made at least one late payment in 2025, up from 39% in 2024 and 34% in 2023. The main issue here is that, due to the unregulated nature of the debt, most of it is not reported to credit bureaus, leading to ‘phantom debt’. That means that other lenders can’t see when someone has taken out five different BPL loans across multiple platforms, as it does not impact your credit score. Therefore, there is an incentive to keep using BNPL companies, as the acceptance rate is significantly higher than that of credit cards, and it does not impact your credit score as of now if you default on one or multiple payments.

The CFPB released a report in January this year showing that roughly 63% of borrowers originated multiple simultaneous loans at some point during the year, and 33% took out loans from various BNPL lenders. While BNPL itself is not a systemic threat yet, as the total market is roughly a trillion, the lack of visibility, combined with the concentration of significantly distressed borrowers, can be a catalyst for more, as BNPL continues to grow significantly.

Klarna: The Canary in the Coal Mine

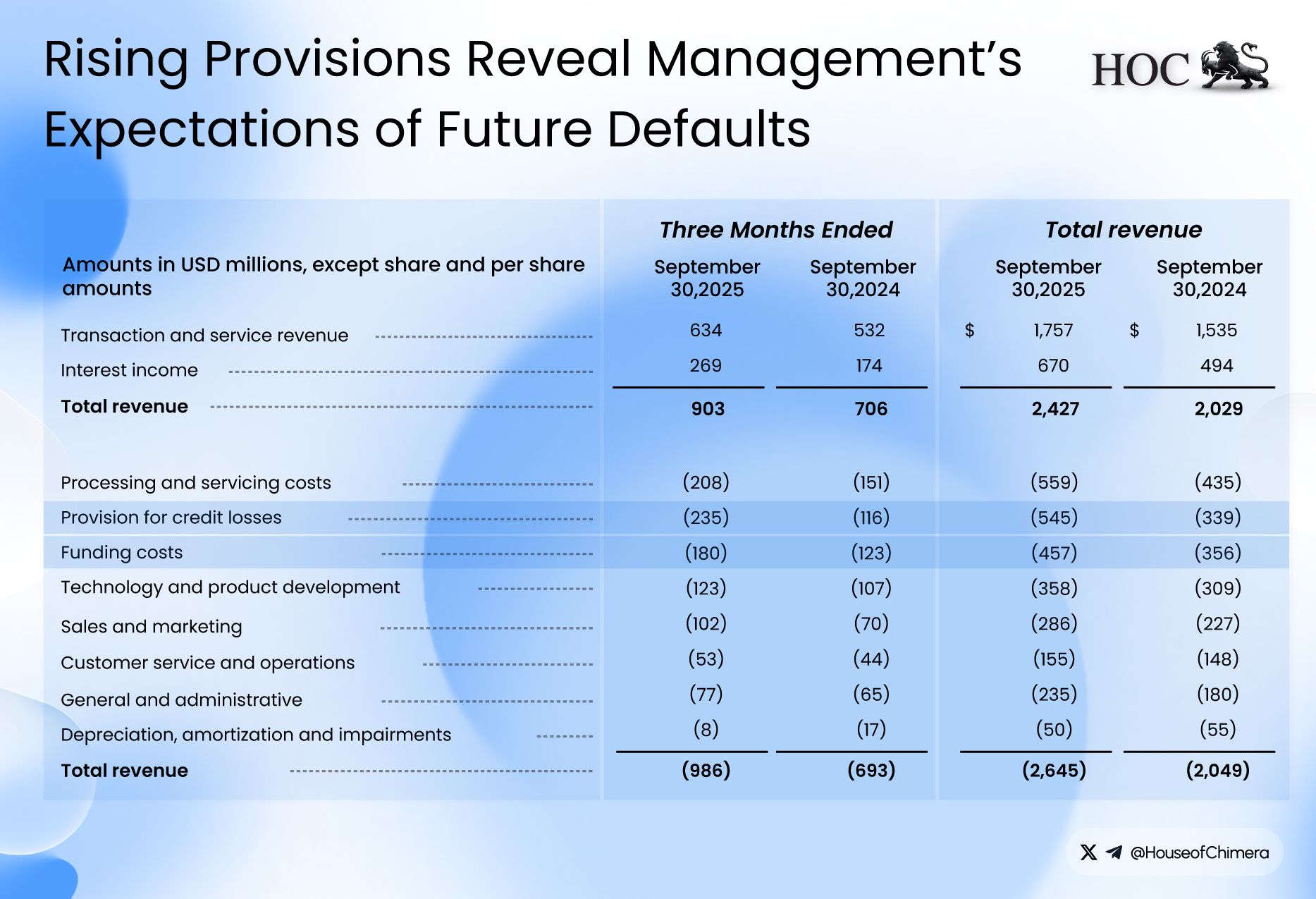

Klarna currently leads the BNPL industry with a 35% market share. In Q3 2025, the company reported $903 million in revenue, up about 26% year over year. Klarna also disclosed a 32% increase in active consumers, reaching more than 114 million users, and a 38% rise in merchants, with over 850,000 merchants supporting Klarna YoY. The CEO of Klarna has stated in the recent earnings release of the company that Q3 2025 was Klarna’s strongest ever, and that the Klarna Card has exploded since its launch of July, which currently accounts for 15% of all global transactions. Klarna currently processes over 3.4 million USD in daily transactions. However, beneath the growth story, the cracks are beginning to show.

In Klarna's recent income statement, the company has significantly increased its provision for credit losses. As a provision is, by definition, always forward-looking, as it is based on the expectation of a particular event, it shows that Klarna expects more and more of its consumers to default on their BNPL loans. In Q3 2024, the provision was approximately 116 million USD, increasing by 102% YoY to over 235 million USD in Q3 2025. The credit provisions to revenue ratio increased from 17% to over 26%, highlighting that despite the increase in Klarna’s revenue, the overall credit provisions has increased more, leading to a weaker position of the company. This is further exaggerated by a significant increase in funding costs of 60 million USD to 180 million USD, up from 123 million USD in 2024, as the company is suffering from high interest rates. Despite the significant increase in growth, the company incurred a loss of 246 million in 2025, mainly due to a substantial increase in the provision for credit losses and funding costs.

The House of Cards

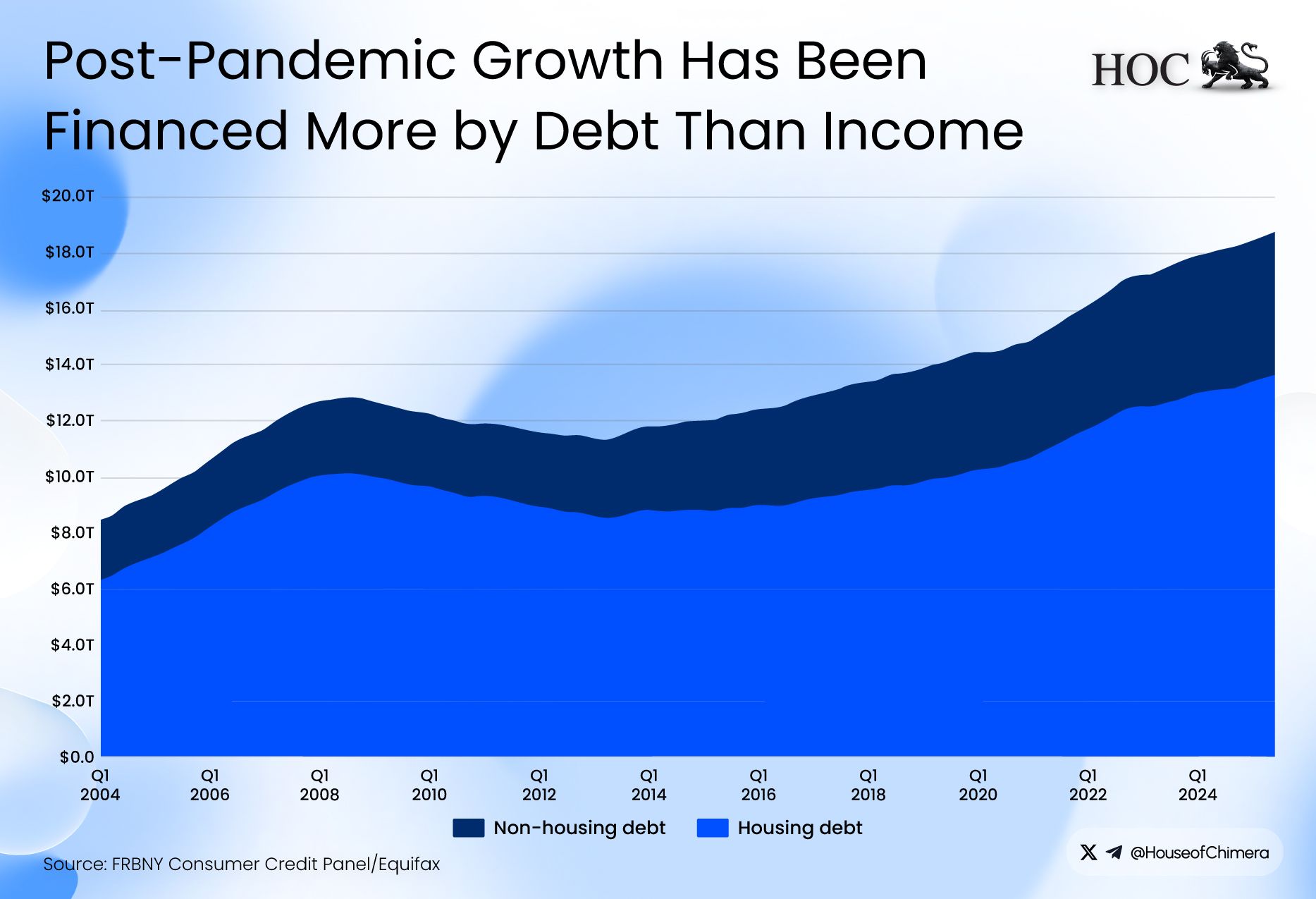

The U.S. economy currently operates as a set of temporary band-aids attempting to hold a fracturing system together, while the underlying house of cards slowly but surely crumbles. Total housing debt has been climbing steadily since 2014, but more alarmingly, there has been a distinct acceleration in this trend since 2020. This suggests that the post-pandemic recovery was built less on organic growth and more on leveraged appreciation.

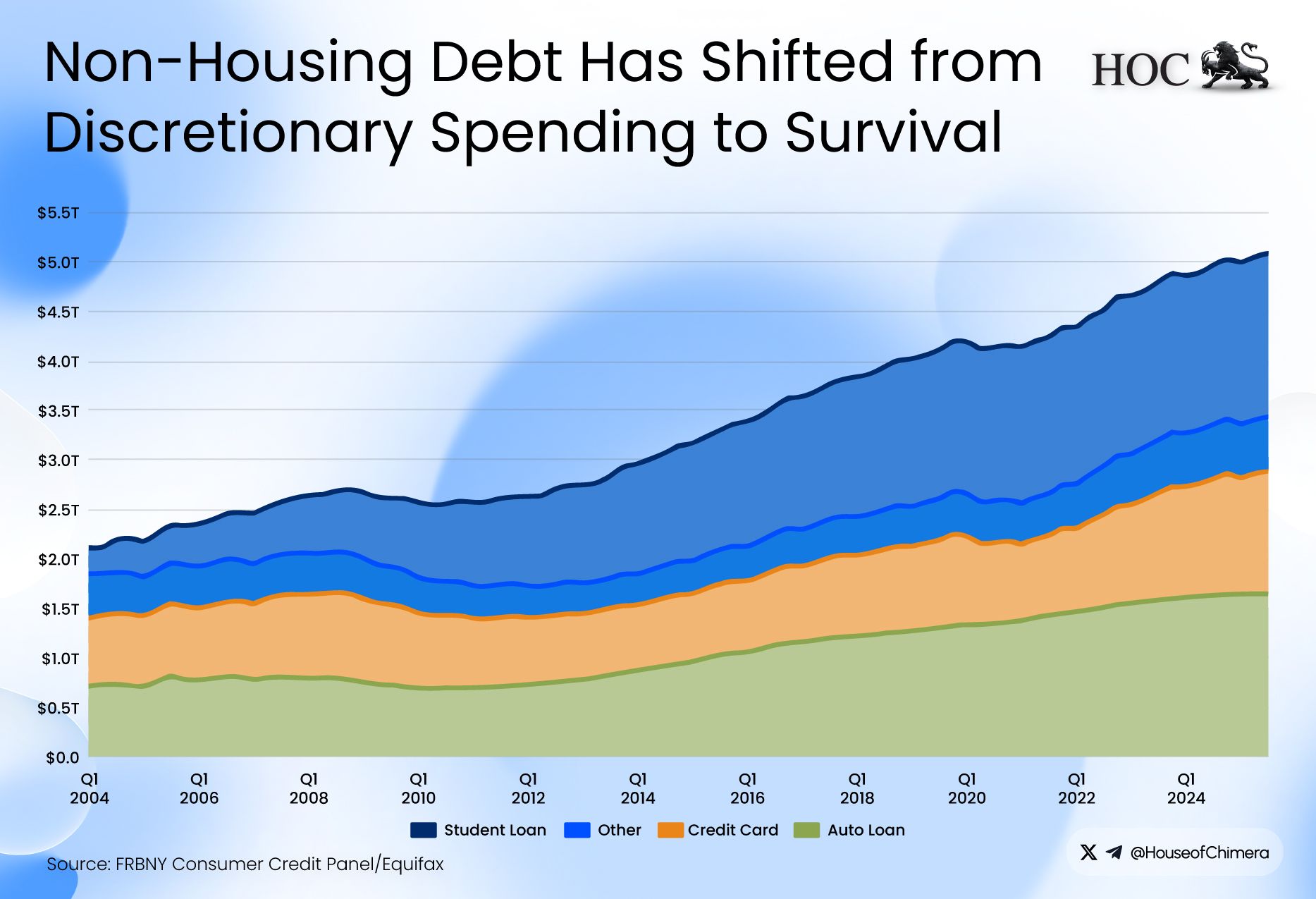

Simultaneously, overall non-housing debt has surged, fueled primarily by a sharp increase in credit card utilization. This pivot to revolving credit indicates that for a growing segment of the population, debt has shifted from a tool for lifestyle enhancement to a survival mechanism against the rising cost of living. As interest rates remain elevated, the cost of servicing this ballooning debt is compounding, effectively draining liquidity from consumers and removing the final structural support for the economy.

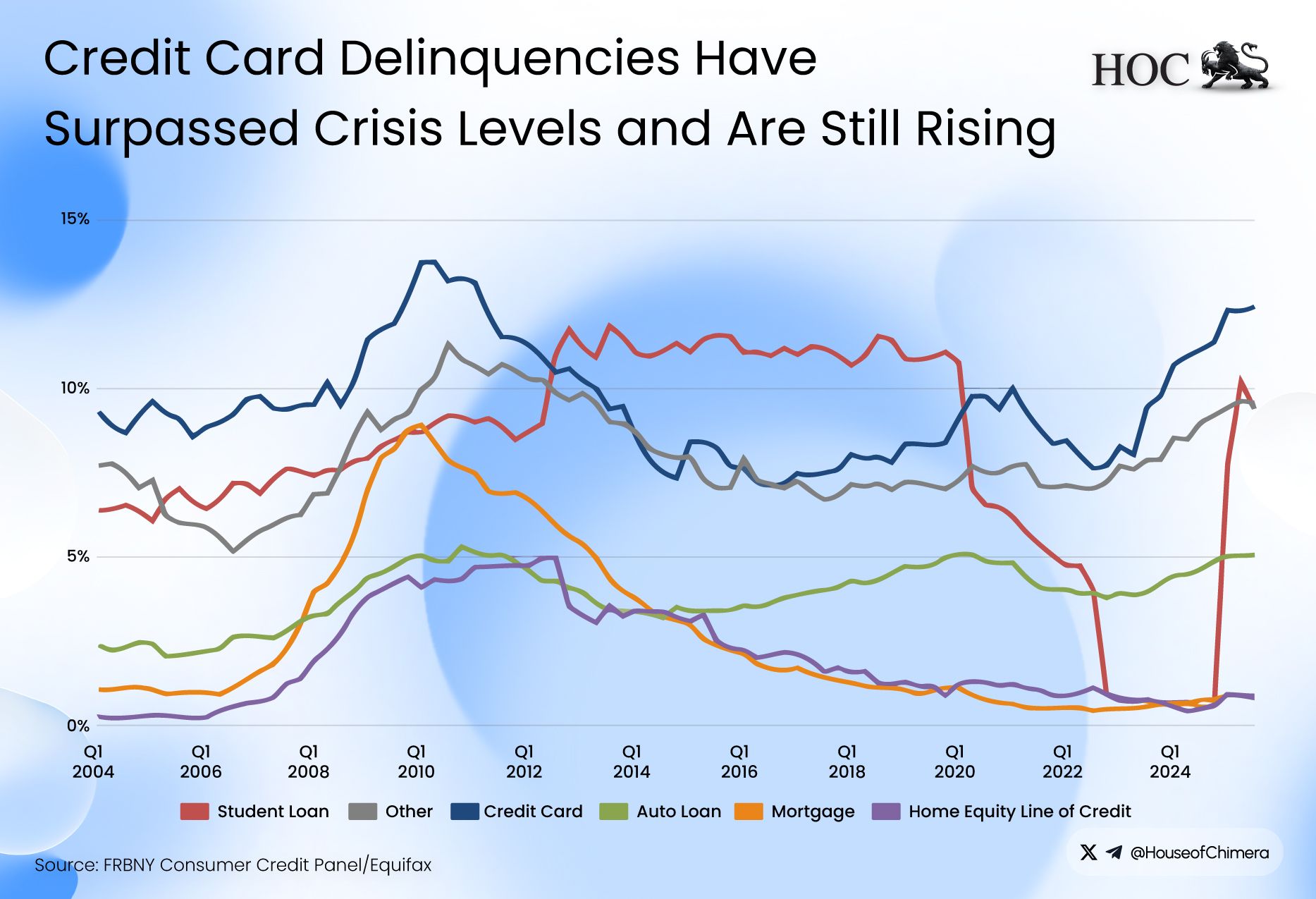

Credit card delinquency rates have surged to 12.4%, exceeding levels seen during the 2008 financial crisis. This figure is likely an underestimation because it excludes BNPL services favored by younger generations. Furthermore, because delinquency is a lagging indicator, the sharp increase observed from 2024 to 2025 suggests that rates will continue to rise as macroeconomic conditions deteriorate for individual consumers

It is not just the debt data that is flashing red; consumer sentiment is collapsing in real-time. The University of Michigan’s consumer confidence index climbed to 53.3 in December from 51, the second-lowest reading on record. The survey comprises approximately 50 core questions tracking various consumer attitudes. Notably, the Index of Consumer Expectations specifically gauges three key areas: personal financial outlooks, near-term economic performance, and long-term economic prospects.

Finally, we must look at the engine keeping this entire machine running: the stock market. We have already established in another article that the current rally is heavily artificial, driven primarily by the AI boom. Since ChatGPT’s launch in November 2022, AI-related stocks have accounted for a staggering 75% of S&P 500 returns and 80% of earnings growth.

The "Staking" of a Generation

The ultimate prop for this fragile market is the “One Big Beautiful Bill Act”, a policy that functions as a form of legislated Quantitative Easing (QE). By providing a $1,000 seed in S&P 500 stocks for every newborn and incentivizing up to $5,000 in annual tax-advantaged contributions, the Treasury has effectively created a permanent, price-insensitive bid for U.S. equities. Because this capital is legally mandated to remain in the market until the child turns 18, it serves as a forced floor for the S&P 500. This essentially stakes the stock market on the future of the American family.

However, this creates a grotesque economic paradox in which the government is forcing capital into the stock market for the year 2043, while the parents of those same children are using high-interest BNPL loans to afford diapers and formula today. It is a desperate attempt to manufacture long-term stability by ignoring a short-term liquidity crisis, ensuring that when the market eventually corrects, it will not just hit retirement portfolios but will wipe out the seeds of an entire generation.

The Final Grain of Sand

The history of economic collapse is rarely written in a single day. Instead, it is the story of a million small, ignored choices that eventually reach a tipping point. As we move into 2026, the U.S. economy finds itself in a precarious "K-shaped" reality. At the top, a stock market fueled by the AI boom and artificial liquidity injections from the One Big Beautiful Bill Act continues to break records. At the bottom, a generation is drowning in "phantom debt," gig-economy oversupply, and a cost-of-living crisis that has turned credit from a tool into a survival vest.

We are currently witnessing the "gradually" phase in real-time. It is visible in the rising credit provisions on Klarna’s balance sheet, the 12.4% delinquency rates in credit card portfolios, and the "default cliff" facing millions of student loan borrowers. These are not isolated data points; they are the creaks in the floorboards of a house propped up by high-interest scaffolding and short-term bandages.

The "suddenly" arrives when the consumer, who accounts for nearly 70% of U.S. GDP, finally loses the ability to shuffle debt from one unregulated platform to another. When the "buy now" finally meets the "pay never," no amount of legislated market floors or baby bonds will be enough to stop the gravity of a debt-deleveraging cycle. Hemingway’s warning remains our most accurate forecast: by the time you see the crisis, the foundation has already rotted. The question for 2026 is no longer if the pressure cooker will blow, but how many people will be left standing when the steam clears.